Aisle Talk, Week of March 19

Top headlines from the active lifestyle industry you may have missed this week.

Nike Eyes North American Comeback

Aided by a strong response to new launches such as Nike React and Airmax 270, continued momentum in online sales and early success in pushing for further differentiation at its retail partners, Nike Inc. said its North America business is poised to return to growth mode.

Boardriders CEO: Billabong Won’t Get Another Deal This Good

Two Billabong shareholders are opposed to the $200 million, or $1 per share, acquisition offer from Boardriders, which has jeopardized the potential blockbuster deal and sparked sharp words from Boardriders CEO David Tanner.

Outdoor, Footwear, Fashion & Retail Industries Vocalize Opposition to Tariffs

It’s not China that will be punished for stealing American intellectual property but instead U.S. companies and consumers that will feel the effects of President Trump’s move to impose $50 billion in retaliatory tariffs on Chinese imports. That was the message Thursday from numerous trade associations that represent industries whose products might be affected by Thursday’s decision to move forward with the new tariffs.

Dick’s Touts Growth Opportunities In Footwear And Apparel

Speaking last week at the Bank of America Merrill Lynch Consumer and Retail Technology Conference, Dick’s Sporting Goods’ officials elaborated on its exit from the fitness tracker category and challenges in firearms. But much of its presentation was spent discussing growth opportunities on the footwear and apparel side with brands including Nike, Adidas, Brooks and Patagonia as well as its numerous private labels.

Ibex’s New Owner Talks Up Merino Wool Brand’s Revival

On March 9, news arrived that Ibex, which ceased operations last November, had been sold to Flour Fund, a New York-based group led by David Hazan, a marketing expert. SGB Executive talked to Hazan about what’s next for Ibex.

Omnichannel Focus Fueling Duluth’s 2018 Ambitions

Bolstered by double-digit revenue growth in both the fourth quarter and fiscal year, Duluth Holdings Inc., parent of Duluth Trading Co., is doubling down on its omnichannel strategy of building its brick-and-mortar presence while also beefing up e-commerce capabilities.

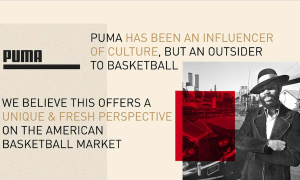

Puma Looks At Basketball To Continue U.S. Momentum

At Puma’s Capital Markets Day, Bjørn Gulden, CEO, said re-entering the basketball category becomes the 6th priority in its turnaround plan as it aims to regain a foothold in American sports.

FDRA President Discusses Impact Of Proposed Higher Tariffs

SGB Executive talked to FDRA President Matt Priest about the impact the Trump Administration’s proposed higher tariffs will have on companies and consumers.

Hibbett Looks To Build On Q4 Momentum In 2018

Hibbett Sports’ earnings fell, as expected, in the fourth quarter due to the promotional marketplace. But results were better-than-expected coming into the quarter due to an acceleration in its e-commerce business and strength in sportswear and overall footwear offerings.

L.L. Bean Forgoes Bonuses After Challenging Year

With sales coming in slightly down in 2017, L.L.Bean said it plans to eliminate employee bonuses for the first time since 2008 and will lay off about 100 positions this spring.

Golf and Nike Swim Drive Perry Elllis’ Q4 Growth

Perry Ellis International reported sales its Golf segment grew 20 percent in the fourth quarter ended February 3 while Nike Swim saw healthy gains.

Zumiez Misses Q4 Guidance On European Write-Offs

Zumiez Inc. reported fourth-quarter earnings rose 18.2 percent but came in below guidance due to write-offs for its European operations.

Aisle Talk, Week of March 12

Top headlines from the active lifestyle industry you may have missed this week.

Journeys Momentum Offset Lids Woes To Salvage Genesco’s Q4

A strong retro athletic and lifestyle athletic boosted revenues at Journeys to offset a steep decline at Lids and help Genesco deliver fourth-quarter results in line with guidance.