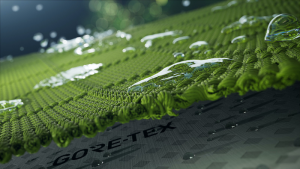

Gore-Tex Introduces Expanded Polyethylene (ePE) Membrane

There’s a new waterproof/breathable fabric coming out from Gore. In a heralded media presentation with company executives on September 30, W. L. Gore & Associates announced that it’s introducing expanded Polyethylene (ePE) membrane as a new complementary material platform to serve as the basis for its membrane technologies.

Geoff Curtis, VP, Marker/Dalbello/Volkl, On Why GripWalk ISO Certification Is Important Standardization

In August, the International Organization for Standardization confirmed its ISO standard 23223, Alpine Ski Boots with Improved Walking Soles, making Marker’s GripWalk technology an industry-standard beginning this year.

Water Filtration Sales Surging, New Products In Pipeline

As a subset of the outdoor industry, the water filters and purifier category enjoyed robust growth during the pandemic, capitalizing on consumers’ growing desire to get outside.

Nike, Air Jordan And Lululemon Stand Out In Cowen’s Gen Z/Millennial Survey

Cowen’s fourth annual Gen Z and Millennial survey found that Nike, Air Jordan and Lululemon have solid traction by preference in the active lifestyle space among the younger demographic. The North Face and Amazon also ranked high by preference, and the overall survey suggested ESG and social commerce gained greater momentum in 2021.

Nike Scores “Buy” Rating From Goldman Sachs

In initiating coverage of Nike Inc. with a “buy” rating, Goldman Sachs noted that sportswear giant is facing more macro headwinds, including weakness in China, supply chain disruption and cotton inflation, “than it has in some time.” However, analyst Kate McShane said Nike’s underlying fundamentals remain solid, and the recent pullback offers some stock upside.

Aspen Institute Survey: Kids’ Sports Participation Recovers, Still Challenged

Aspen Institute’s just-released State Of Play 2021 survey found that most kids are back playing sports with their families feeling more comfortable about their safety amid the ongoing pandemic. However, challenges remain with more kids feeling less physically fit and mentally drained.

Nike Touts Payback From Consumer Direct Acceleration Strategy

“As I said before, and I’ll say again, these are times when strong brands can get stronger, and that’s what Nike did this past year,” said John Donahoe, Nike’s president and CEO, at the company’s 41st annual meeting. He attributed much of the gains to progress coming from its Consumer Direct Acceleration strategy.

On Holding Attracts Bullish Wall Street Coverage

On Holding AG attracted largely positive ratings from Wall Street as the quiet period related to its initial public offering ended.

Solo Brands Looks To Become Outdoor’s Digital DTC Disruptor

Solo Brands, the parent of Solo Stove, Oru Kayak, ISLE Paddle Boards, and Chubbies apparel, filed for an initial public offering to cement its position as the “leading digitally-native DTC lifestyle disruptor” in the outdoor space

Oboz President, Amy Beck, Discusses Ownership And Growth Under Kathmandu

Oboz parent Kathmandu, which purchased the Bozeman, MT-based footwear brand in 2018, recently released its fiscal year results for three of its brands—Rip Curl, Kathmandu and Oboz. With total group sales increasing 15.1 percent to $922.8 million, Oboz helped lead the way, with sales growing 44.9 percent to reach $78.4 million. SGB Executive discussed this and more with its president, Amy Beck.

Inside The Call: Levi’s Eyes Multiple Growth Opportunities From Beyond Yoga Acquisition

In his first comments to the investment community on Levi Strauss’ acquisition of Beyond Yoga, Chip Bergh, Levi’s president and CEO, cited opportunities to expand the Los Angeles, CA-based yoga brand into retail, men’s and international as well as take advantage of growth momentum in the overall performance athletic category.

Inside The Call: Hydro Flask Delivers Solid Growth In Second Quarter

According to the quarterly call of its parent, Helen of Troy, Hydro Flask saw “broad-based strength” in its second quarter, ended August 31, in domestic brick and mortar sales, driven by retailers increasing orders to replenish a more robust back-to-school season and healthy holiday ordering.

Adidas Sees Stock Downgrade On China And Supply Chain Concerns

Bank of America downgraded Adidas to “Underperform” from “Neutral” due to uncertainty around China’s recovery and supply-chain issues, coupled with ongoing market share losses.

Nike, Lululemon, Crocs, And Converse Scoring With Teens

Piper Sandler’s 42nd Semi-Annual Gen-Z Fall Survey found athletic apparel and footwear continue to retain strong appeal among teens. Within apparel, Nike and Lululemon reached new highs in preference. Within footwear, while Nike reigned supreme, Converse and Crocs gained share whereas Vans declined.

Bank Of America Sees Five Megatrends Behind Sportswear

In a new report, Bank Of America identified five “megatrends” expected to drive sports apparel and footwear categories in the years ahead: Health & Wellness, Female Sports Participation, Hybrid Working Models, Affordable Luxury, and Sustainability.