In Clarus Corp.’s first discussion with the investment community since announcing plans to acquire Rhino-Rack, John Walbrecht, Clarus’ president, said the rack system manufacturer has a dominant share in Australia and New Zealand with the major initial opportunity expanding the brand to North America.

Author: SGB Executive

Rocky Brands Talks Synergies In Honeywell’s Footwear Acquisition

At Baird’s 2021 Global Consumer, Technology & Services Conference, Jason Brooks, CEO and newly-elected chairman at Rocky Brands admitted that the company’s $230 million acquisition of Honeywell’s performance and lifestyle footwear portfolio was “probably not the optimal size” for the first acquisition for his management team. However, he described the acquired brands as “phenomenal” and detailed how they complement Rocky’s existing portfolio.

Thor Industries Q3 Boosted By Unflagging Demand For RVs

Profits at Thor Industries Inc. jumped more than six-fold in the third quarter ended April 30 as demand for RVs remains robust at retail and dealer inventory levels remain at historic lows. Bob Martin, CEO, said, “We see the increased interest in the outdoors and RV lifestyle as a fundamental shift in consumer preferences, a shift that began before the pandemic and picked up steam over the last year.”

Academy Sports’ Chief Merchant Discusses Post-Pandemic Growth Drivers

In an interview with SGB Executive, Steve Lawrence, EVP and chief merchandising officer, Academy Sports + Outdoors, discusses the chain’s first-quarter performance marked by a 38.9 percent same-store gain and a significant hike in its annual outlook. He also digs deep into the expected growth drivers for the rest of the year.

Vail Resorts Seeing Early Signs Of Recovery For Upcoming Ski Season

Vail Resorts Inc. wrapped up the 2020/21 North American ski season by reporting steadily improving visitation rates for the third quarter ended April 30 and healthy season pass sales so far for the upcoming 2021/22 North American ski season.

Inside The Call: Academy Sports Hikes Outlook As Sales Momentum Continues

Academy Sports + Outdoors significantly lifted its sales and earnings guidance for 2021 after seeing the strong demand for many of its categories during the pandemic only accelerate further in the first quarter of 2021. Ken Hicks, chairman, president and CEO, said, “Our customers are coming back more often and shopping more areas of the store. Sports and outdoors remain a meaningful part of their lives.”

KOA: Camping And RV Interest Surges During Pandemic

According to Kampgrounds of America’s (KOA) annual North American Camping Report, the proportion of first-time campers across the U.S. grew five-fold compared to 2019. COVID-19 proved a key driver behind the influx of many camping attributes, including the 10.1 million households who camped for the first-time in 2020.

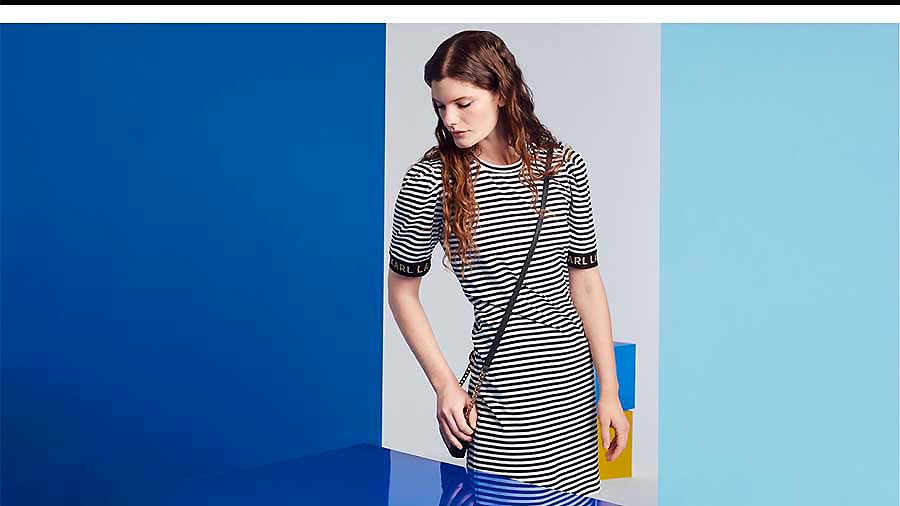

Inside The Call: G-III Apparel Rides Casual Strength To Healthy First-Quarter Recovery

G-III Apparel Group reported first-quarter results handily surpassed company guidance as demand for casual apparel remained strong and extended to include additional more categories. Morris Goldfarb, G-III’s chairman and CEO, said, “Demand for athleisure and casual sportswear across our power brands once again accelerated and continues to be strong.”

