Under Armour, Inc. saw its UUA shares under pressure in pre-market trading on May 16 as the company issued guidance that came up short of sales and profit estimates for the fiscal 2025 year ahead. However the market may have seen the long-term upside to the company’s reset plan for the U.S. business as shares were relatively flat in early trading.

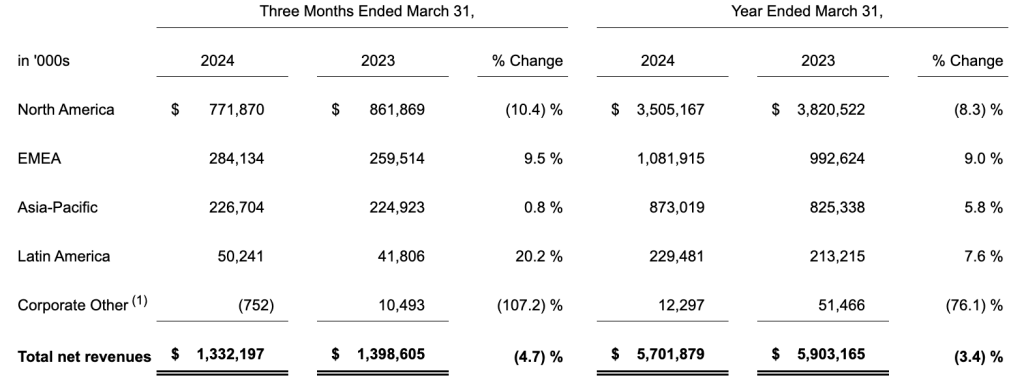

The company reported fiscal 2024 fourth quarter net revenue was down 5 percent year-over-year (YoY) to $1.3 billion for the three-month period ended March 31, 2024. Revenues were also down 5 percent in currency-neutral (CN) terms for the period.

Region Review

- North America revenue decreased 10 percent YoY to $772 million in the fourth quarter.

- International revenue increased 7 percent (+6 percent CN) YoY to $561 million .

- EMEA (Europe, Middle East & Africa) revenue increased 10 percent (+7 percent CN) in the quarter.

- Asia-Pacific revenues inched up 1 percent (+5 percent CN) for the Q4 period.

- Latin America revenues jumped 20 percent (+12 percent CN).

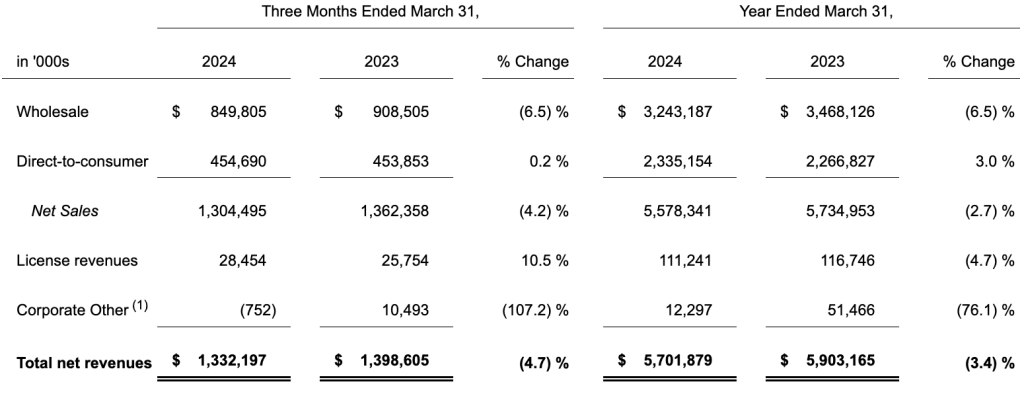

Channel Review

- Wholesale revenue decreased 7 percent to $850 million in Q4.

- Direct-to-consumer (DTC) revenue was flat at $455 million.

- Owned and operated store revenue increased 7 percent.

- E-commerce revenue decreased 8 percent, representing 43 percent of the total DTC business for the quarter.

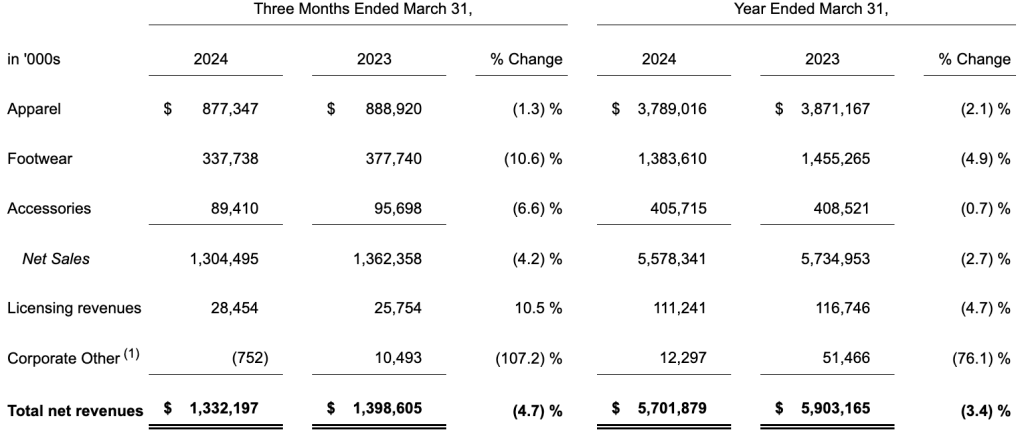

Category Review

- Apparel revenue decreased 1 percent to $877 million in the fourth quarter.

