SGB Executive Sportsmans

Pure Fishing Hits The Selling Bock

Pure Fishing, the parent company of well-known fishing brands Berkley, Abu Garcia, Penn, Fenwick, Sterns, Mitchell, Pflueger, Shakespeare, Ugly Stik Spiderwire, among others, has joined Rawlings on the list of businesses Newell Brands is looking to divest.

Aisle Talk Week of April 30

Top headlines from the active lifestyle industry you may have missed this week, including Nike Inc. CEO Mark Parker (pictured) holding a rare company-wide staff meeting at Nike headquarters to apologize for recent incidents at the company.

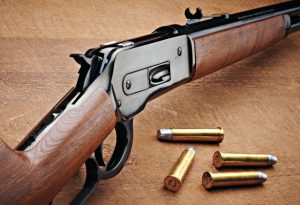

Olin Corp Sees Winchester’s Earnings Declining In 2018

Olin Corp reported a sharp decline in earnings at the company’s Winchester segment due to reduced commercial demand and higher-commodity material costs. Olin officials no longer see Winchester’s results improving in 2018, but also assured analysts it has no plans to sell the business.

Crosman And 5.11 Up, Liberty Safe Down For CODI

Compass Diversified Holdings (CODI) reported healthy growth for Crosman and 5.11 in the first quarter but Liberty Safe saw a steep decline.

Ellett Brothers To Buy AcuSport In Asset Sale

The assets of AcuSport, a Bellefontaine, OH-based distributor of shooting and hunting products that filed Tuesday for Chapter 11 bankruptcy protection, will be acquired by Ellett Brothers LLC, a wholly owned subsidiary of United Sporting Cos., the parties have announced.

Big 5 Wacked By Weather Woes In Q1

Big 5 Sporting Goods reported that a lack of cold weather crushed its winter business early in the first quarter while the arrival of chilly weather restrained its spring business later in the quarter.

Vista Outdoor To Exit Firearms, Sports Protection And Paddle Boards

On a conference call with analysts, Christopher Metz, CEO of Vista Outdoor, explained the strategy behind the company’s decision to focus on brands within four distinct categories, ammunition, hunting/recreational shooting accessories, hydration bottles and packs and outdoor cooking products, while divesting Bell, Giro, Blackburn, Jimmy Styks and Savage and Stevens firearms.

Aisle Talk Week Of April 23

Top headlines from the active lifestyle industry you may have missed this week.

Balanced Portfolio, Channel Strategy Fuels Rocky Brands’ Q1

Though Rocky Brands Inc. narrowly missed Wall Street’s revenue estimates in the first quarter, the Nelsonville, OH-based company rode a healthy balance across portfolio and sales channels to more than double net income from the same quarter a year ago.

Shimano’s Q1 Boosted By Fishing Momentum, Cost Controls

Shimano’s earnings showed some recovery in the first quarter with the help of strong expense controls, a profit uptick in the company’s Fishing Tackle segment and a modest earnings gain in Bicycle Components.

Newell Brands Averts Proxy Battle

The battle over board seats at Newell Brands has come to a quicker-than-expected end. But the divestitures will continue.

Escalade’s Earnings Dip In Part On E-Com Investments

Escalade Inc. reported that its key archery category is finally showing some signs of stabilizing but investments in new businesses and e-commerce brought down earnings slightly in the first quarter.

Wells Fargo Upgrades Newell Brands On Potential Further Sales

Wells Fargo raised its rating on Newell Brands due to expectations that proceeds from divestitures will come in greater than planned. West Fargo expects the second round of asset sales will include Newell’s outdoor & recreation division, which includes Coleman, along with outdoor apparel and beverage brands; and its fishing brands.

Frank Hugelmeyer Sees RVs Supporting Camping’s Growth

With the RV (recreational vehicle) industry seeing record sales over the last three years at a double-digit growth pace, it’s no surprise to Frank Hugelmeyer, president of the Recreation Vehicle Industry Association (RVIA), that camping is seeing an uptick.

SFIA: Sporting Goods Scores Highest Annual Growth In Three Years

SFIA’s 2018 Manufacturers’ Sales Report showed sales in the sports and fitness industry grew 2.9 percent in 2017, representing the best annual growth in three years. Strong category performance was seen in basketballs, batting gloves, camping coolers, sports bras, fitness/workout footwear and fishing equipment.