By Thomas J. Ryan

<span style="color: #969696;">On its first-quarter conference call with analysts, Tim Boyle, chairman, CEO and president, said he believes his company’s trusted brands, strong balance sheet and an expected hike in outdoor participation will help the company manage COVID-19’s fallout. His confidence is particularly high because he contends the company already survived a more challenging period in the seventies.

At that time, the sudden passing of his father, Neal, left the company in the hands of his mother, Gert, and Tim, with both having little understanding of the business.

“I was a senior journalism student at the University of Oregon and Gert’s previous business to the Columbia Sportswear office had been limited to dropping in to saying, ‘Hi!,’” said Boyle. “It goes without saying that the leadership team left room for improvement in those first few years.”

He added, “We faced insurmountable challenges across all aspects of the business, interest rates were over 20 percent, and you couldn’t buy gasoline at any price. That first year, we managed to take a company with $1 million in annual sales and turn it into a company with $500,000 in annual sales. We eventually found our path and built a global brand portfolio company you see today.”

Boyle then proceeded to detail how Columbia plans to manage the current crisis, including numerous steps to strengthen liquidity, preserve capital and reduce costs “as we prepare for a prolonged downturn of unknown duration.”

…

With steps taken to shore up liquidity, Columbia has total credit lines providing $631 million of borrowing capacity, of which $525 million is committed. Moves to suspend both the company’s dividend and share repurchases, as well as to reduce capital expenditures, are expected to reduce 2020 capital outflows by approximately $130 million.

Operating expense for the current year is expected to be reduced by more than $100 million due to moves to minimize discretionary expenditures, reducing marketing spend, curtailing hiring, and from staff and salary reductions. Boyle’s salary was reduced to $10,000, the minimum to retain health care benefits.

Said Boyle, “Overall, our near-term capital allocation priorities have shifted to focus on maintaining a strong balance sheet in order to provide maximum strategic flexibility and access to additional liquidity, if warranted.”

On the offensive side, Boyle noted the shift to e-commerce has accelerated due to the pandemic, and he stressed that “the single biggest investment we’re making in 2020 is on improving and enhancing our digital capability.”

Investments will continue to support the launch of the Experience First initiative, or X1, the online platform for Columbia brand, Sorel and Mountain Hardwear in North America prior to holiday selling. Said Boyle, “We know that our e-commerce businesses are powerful brand marketing engines in the marketplaces where we connect directly with consumers.”

Online, sales declined in March across North America as consumers focused on purchasing essential items, but recovered smartly in April with a gain of over 60 percent across Columbia’s platforms. “Healthy growth” was also seen in April at third-party online partners, including Dick’s Sporting Goods, Kohl’s and REI. In 2019, e-commerce represented 11 percent of Columbia’s own sales and over 20 percent including those from its wholesale retail partners and pure-play e-tailers.

While overall marketing spend is being reduced to align with demand, digital marketing is being enhanced with a focus on brand stories. Said Boyle, “We’re focusing on key products across a unique brand portfolio that we know our retail partners can sell in high-volume, including iconic Columbia PFG styles and time-tested innovation platforms like Omni-Heat.”

Boyle said he believes the flagship Columbia brand is well-positioned for the challenging economic climate. Said Boyle, “As consumers look to make every dollar they spend count during this downturn, we know that Columbia’s reputation for exceptional value and differentiated innovation is as important as ever.”

The arrival of innovations, including enhancements to the Omni-Heat platform, is expected to support the Columbia brand in the months ahead. Sorel, which has been the company’s fastest-growing brand in recent years, continues to outperform in the marketplace. Prana and Mountain Hardwear are both expected to benefit from their “reinvigorated” product lines.

Boyle added, “It’s important to note that with all this uncertainty, our retail partners know that Columbia Sportswear will be around to continue selling them great product for seasons to come.”

…

Another key focus for Columbia will be inventory optimization. As stores closed and its retail partners’ focus shifted to preserving cash, Columbia reassessed orders and subsequently significantly curtailed purchases of Fall 2020 inventory. Any remaining excess inventory will be cleared at outlet stores. Inventories were up 11 percent as of March 31.

Boyle also said that in a shift in strategy due to the current uncertainty, the company will be “acutely focused on managing inventory and improving turns.” Historically, Columbia used its balance sheet to drive production efficiencies and to capitalize on sales opportunities, a move that drove sales albeit at slower inventory turns.

Another benefit expected for Columbia includes an expected pick-up in outdoor participation as social distancing restrictions are eased. Said Boyle, “It’s hard to say how this pandemic will permanently change consumer behavior, but in an era when everyone is working from home, trying to avoid crowds and looking for an escape, it certainly seems like getting outdoors and enjoying nature is the perfect solution. I’m convinced we’re going to see outdoor participation grow as a result of this pandemic. Our mission is to connect active people with their passions, and we’re ready to equip outdoor enthusiasts with innovative footwear and apparel.”

