Fenix Outdoor International AG (Group) reported that the start of 2024 was in line with expectations as the company continued to face challenges and specific positive indications and opportunities to capitalize on in the next few quarters.

The company noted in its first quarter Interim Report that it entered Q1 with a lower order book compared to last year, and company Chairman of the Board Martin Nordin explained in a letter to investors that this was mainly due to the inventory situation last spring, which had caused high insecurity among retailers, still affecting their liquidity.

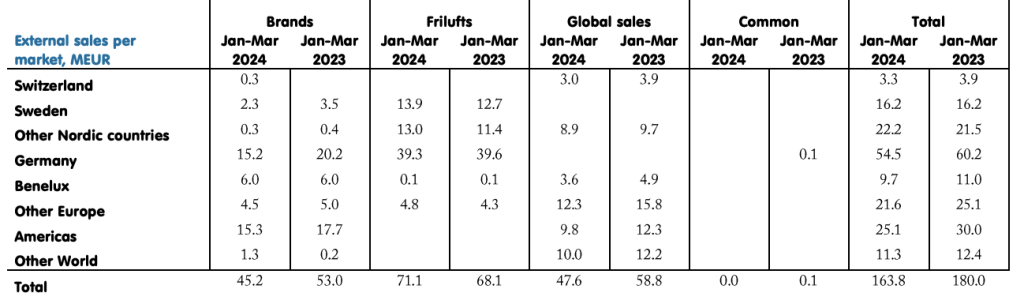

“The lower order book resulted in lower sales for our Global Sales and Brands segments,” Nordin added. “When comparing numbers to Q1 2023, it is important to remember that Primus is no longer a part of Fenix Outdoor, naturally resulting in a skewed comparison.” Primus contributed €4.6 million in Q1 2023.

The company reported that consolidated first-quarter sales declined 7.2 percent to €168.7 million, compared to €181.9 million in the prior-year comparative quarter. Excluding Primus in the year-ago period, sales declined 4.9 percent year-over-year.

Direct-to-consumer (DTC) sales grew 4.5 percent during the quarter and now represent 57.4 percent of the group’s total sales. It was said to be primarily driven by brick-and-mortar, but also “well supported” by the online sales from the individual brand sites. Digital sales comprised 19.2 percent of the quarter’s total sales, compared to 16.8 percent in Q1 2023. Group gross margin increased for the quarter due to increased DTC sales.

Group operating profit declined 25.2 percent to €12.8 million in Q1, compared to €17.1 million in operating profit in Q1 2023. Fenix posted net income of €6.9 million, or €0.51 a share, in the 2024 first quarter, compared to net income of €10.6 million, or €0.79, in the 2023 first quarter. EBITDA of the Group was €27.2 million in Q1, compared to €31.2 million in Q1 last year.

Nordin said the year started well for Frilufts Retail, especially in the Nordics due to the colder weather in the region, but the business started to slow toward the end of the quarter. He added that they were able to deliver according to plan without any significant problems in the Brands and Global Sales segments.

“We did have some smaller cost overruns in the logistics, mostly due to a steep learning curve during the roll-out of a new automated logistic system in our central warehouse in Ludwigslust, Germany,” Nordin shared.

Frilufts Segment

Net sales for Frilufts increased 4.4 percent to €71.1 million in the first quarter, compared to €68.2 million in the year-ago comp period. Nordin said that Q1 is by tradition a weak quarter for retail.

The Frilufts business in the Nordics region grew in Q1, especially supported by the colder weather, but Germany saw flat results. In terms of sales, brick-and-mortar outperformed digital sales again. Trekit in the UK, predominately a digital player, continues to struggle but was profitable.

Segment operating profit (loss) was a loss of €7.3 million in the quarter, slightly better than the €8.6 million operating loss record in the year-ago period. The improvement was said to be mainly driven by higher sales in Sweden.

Brands Segment

The company’s Brands segment, which includes Fjällräven, Royal Robbins, Hanwag, and Fenix Outdoor, had sales of €45.2 million in the first quarter, falling 14.9 percent from €53.1 million in the prior-year first quarter, nearly matching the decline posted in the fourth quarter.

“Overall, we have seen a slowing development in all major markets due to the inventory situation and the general caution among retailers,” explained Nordin. “Interestingly, the direct-to-consumer sales in Europe for our brands are growing in most markets, particularly on the web.” He said Fjaillraven is performing best in this area.

Segment operating profit was €12.9 million in the quarter, compared to operating profit of €17.6 million.

Global Sales Segment

Within Global Sales, the company saw net sales decrease from €58.7 million in Q1 2023 to €47.6 million in Q1 2024. Segment operating profit was €7.8 million in Q1, compared to €12.3 million in the year-ago Q1 period.

Regional Results

Regarding geographical development, Nording said most of the company’s wholesale markets had no growth during the quarter, due to the low order books. “We did have a very good Q1 in Asia with record numbers in China. In retail, we saw growth in the Nordics, but Germany’s was flat.”

Inventory & Cash Flow

Inventory & Cash Flow

Nordin also pointed out that the company has seen the first sign of gaining better control of its inventory situation. “An interesting fact is that we have seen an increase in direct orders in most markets, supporting our trust that the inventory situation is improving,” he noted.

Inventory was reportedly down 4.9 percent to €257.8 million at quarter-end from €271.1 million at the end of 2023. The operational cash flow for the period was €27.3 million, stronger than last year.

Outlook

Nordin said that the expectations for the second quarter are hard to predict. “Given the situation in Q2 last year, we are cautiously optimistic for Q2 this year,” he expressed. “Due to our direct order rate as of now being higher than last year, and how the direct order rate developed late Q2 and early Q3 last year.”

He said the company’s main risk lies more in the financial well-being of the retailers and their ability to pay.

Looking forward at full-year 2024, Nordin admitted the company faces several challenges and possible opportunities. “As I have mentioned earlier, we are facing a non-satisfactory inventory situation,” Nordin noted. “However, we are now seeing the first signs of improvement both internally as well as at our retailers. On the retail side, there is still a high risk of discounting in the market to activate the large inventories on hand.”

The Board chair continued: “The COVID years created a boom for our industry, which in turn created a huge inventory when consumers returned to normal behavior; this means that the market is not growing to the same extent that we have been used to. This conclusion is supported when we look at our Frilufts operation, where we see few brands showing any growth at all, and considering the inflation, the real growth is even lower. When we look at our retailers, we see that a lot of them are hurting financially. The same goes for quite a few competing brands.

“If we add the general economic and societal issues to the picture, my conclusion is that it is still very unpredictable how long this will continue. I believe this year will continue to challenge us in certain areas, even though we see some improvements going into H2,” he said.

Nordin also said he was convinced that the company is well-placed to capitalize on all the opportunities ahead.

“We have strong brands run by competent and good people in our portfolio, enabling us to gain the necessary momentum going forward. We continue working on our costs as well as rebuilding our operations to become more efficient and utilize our great internal resources to the fullest,” he said. “It is also worth noting that this environment creates possible opportunities in terms of acquisitions and, given our strong cash position, is a definite possibility going forward as it could enable us to capitalize on the challenges in the market. I am positive in terms of the long-term future as I believe that our business model has and will continue to show its robustness.”

Image courtesy Fjällräven, Chart courtesy Fenix Outdoor International AG