Inside The Call: Lululemon Lifts Annual Guidance As In-Store Traffic Roars Back

Lululemon Athletica raised its outlook for sales and earnings for 2021 as first-quarter results showed continued momentum in online sales, a strong resurgence in in-store traffic and strength across its men’s and women’s offerings. On a two-year CAGR basis, revenue increased 25 percent, representing an acceleration relative to its three-year CAGR of 19 percent leading up to the pandemic.

Inside The Call: Tilly’s Sees Stronger Recovery Than Expected

Tilly’s Inc. reported its best first-quarter net sales and EPS since becoming a public company in 2012 as the action-sport chain’s sales recovery coming out of the pandemic gains momentum. Tilly’s officials also said its expansion of hard goods is seeing a good response and the sustainability section on its website would expand to more than 1,000 products by the end of the third quarter.

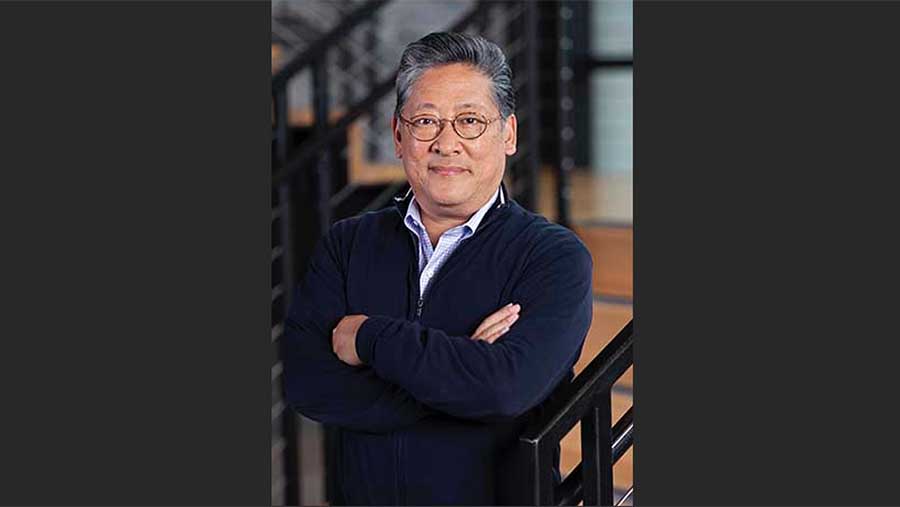

Duluth Trading Looks To Capitalize On Multi-Brand Platform

In his first comments to the investment community since taking over as president and CEO of Duluth Holding, Sam Sato said he is seeking to better scale Duluth’s omnichannel assets and remains focused on building a multi-brand brand platform across Duluth Trading, Alaskan Hardgear, 40 Grit and Best Made.

Surveys Show Climate Change A Top Concern

A number of surveys arriving in recent weeks largely timed to Earth Day show concerns over climate change appear to have only heightened as a result of the pandemic. Many consumers, particularly younger ones, are increasingly highlighting sustainability as a key purchasing driver although some

admit to being confused over what sustainability means.

Champion’s Four Growth Drivers To Reach $3 Billion

At Hanesbrands Inc.’s recent 2021 Investor Day, Jon Ram, group president, global activewear, highlighted four key “actions” designed to grow the Champion brand another $1 billion in sales globally over the next three years. Said Ram, “Champion competes in the land of giants, but we’re not trying to copy the competition. We’re forging a separate path.”

Inside The Call: Famous Footwear’s Record-Breaking Quarter Boosted By Athletic And Seasonal Categories

Famous Footwear achieved record quarterly earnings and sales in the first quarter, boosted by improving in-store traffic trends with strong demand across athletic, seasonal and kids categories.

Inside The Call: Athleta’s Momentum Accelerates In Q1

Athleta sales growth accelerated in the first quarter with the benefit of a 113 percent hike in online sales and strong full-price selling, said Sonia Syngal, Gap Inc.’s CEO, on a conference call with analysts. “Athleta drove outsized digital growth while achieving record full-price sales through gains in performance lifestyle products, particularly warm weather short, dresses, swim, and tanks, and it really differentiates us from the competition.”