SGB Executive Sports & Fitness

Adidas’ Supply Chain Problems Stunt North America’s Momentum

Adidas warned investors it will miss its 2019 growth target because supply chain bottlenecks in the first half of the year are making it difficult to meet demand. The growth is particularly expected to slow in North America, where it has doubled its business in the last three years to take market share from rival Nike

Dick’s Traffic Doldrums Continue

Dick’s Sporting Goods reported better-than-expected fourth-quarter results and outlined a number of initiatives to jump-start comp growth, including replacing its hunt sections in another 120 stores with faster-turning categories and switching out its licensed Reebok brand for a new private-label athletic label. But shares of Dick’s fell as management predicted only minimal top-line recovery in the current year.

Wall Street: Nike’s Share Gains On Adidas Seen Accelerating

With quarterly results soon arriving from both firms, two reports from Stifel and Cowen arrived finding Nike’s growth accelerating largely at the expense of Adidas.

Patagonia, L.L. Bean Near Top Of Reputation Rankings

Patagonia ranked third and L.L. Bean fourth in this year’s Axios Harris Top-100 Poll’s survey ranking the public’s perception of the 100 most visible U.S. companies. Nike, Adidas, Under Armour and Dick’s Sporting Goods also landed on the list.

Active Offering Most Potential For Sequential Brands

Sequential Brands’ Active division – including Gaiam, AND1, and Avia – remains its largest and most profitable division and will continue to be a focus for investments, including potential acquisitions, in the years ahead, Sequential officials said on the company’s fourth-quarter conference call.

Kohl’s Seeing Share Gains In Active, Adding Nike Plus-Sizes

Kohl’s Corp said it continued to see strong momentum across its Active categories in the fourth quarter. The retailer also said that its test of expanded Active areas will be extended to 160 stores and Nike plus-size offerings will arrive this spring.

Foot Locker Scores Best Quarterly Comp Since 2014

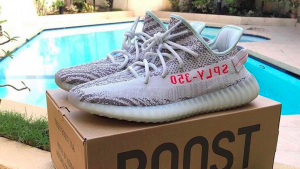

With hot sellers ranging from Adidas Yeezy to Jordan, Nike’s Max Air, Fila and Champion, Foot Locker Inc. belted out a 9.7 percent same-store gain in the fourth quarter – its best quarterly gain since the fourth quarter of 2014. Fourth-quarter earnings and 2019 guidance also arrived well ahead of expectations. Some setbacks include the planned closing of its SIX:02 women’s chain and more impairment charges for Runners Point, but a bigger investment has been made into in Carbon38, the women’s activewear upstart.

Athleta Becomes Prime Growth Engine With Old Navy’s Exit

Gap Inc.’s move to spin off Old Navy is expected to accelerate growth opportunities for Athleta, the already fast-growing women’s activewear chain. The fourth quarter for Athleta marked a two-year comp hike of nearly 30 percent.

Fitbit’s Shares Sink On Weak Guidance

Fitbit in the fourth quarter managed to show its first quarterly year-over-year increase in device sales since the fourth quarter of 2016. But shares were trading down about 16 percent in late-afternoon trading amid warnings of softer-than-expected sales for the first quarter and margin deterioration for the year.

Big 5 Turns Bullish As Winter Kicks In

Big 5 Sporting Goods Corp. said its holiday quarter came out better than expected as chilly weather goosed sales. Continued seasonal weather into February also has the California-based chain upbeat for the first quarter.

Adidas Earns Upgrade On Yeezy Momentum

Wells Fargo raised its rating on Adidas to “Outperform” from “Market Perform” due to the success the brand is finding with its “democratization” of Yeezy, its sub-brand collaboration with Kanye West.

Retail Reports Roundup

Retail studies arrived over the last two weeks on the value of in-person customer service, in-app spending growth, mobile payments, virtual assistants, supply chain digitization and more…

Zion Williamson Injury Puts Spotlight On Nike And College Hoops

A shoe malfunction that injured college basketball’s biggest star in the most-hyped game of the year sent Nike into full damage control mode and drove more debates on the risks of college athletics.

Wolverine’s Shares Sink On Cautious Guidance

Wolverine World Wide reported sales came in slightly below Wall Street’s expectations but are expected to accelerate to mid-single digit growth in the back half of 2019 due to an expected turnaround at Saucony and accelerated growth at Merrell and Sperry. EPS guidance for 2019, however, came in below expectations as the company plans to ramp up brand-building efforts this year.

SFIA: Sports Industry Facing Too Many Casual Participants

The annual SFIA Topline Participation Report found more Americans embracing healthy lifestyles in 2018, including notable gains in participation in a number of outdoor and fitness activities. But the study found tackle football participation taking another hit and overall gains being driven by casual rather than core participants.