…

<span style="color: #969696;">The pandemic, not unsurprisingly, took its toll on first-quarter results.

Net sales decreased 13 percent to $568.2 million year-over-year. The decline primarily reflects the impact of the pandemic and, to a lesser extent, lower demand resulting from warmer weather compared to a strong sales performance in the first quarter of 2019.

By region, U.S. sales declined 9 percent to $375.9 million with the steepest decline in March. Retail traffic trends started to decline early in the month before Columbia closed all its owned stores in mid-March.

Internationally, LAAP sales were down 22 percent on a currency-neutral basis, to $102.6 million. China dropped in the high-40 percent range. EMEA sales were down 20 percent on a currency-neutral basis to $55.8 million, reflecting lower consumer demand related to the pandemic and widespread store closures that started in mid-March. Canada was off 13 percent on a currency-neutral basis to $33.9 million.

By brand, Columbia’s sales fell 15 percent on a reported basis and 14 percent on a currency-neutral basis to $471.7 million due in part to the warm winter. Highlights for the brand include media call-outs and awards for new products from GQ, Shape and Men’s Journal. On the marketing front, a new Outdoor Guide to inspire outdoor enthusiasts was launched on Columbia brand’s website and Instagram. In response to the pandemic, the brand launched the #together campaign to interact with the brand and its ambassadors and encourage fans to share their favorite outdoor adventures or future plans.

Sorel’s sales were down 2 percent to $36.5 million due primarily to lower sales of winter utility styles in Europe. On the bright side, Sorel’s unit sales volumes across the brand’s wholesale business and sorel.com in April was up year-over-year and have set sales records despite significant store closures. Through the first several weeks of April, sorel.com has generated nearly 300 percent year-over-year growth.

Prana’s revenues declined 11 percent to $38.7 million. Lower wholesale sales more than offset strong e-commerce growth that continued from the fourth quarter. Said Boyle, “We remain confident in Prana’s focus, including its message of clothing for positive change and refreshed product line.”

Mountain Hardwear’s sales eased 2 percent to $21.3 million. Boyle said a “healthy start to the year gave way to lower demand due to the pandemic as the quarter progressed.”

Gross margin in the quarter contracted 360 basis points to 47.8 percent. The erosion primarily reflected COVID-related inventory obsolescence provisions and lower DTC product margins reflecting higher promotional activity.

SG&A expenses increased 10 percent to equal 48.7 percent sales, up from 38.5 percent a year ago.

The loss from operations came to $2.0 million compared to an operating income of $88.0 million a year ago. The latest quarter included a $21.5 million year-over-year increase in bad debt expense as a precautionary move in the current environment and a $9.2 million year-over-year increase in inventory obsolescence provisions.

Net income came to $213,000, or break-even per share, down from $74.2 million, or $1.07, for the comparable period in 2019.

Boyle concluded, “In summary, while 2020 will take a different path than we originally expected, we’re confident in our strategy and ability to weather this storm. Our long-term commitment to driving sustainable and profitable growth has not changed. Our strategic priorities remain to drive global brand awareness and sales growth through increased focused demand creation investments, enhanced consumer experience and digital capabilities in all of our channels and geographies; expand and improve global direct-to-consumer operations with supporting processes and systems, and invest in our people and optimize our organization across the portfolio of brands.”

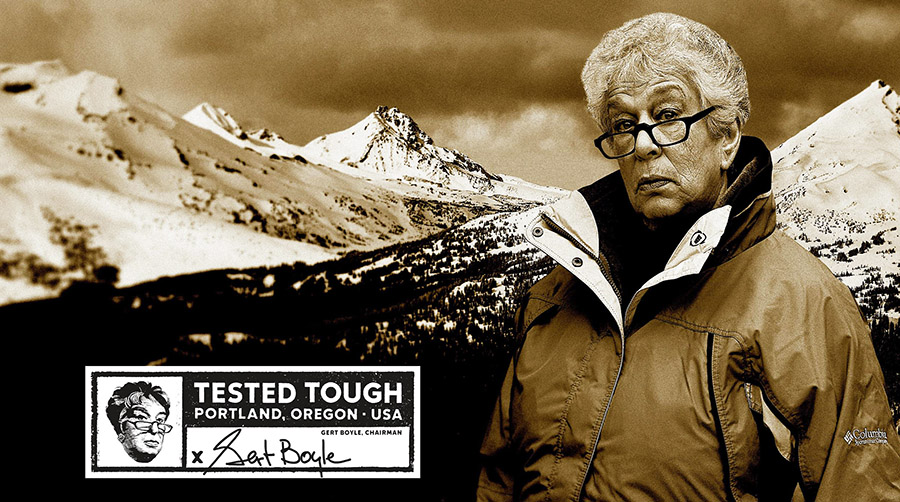

Photo courtesy Columbia Sportswear