The Return Of Sports Remains Cloudy

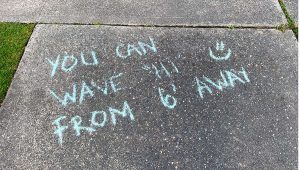

With no signs of a coronavirus vaccine arriving anytime s soon, when it’s safe to play, many are uncertain and related concerns have been found in recent surveys. Even solo activities such as running and cycling are also facing challenges with social distancing guidelines and restrictions.

Behind The Deal: Why Exxel Outdoors Proceeded With Latest Acquisition

Exxel Outdoors announced its acquisition of outdoor apparel and gear brand Compass 360 during an unlikely time for U.S. business expansion. Exxel CEO Harry Kazazian spoke exclusively with SGB Executive about the company’s reasons for moving forward with the deal despite the economic uncertainty.

SFIA’s Tom Cove Talks Recovery

Tom Cove, SFIA’s president and CEO, believes the sporting goods industry is still scrambling to offset the fallout from the pandemic. But he also believes many have “settled in a little bit” into how to manage amid the crisis and have started to position themselves to be ready for better business conditions.

OIA’s Lise Aangeenbrug On Outdoor Industry’s Challenges, Path Forward

In another installment of SGB Executive’s series of interviews with industry leaders exploring how businesses are coping with the coronavirus, Outdoor Industry Association’s new executive director Lise Aangeenbrug discusses the challenges facing the outdoor industry, how OIA is helping member businesses cope and the industry’s path forward out of this unprecedented crisis.

Aisle Talk Week Of April 6, 2020

Top National Stories and the Latest Headlines from SGB Updates across the Active Lifestyle Market during the week of April 6, 2020.

Survey: Teens Still Embracing Sneaker Culture

Sneaker culture is alive and well among teenagers, especially males, even as teens’ overall spending has declined amid the coronavirus, which has quickly become one of their top concerns. That was one of many key takeaways from investment bank Piper Sandler, which published its semi-annual Taking Stock With Teens Survey this week.

SIA’s Nick Sargent On What Lies Ahead For Snow Sports Industry

In another installment of SGB Executive’s series of interviews with industry leaders exploring how businesses are coping with the coronavirus, Nick Sargent of Snowsports Industries America dishes on these troubling times for snow sports businesses, how SIA is responding and why he’s confident the industry will come back stronger than ever.

Surveys On Coronavirus Impact Underscore Near-Term Challenges

A number of surveys arriving in recent days have detailed the severe impact social distancing measures to stop the spread of COVID-19 has had on U.S. retail and prospects in the near term. Some cautious optimism, however, could be found.

Which Public Companies Will Emerge Strongest From COVID-19 Crisis?

How are active-lifestyle brands like Crocs, Nike and Lululemon plus retailers like Dick’s, Foot Locker and Hibbett navigating the coronavirus? Susquehanna’s most recent note says that the current crisis is weighing on all businesses, but some are better positioned than others. Here’s their ranking of 19 public companies based on who will emerge the strongest from this crisis.

April 6 Coronavirus Notebook: Who Else Is ‘Winning’ During Crisis?

For this latest installment of the Coronavirus Notebook, SGB Executive looks at more “winners” that have emerged during the COVID-19 pandemic—including a water filtration and purification brand—plus a recap of our recent coronavirus coverage in case you missed it.

Survey: Social Media Driving Engagement With Runners

According to Running USA’s “National Runner Survey 2020,” social media continues to play an increasing role in enabling runners to connect with running stores, running brands as well as the overall running community. Thirty-nine percent of runners now follow running stores and 32 percent follow running brands on social media. The favorite running shoe brand among survey respondents by far was Brooks, followed by Asics, New Balance, Nike and Saucony.

What’s In The Economic Stimulus Package?

Officials from Monument Advocacy, a leading, bipartisan government and public affairs firm in Washington, D.C., Thursday, in a webinar held by the Outdoor Industry Association (OIA), provided a deep dive into what the $2 trillion stimulus package, called the Coronavirus Aid, Relief, and Economic Security (CARES) Act, means for businesses and workers.

Outdoor Industry’s Signature Event Finally Called Off

Outdoor Retailer ended weeks of speculation Thursday afternoon when it finally pulled the plug on Summer Market in response to the coronavirus pandemic, which is ravaging U.S. business activity, including the cancellations of large gatherings like trade shows. OR will now pivot to a digital format, as other events have done in response to the crisis.

Aisle Talk Week Of March 30, 2020

Top National Stories and the Latest Headlines From SGB Updates across the Active Lifestyle Market during the week of March 30, 2020.

Why Sportsman’s Warehouse Is Well-Positioned During The Coronavirus Crisis

Jon Barker, CEO of Sportsman’s Warehouse Holdings Inc., says the company is “positioned as well as anyone” in sporting goods retail in terms of dealing with the coronavirus—but it goes beyond selling firearms and ammunition. He spoke with SGB Executive about why Sportsman’s is in such a good spot.