Aisle Talk Week Of January 11, 2021

The Top National stories and the Latest headlines across the Active Lifestyle Market for the week of January 11, 2021 covered in the SGB Updates and delivered to your inbox every business day.

Big 5 Caps Off Record Year With Double-Digit Q4 Comps

At the 23rd Annual ICR Conference, Steven Miller, Big 5’s chairman, president and CEO, provided a rare deep dive into the sporting goods chain on the same day it reported a record year as a wide range of outdoor sports and fitness activities have been embraced during the pandemic. Miller said, “Items were selling out as fast as we could unload the truck.”

Zumiez’s Store Associate Home Delivery Service Off To Strong Start

At the 2021 ICR Conference, officials at Zumiez Inc. expounded on the rollout of its innovative Zumiez Delivery program, which enables store associates to deliver directly to a customers door in select markets around the U.S. Rick Brooks, Zumiez’s CEO, said “What we’re trying to do is always localize our brand experience.”

Mad River Glen Co-Op Celebrates 25th Anniversary And Unique Business Model

The motto for Mad River Glen has always been “Ski it if you can!” It might as well be “Own it if you can” as well. Especially this year, where COVID-19 restrictions have seen its ownership shares sell like hotcakes at its newly refurbished base lodge.

Dick’s SG’s Incoming CEO Discusses Pandemic Recovery At CES

At a session held during CES’s first virtual trade show, Lauren Hobart, the president of Dick’s Sporting Goods, (to become President and CEO effective February 1, 2021), discussed her team’s herculean efforts to establish curbside pickup early in the pandemic and how the role of the store has changed. She said, “We went back in March thinking that survival was at risk.”

Journeys Leads Genesco To Better-Than-Expected Holiday Performance

Genesco Inc. reported same-store sales were down 3 percent in the quarter-to-date period ended December 26, but came in better than expectations due to Journeys’ outperformance. At the 2021 ICR Conference, Mimi Vaughn, Genesco president and CEO, said teen spending continues to hold up well in the face of the pandemic.

Crocs Highlights Growth Drivers For 2021

Crocs Inc. significantly lifted its 2020 revenue guidance after a robust holiday selling season and predicted growth would sharply accelerate in 2021. At a presentation Monday morning at the 2021 ICR Conference, Andrew Rees, CEO, highlighted sandals, personalization, digital, and China as key growth drivers.

Q&A With Allied Feather + Down President Daniel Uretsky

Amid the pandemic, with the world still shutting down and retailers unsure about orders, Los Angeles-based Allied Feather + Down is capping off its biggest growth streak in company history. print. SGB Executive caught up its President, Daniel Uretsky, to see what’s up in the world of down.

Aisle Talk Week Of January 4, 2021

The Top National stories and the Latest headlines across the Active Lifestyle Market for the week of January 4, 2021 covered in the SGB Updates and delivered to your inbox every business day.

SGB Media Reports Top Stories Of 2020

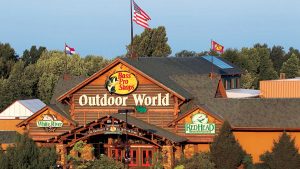

SGB Media has reported its Top 20 stories read online in 2020, with the Bass Pro acquisition of Sportsman’s Warehouse and related stories leading the charts. Overall, the SGBonline.com web site had a banner year in readership, recording over 2.5 million page views, a 20 percent increase over 2019.

Inside The Call: Hydro Flask Growth Impacted By Soft Back-To-School Season

Helen of Troy said sales of Hydro Flask were “challenged” by a soft back-to-school selling season in the third quarter ended November 30 as most U.S. students were learning remotely outside the classroom. Julien Mininberg, Helen of Troy’s CEO, however, on an investor call highlighted a number of growth drivers for Hydro Flask in the years ahead.

NPD Recaps 2020 Trends To Kick Off OR Virtual Show

Kicking off this year’s Outdoor Retailer Winter Virtual Tradeshow was a seminar presented by NPD Executive Director and industry analyst Dirk Sorenson examining what’s trending in the outdoor and fitness markets and the opportunities for growth in 2021.

Active Lifestyle Market 2021 Vision … Part Three

The Editors from SGB Executive present the third and final installment of SGB’s Annual Outlook Survey exploring what leaders in the active lifestyle market are projecting for 2021. Comments from Lids, BSN Sports, NSGA, Saucony, Academy Sports, Asics, The North Face, Keen, Vuori, SFIA, OIA, Gazelle Sports, CEP, TRX, Vasque, Houlihan Lokey and more.

Active Lifestyle Market 2021 Vision … Part Two

The Editors from SGB Executive present the second installment of SGB’s annual outlook survey exploring what the leaders in the active lifestyle market are projecting for 2021. Comments from Rawlings Sporting Goods, Grassroots Outdoor Alliance, Orvis, Big Agnes, OrderMyGear, Robert W. Baird, Elan USA and more.

Taking Time With Taxa President Divya Brown

Opening its new 69,356-square-foot headquarters in Houston, TX on December 23, Taxa Outdoors is rolling strong with sales of its overland habitat spaces. SGB Executive caught up with Taxa President Divya Brown for insight into the Overland market amidst the pandemic.