Wolverine World Wide, Inc. delivered better-than-expected revenue and earnings in the first quarter as the parent of the Merrell, Saucony, Wolverine and Sweaty Betty brands begins to see proof points emerge as early validation of its strategy and execution on its turnaround and transformation plan. Company President and CEO Chris Hufnagel said in a release that the company posted record gross margins in the quarter, saw acceleration in the direct-to-consumer(DTC) business, improved order trends across wholesale operations, and netted a healthier balance sheet in the quarter ended March 30.

“We’re executing our turnaround and transformation with pace and continue to make meaningful progress towards realizing the full potential of our brands, platforms, and teams,” said Hufnagel. “While we have more work to do, I’m encouraged by the great work of our teams and the power of our brand-building model – focused squarely on creating awesome products, telling amazing stories, and driving the business each and every day.”

Total consolidated continuing revenue fell 24.5 percent in the first quarter to $390.8 million, a 25.1 percent decline in constant-currency (CC) terms. The quarter compares to $517.5 million in the year-ago Q1 period for the go-forward business.

Total revenue, which excludes the divested or licensed brands and businesses, fell 34.6 percent CC year-over-year to $394.9 million, compared to $599.4 million in the year-ago period.

- Merrell sales fell 26.2 percent (-26.6 percent CC) to $133.0 million in Q1.

- Saucony declined 24.5 percent (-24.7 percent CC) to $100.1 million for the period.

- Wolverine brand decreased 20.3 percent year-over-year to $41.2 million in Q1.

- Sweaty Betty slipped 4.8 percent (-8.1 percent CC) to $45.2 million in the quarter.

The International business contributed $178.5 million in the first quarter, a decline of 31.5 percent for the Toal business, or a decline of 25.3 percent for the continuing business.

The DTC continuing business declined 6.2 percent to $103.6 million in the quarter, while the total business suffered a 15.9 percent decline for the period.

Financial results for 2024, and comparable results from 2023, in each case, for the continuing, or ongoing business exclude the impact of Keds, which was sold in February 2023, the U.S. Wolverine Leathers business, which was sold in August 2023, the non-U.S. Wolverine Leathers business, which was sold in December 2023, and the Sperry business, which was sold in January 2024.

Financial Results

Gross margin improved 650 bassi points to 45.9 percent of net sales in the quarter, said to be due to lower supply chain costs, lower sales of end-of-life inventory, less promotional e-commerce sales and favorable distribution channel mix.

- Adjusted gross margin grew 540 basis points to 46.5 percent of net sales.

Operating margin was negative 0.8 percent of net sales in the quarter, compared to 7.6 percent in the year-ago Q1 period.

- Adjusted operating margin declined 110 basis points to 5.0 percent of net sales in the quarter.

The company posted a net loss of $13.7 million, or a loss of 19 cents per diluted share, in the first quarter, compared to net income of $18.0 million, or EPS of 23 cents per diluted share, in the year-ago Q1 period.

Balance Sheet Highlights

Inventory at the end of the quarter was $354.3 million and was down $371.6 million, or approximately 51.2 percent, compared to the prior-year comparative quarter-end and down $19.3 million from the prior year-end.

Net Debt at the end of the quarter was $685 million, down $380 million compared to the prior-year quarter and down $55 million from the prior year-end.

“The company exceeded first quarter revenue expectations with well-balanced performance across the portfolio,” said Mike Stornant, EVP and CFO. “We drove 540 basis points of gross margin expansion from a healthy sales mix and our profit improvement actions initiated last year. We also continued to strengthen the balance sheet by reducing inventory for our ongoing business by $251 million year-over-year and net debt by $55 million since year-end 2023 – both nicely ahead of our plan. We remain on track to achieve our financial objectives for the year, and we are encouraged by the progress we have made in such a short time frame.”

Full Year 2024 Outlook

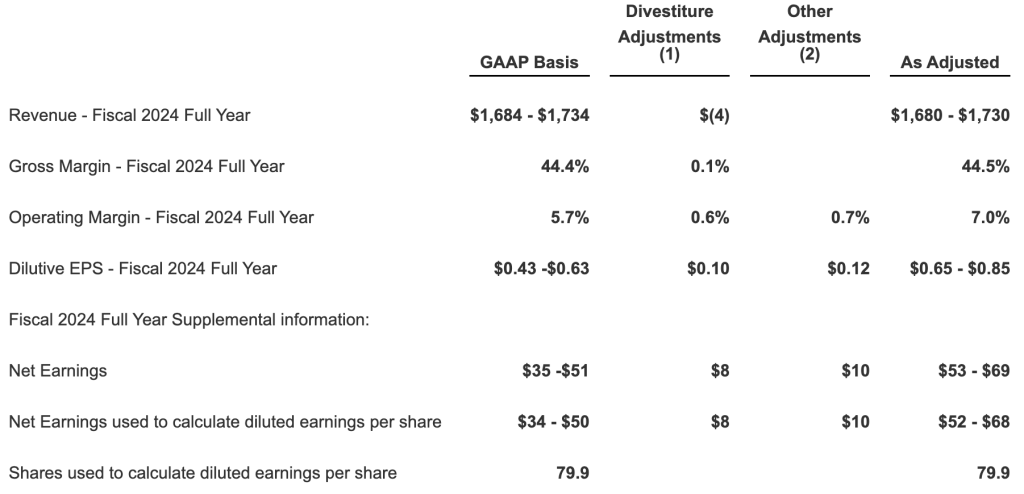

Revenue from the ongoing business is now expected to be approximately $1.68 billion to $1.73 billion, which is adjusted for the new licensing model recently announced on May 1 for the Merrell and Saucony kids business. This range represents a decline compared to 2023 of approximately 15.7 percent to 13.2 percent and constant-currency decline of approximately 15.5 percent to 13.0 percent.

Gross margin is expected to be approximately 44.5 percent, up 460 basis points compared to 2023.

Operating margin is expected to be approximately 5.7 percent of net sales and adjusted operating margin is expected to be approximately 7.0 percent of net sales, up 310 basis points compared to 2023.

The effective tax rate is expected to be approximately 18 percent.

Diluted earnings per share are expected to be in a range between 43 cents and 63 cents, and adjusted diluted earnings per share are expected to range between 65 cents and 85 cents. These full-year EPS projections include an approximate $0.10 negative impact from foreign currency exchange rate fluctuations.

Diluted weighted average shares are expected to be approximately 80 million.

Inventory is now expected to decline by at least $75 million by year end.

Net Debt at year end is now expected to be approximately $565 million, a reduction of $175 million from the prior year end.

Full Year 2024 Outlook

GAAP versus Adjusted

Images, Data and Charts courtesy Wolverine World Wide, Inc.