Life Time Group Holdings, Inc. reported its financial results for the fiscal first quarter ended March 31, 2024.

Bahram Akradi, company founder, chairman and CEO, stated: “We are extremely pleased with our first quarter financial performance. The desirability of our brand combined with historic levels of member retention and engagement continues to drive strong financial results. As a result, we are raising our full-year revenue and Adjusted EBITDA guidance. We also remain on track to achieve our other 2024 financial goals, namely being free cash flow positive beginning in the second quarter, further improving our balance sheet, and reducing our net debt leverage ratio.”

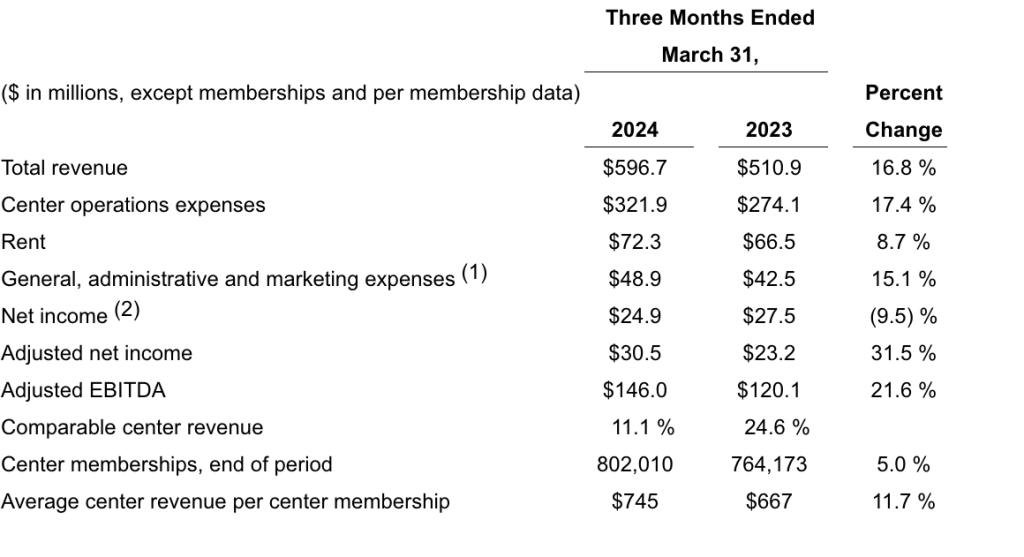

Financial Summary

First Quarter 2024 Key Takeaways

- Revenue increased 16.8 percent to $596.7 million from continued strong membership dues and in-center revenue growth.

- Center memberships increased by 37,837, or 5.0 percent, compared to March 31, 2023, and increased sequentially from December 31, 2023, by 38,794, consistent with typical seasonality.

- Total subscriptions, including center memberships and digital on-hold memberships, increased 4.9 percent from March 31, 2023, to 853,072.

- Center operations expenses increased 17.4 percent to $321.9 million , primarily from increased operating costs related to new and ramping centers and growth in memberships and in-center business revenue.

- General, administrative, and marketing expenses increased 15.1 percent to $48.9 million, primarily from higher share-based compensation expenses in the current period, the timing of marketing expenses related to new club openings and increased information technology costs.

- Net income decreased $2.6 million to $24.9 million primarily from tax-effected one-time net benefits of a $5.1 million gain from sale-leasebacks and a $3.6 million gain related to the sale of two triathlon events in the prior year period. Gains were largely offset by improved business performance in the current period.

- Adjusted net income increased $7.3 million to $30.5 million.

- Adjusted net income and Adjusted EBITDA improved as Life Time experienced greater flow-through of its increased revenue and benefited from the structural improvements to the business that improved the company’s margins.

New Club Openings

Life Time opened one new club in the first quarter of 2024. As of March 31, 2024, it operates 172.

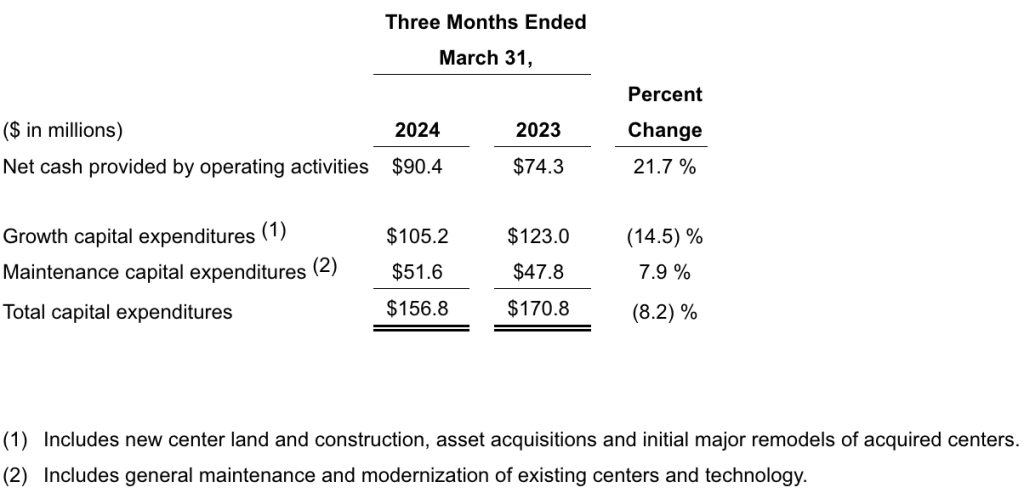

Cash Flow Highlights

Liquidity and Capital Resources

- As of March 31, 2024, Life Time’s total available liquidity was $242.7 million, which included its revolving credit facility, cash and cash equivalents.

- The company’s net debt leverage ratio improved to 3.6x as of March 31, 2024 from 5.2x as of March 31, 2023.

2024 Outlook | Full-Year 2024 Guidance

Images and data courtesy Life Time Fitness