SGB Executive Apparel

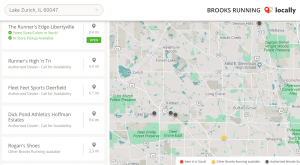

SGB Exec Q&A: Locally’s Founder And President Mike Massey

In an interview with SGB, Mike Massey, Locally’s founder who is also the owner of Massey’s Outfitters in New Orleans, discussed the rapid expansion and evolution of Locally since its launch in 2014, as well as the fast-changing dynamics of online and offline retailing.

‘Battle Has Begun’: Global Trade War Now Underway

Trade associations called Friday the first official day of the trade war between the U.S. and China, as $34 billion in tariffs on Chinese goods kicked in overnight. The U.S. is expected to add tariffs on an additional $16 billion of Chinese goods at a later date.

Aisle Talk Week Of July 2

Top headlines from the active lifestyle industry you may have missed this week, including Pentland Group’s solid year driven by a record performance from JD Sports Fashion PLC.

Active-Lifestyle Stocks Bounce Back In First Half

With the nine-year bull market facing some choppiness this year due to a number of macro challenges, many stocks in the athletic-lifestyle space stood out for their outsized performances. Big gainers included Canada Goose, Under Armour, Lululemon, Deckers Outdoor and Crox.

June M&A Roundup: Megaresorts Expand Their Empires

Summer is an odd time to discuss what’s happening at North American ski areas—especially with record high temps now sweeping the U.S.—but the escalating “arms race” between megaresort operators Vail Resorts Inc. and Alterra Mountain Co. was among the hottest M&A developments in June.

Retail Report Roundup – July 1

Studies arrived last week showing Nike ranked highest among active lifestyle brands, but lost ground on Brand Finance’s annual ranking of the most valuable American brands. Studies also rated the digital expertise of department stores, the relevance of social activism for brands with teens, robust urban population growth and apparel’s expansion online.

Nike’s Shares Pop On U.S. Recovery

Shares of Nike Inc. shot up $8.00, or 11.2 percent, to $79.70 to surpass an all-time high as the sports leader saw growth for the first time in four quarters in the U.S. The gains were boosted by the success of several break-through product launches and the payback of investments in direct-to-consumer and digital engagement.

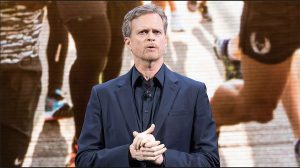

Nike CEO Mark Parker On Company’s Digital Progress

Nike Inc.’s impressive fourth quarter saw balanced growth across regions and divisions, but the company’s digital gains were especially notable. A jump in digital sales was the result of an increased emphasis on platforms and not just products, according to CEO Mark Parker.

Aisle Talk Week Of June 25

Top headlines from the active lifestyle industry you may have missed this week, including Adidas announcing a potential data security incident.

Does The Online Tax Ruling Even The Playing Field?

Many brick-and-mortar retailers hailed the Supreme Court’s ruling late last week that finally gave states the authority to require online retailers to collect sales tax. But interviews with a number of independent specialty retailers show many in the industry still face uphill battles competing with online selling.

Four Questions: Smartwool’s Jennifer McLaren

On June 26, VF Corp. announced that Jennifer McLaren would succeed Travis Campbell as president of Smartwool. Here, she talks about Smartwool’s strengths, near-term priorities in her new role, and becoming the first female to be promoted to president in the VF Outdoor and Action Sports Coalition.

Running Rebrand: Fleet Feet Refreshes Logo, Drops ‘Sports’ From Name

Fleet Feet has unveiled a new logo that resembles a torch and also dropped the word “Sports” from its name, all part of a brand refresh for the 42-year-old retailer.

Goldman Sachs Initiates Apparel Coverage With Attractive View

In initiating coverage on the Apparel & Accessories sector, Goldman Sachs said many companies in the space are expected to benefit from ongoing lifestyle shifts towards active and casualwear, the ability to react to faster fashion cycles and digital’s ability to drive direct communications with consumers and commerce. Among active lifestyle stocks, VF was initiated at a “Buy” while “Neutral” ratings were given to Nike, Under Armour, Lululemon and Canada Goose.

Retail Report Roundup – June 25

Studies arrived last week on the benefits to local retailers from community engagement, quality beating price as a purchase driver, apparel’s continuing appeal in malls, the benefits of perks over raises for workers, the stress of online shopping, and Fourth of July sales.

Retailers Cheer Supreme Court Ruling On Online Taxes

Specialty retailers in the active space – decimated over the years by consumers showrooming stores and then fetching lower prices online – stand to significantly benefit from the U.S. Supreme Court’s ruling that requires online retailers to collect sales taxes. Amy Roberts, executive director of Outdoor Industry Association (OIA), said, “The Supreme Court’s ruling is a huge win for the future of specialty outdoor retailers and will help ensure that all retailers compete on a level playing field.”