Planet Fitness Gets Ready To Re-Open

Planet Fitness expects to benefit from expected consolidation in the fitness space, heightened interest in health and wellness and pent-up demand for workouts. But the key will be a 100-page COVID-19 operations playbook developed with its franchise partners to elevate sanitation protocols and convince members that it’s safe to return.

Johnson Outdoors Sees Q3 Shortfall

On Johnson Outdoors’ second-quarter conference call, Helen Johnson-Leipold, chairman and CEO, warned third-quarter results will be “significantly impacted” as COVID-19 has arrived “at the heart of our primary selling season.” Government mandates have restricted activities across the fishing, dive, camping and watercraft markets the company serves.

April M&A Roundup: CODI, Exxel, Vicis And More

April was another slow month for M&A in the active-lifestyle market as the coronavirus continued to ravage traditional business transactions, but a few deals were either announced or completed, including those from Compass Diversified Holdings (CODI), Exxel Outdoors and Vicis.

Schoeller Strengthens Vendor Partnerships Amid Pandemic

Schoeller North America has been working closer than ever with its brand partners on forecasting, sharing information and finding ways to be flexible to help each other manage through the pandemic. Stephen Kerns, president, Schoeller North America, talks to SGB Executive about the many ways the crisis has impacted Schoeller, heightened demand for functional fabrics, and what he hopes will be post-coronavirus benefits to healthy lifestyles, the environment and the family.

Emerald Outlines COVID-19 Response Playbook

With many of its trade shows—including Outdoor Retailer Summer Market in June—already canceled or postponed, Emerald Holding Inc. has shifted into full pivot mode as it works to maintain liquidity through this downturn and convert some events to virtual ones.

Newell’s Outdoor Brands Crushed As Consumers Shelter In Place

Without places for consumers to recreate or easily buy gear and apparel during the coronavirus, outdoor brands have gotten crushed in the process. And Newell Brands—parent of Coleman and Marmot—is the latest to publicly announce just how bad things have gotten in this space.

Microban Benefiting From Heightened Focus On Cleanliness

For Microban International. Ltd., the specialist in antimicrobial and odor control solutions, one benefit from COVID-19 has been the increased focus on sanitization and the company is accelerating the development of custom antiviral solutions for textiles. Here, Brian Aylward, Microban’s senior director, global textiles business, discusses the elevated opportunities around antimicrobial technologies created by the pandemic that he expects will make Microban a household name.

‘Preparedness Mindset’ Bodes Well For 5.11 Tactical

The nationwide demand for prepping products helped 5.11 Tactical perform ahead of the expectations that parent company Compass Diversified Holdings LLC (CODI) laid out for the brand in the first quarter. In CODI’s overall branded consumer businesses, revenues and EBITDA increased 4.2 percent and 4.3 percent, respectively

Clarus Terminates SKB Acquisition Due To COVID-19 Uncertainty

Clarus Corp., in an 8-K filing Friday morning, said it was terminating its planned acquisition of protective case manufacturer S.K.B. Corporation (SKB) due to “recent events surrounding the COVID-19 global pandemic, and the economic uncertainties in the United States and globally.”

Is Your Outdoor Brand Eligible For Tariff Relief?

A Thursday webcast hosted by the Outdoor Industry Association outlined the ways that outdoor brands that make a variety of products can apply for tariff exclusions or deferrals, saving them money during this difficult time. It’s a tricky process, but here are a few tips on how to begin.

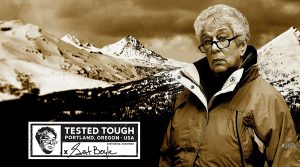

Columbia Sportswear Set To Battle Pandemic

On its first-quarter conference call with analysts, Tim Boyle, chairman, CEO and president, said he believes his company’s trusted brands, strong balance sheet and an expected hike in outdoor participation will help the company manage COVID-19’s fallout. His confidence is particularly high because he contends the company already survived a more challenging period in the seventies.

Aisle Talk Week Of April 27, 2020

Top National Stories and the Latest Headlines from SGB Updates across the Active Lifestyle Market during the week of April 20, 2020.

Why Garmin Is Bullish On Post-Coronavirus Opportunities

Garmin Ltd. might have withdrawn its fiscal 2020 guidance due to coronavirus-related economic uncertainty, but the Olathe, KS-based maker of wearable technology and at-home fitness products emerged from the first quarter with an unusual abundance of confidence. President and CEO Cliff Pemble explains why.

HanesBrands Details Four-Prong Strategy To Manage Pandemic

HanesBrands, while reporting steep declines in sales and earnings in the first quarter due to the pandemic, said it has developed a four-step response strategy to maximize its operating flexibility under a number of modeling scenarios. One scenario assumes stores reopen in late May and another in early July.

Hydro Flask Delivers “Fantastic” Year

Hydro Flask churned out high double-digit growth in both the fourth quarter and fiscal year ended February 29, according to the quarterly report of its parent, Helen of Troy. The leading beverage brand continues to benefit from its “Just One More” strategy that encourages loyal fans to try new colors, shapes, sizes and categories.