SGB Executive Sports & Fitness

Aisle Talk Week Of April 2

Top headlines from the active lifestyle industry you may have missed this week.

Newell Brands’ Proxy Fight Still A Go

Believing the company’s recent partnership with famed billionaire investor Carl Icahn will be enough to fix the company, activist investor Starboard Value LP said it has no plans to drop its proxy fight against Newell Brands.

Nike Admits To Diversity Shortcomings

Coming a few weeks after allegations of inappropriate workplace behavior led to changes in the executive ranks, Nike Inc. in a memo to employees admitted to shortfalls in hiring and promoting more women and minorities to senior-level positions.

Adam Sussman Talks Up Nike’s Digital Connections

At a keynote session at Shoptalk in Las Vegas, Adam Sussman, Nike’s chief digital officer, discussed the brand’s digital transformation and how Nike is tailoring its approaches to best connect with three distinct customer segments: the Weekend Runner, Style Shopper and Dedicated Sneakerhead.

Under Armour Gets Hacked

In another blow for the brand, Under Armour admitted that that as many as 150 million MyFitnessPal user accounts were compromised in February of this year. The incident stands as one of the biggest hacks in history.

Aisle Talk, Week of March 26

Top headlines from the active lifestyle industry you may have missed this week including VF Corp. appointed Steve Murray, pictured left, former President of Vans, to VP Strategic Projects.

Finish Line’s Profits Progress, Sales Retreat In Q4

While its sales recovery efforts took a step back, The Finish Line Inc. improved its underlying profitability in its fourth quarter ended March 3, thanks to inventory end expense controls. Results were in line with a forecast given three days ago when it surprisingly announced plans to merge with JD Sports, the U.K.-based footwear chain.

Shoe Carnival’s Q4 Benefits From Fewer Promotions, Women’s Leads Athletics

Shoe Carnival Inc. reported fourth-quarter earnings arrived at the top end of guidance due to a focus on lower promotions, but the move led to a dip in same-store sales. Adult Athletic comps were up low-single digits as strength in women’s athletic offset weakness in men’s basketball.

JD Sports Looks To Take On Foot Locker In U.S. Market

In a shocker, JD Sports announced plans to enter the U.S. marketplace through the acquisition of the beleaguered sneaker chain Finish Line. Analysts said the merged retailer’s combined buying clout presents a new threat to Foot Locker.

Aisle Talk, Week of March 19

Top headlines from the active lifestyle industry you may have missed this week.

Nike Eyes North American Comeback

Aided by a strong response to new launches such as Nike React and Airmax 270, continued momentum in online sales and early success in pushing for further differentiation at its retail partners, Nike Inc. said its North America business is poised to return to growth mode.

Outdoor, Footwear, Fashion & Retail Industries Vocalize Opposition to Tariffs

It’s not China that will be punished for stealing American intellectual property but instead U.S. companies and consumers that will feel the effects of President Trump’s move to impose $50 billion in retaliatory tariffs on Chinese imports. That was the message Thursday from numerous trade associations that represent industries whose products might be affected by Thursday’s decision to move forward with the new tariffs.

Dick’s Touts Growth Opportunities In Footwear And Apparel

Speaking last week at the Bank of America Merrill Lynch Consumer and Retail Technology Conference, Dick’s Sporting Goods’ officials elaborated on its exit from the fitness tracker category and challenges in firearms. But much of its presentation was spent discussing growth opportunities on the footwear and apparel side with brands including Nike, Adidas, Brooks and Patagonia as well as its numerous private labels.

Ibex’s New Owner Talks Up Merino Wool Brand’s Revival

On March 9, news arrived that Ibex, which ceased operations last November, had been sold to Flour Fund, a New York-based group led by David Hazan, a marketing expert. SGB Executive talked to Hazan about what’s next for Ibex.

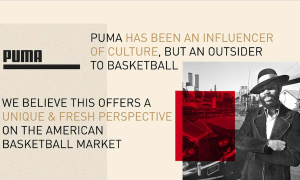

Puma Looks At Basketball To Continue U.S. Momentum

At Puma’s Capital Markets Day, Bjørn Gulden, CEO, said re-entering the basketball category becomes the 6th priority in its turnaround plan as it aims to regain a foothold in American sports.