- Footwear revenue was down 11 percent to $338 million.

- Accessories revenue was down 7 percent to $89 million.

Income Statement

Gross margin increased 170 basis points to 45.0 percent of net revenue in Q4, said to be driven primarily by supply chain benefits related to lower product and freight costs, partially offset by unfavorable foreign currency impacts and proactive inventory management actions, including increased promotional activities in our direct-to-consumer business.

Selling, general & administrative (SG&A) expenses were up 5 percent to $603 million. Excluding a $58 million litigation reserve expense.

- Adjusted SG&A expenses were down 5 percent to $546 million.

Operating loss was $4 million.

- Adjusted operating income was $54 million.

Net income was $6.6 million, or 2 cents per diluted share, in the fourth quarter, compared to $170.6 million, or 38 cents per diluted sahre, in the prior-year Q4 period.

Adjusted net income was $49 million, or 11 cents per diluted share.

Balance Sheet Highlights

Inventory was down 19 percent to $958 million.

Cash and Cash Equivalents were $859 million at quarter-end.

No borrowings were outstanding under the company’s $1.1 billion revolving credit facility.

“Amid a challenging retail environment in fiscal 2024 that included high inventories and a consistent drumbeat of promotions, we demonstrated disciplined expense control and delivered results that were aligned with our previous outlook,” said Under Armour President and CEO Kevin Plank. “We also maintained a strong balance sheet, closing the year with a solid cash position and healthy inventory levels.”

Fiscal 2025 Restructuring Plan

To strengthen and support the company’s financial and operational efficiencies, Under Armour’s Board of Directors approved a restructuring plan for fiscal 2025. In conjunction with the plan, the company expects to incur a total estimated pre-tax restructuring and related charges of approximately $70 million to $90 million, including:

- Up to $50 million in cash-related charges, consisting of approximately $15 million in employee severance and benefits costs and $35 million related to various transformational initiatives: and

- Up to $40 million in non-cash charges comprised approximately $7 million in employee severance and benefits costs and $33 million in facility, software and other asset-related charges and impairments.

See below for more SGB Media coverage of Under Armour’s turnaround plan.

EXEC: CEO Kevin Plank Outlines Dramatic Turnaround Plan for Under Armour

Fiscal 2025 Outlook

“Due to a confluence of factors, including lower wholesale channel demand and inconsistent execution across our business, we are seizing this critical moment to make proactive decisions to build a premium positioning for our brand, which will pressure our top and bottom line in the near term,” Plank continued. “Over the next 18 months, there is a significant opportunity to reconstitute Under Armour’s brand strength through achieving more, by doing less and focusing on our core fundamentals: driving demand through better products and storytelling, running smarter plays like simplifying our operating model and elevating our consumer experience. In parallel, we’re focused on cost management and implementing the strategies necessary to grow our brand and improve shareholder value as we move forward.”

Key points related to Under Armour’s fiscal 2025 outlook include:

- Revenue is expected to be down at a low-double-digit percentage rate, which includes a 15 percent to 17 percent decline in North America as the company works to meaningfully reset this business following years of heightened promotional activities, particularly in its DTC business and a low-single-digit percent decline in its international business due to more conservative macro consumer trends and actions to protect the brand strength it has built.

- Gross margin is expected to be up 75-to-100 basis points compared to the prior year, driven by a material reduction in promotional and discounting activities in the company’s DTC business and product costing benefits.

- Selling, general, and administrative expenses are expected to be down 2 percent to 4 percent.Operating income is expected to be $50 million to $70 million. Excluding the mid-point of anticipated restructuring charges. Adjusted operating income is expected to be $130 million to $150 million.

- Diluted earnings per share is expected to be between $0.02 and $0.05. Adjusted diluted earnings per share is expected to be between 18 cents and 21 cents per share.

- Capital expenditures are expected to be between $200 million to $220 million.

Share Buyback Program

The company also announced that Under Armour’s Board of Directors authorized repurchasing up to $500 million of UA’s outstanding Class C common stock. Repurchases under the program can be made over the next three years through various methods, including accelerated share repurchase, open market, or privately negotiated transactions.

Image courtesy Under Armour