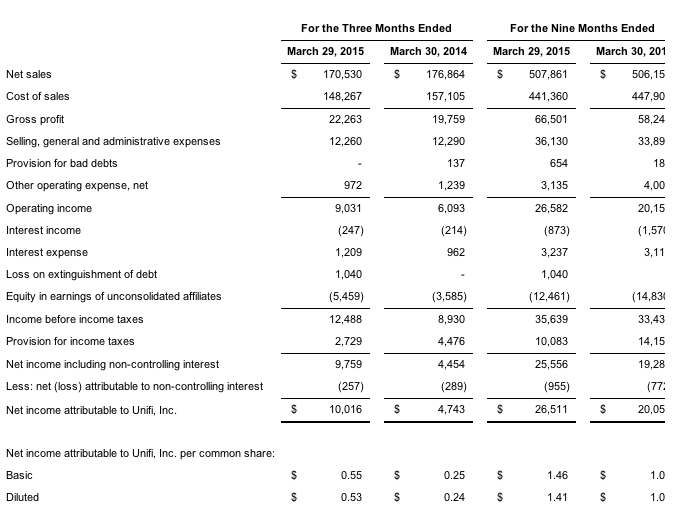

Unifi, Inc. reported earnings more than doubled in its third quarter ended Mar. 29, to $10.0 million, or 55 cents per share, compared to net income of $4.7 million, or 25 cents, for the prior year quarter.

The company is reporting 49 cents of adjusted EPS for the current quarter, which management believes better reflects the company's underlying basic earnings per share, up 20 cents, or 69 percent, from the prior year quarter. These earnings reflect improved operating results for the company's global operations and equity affiliates, along with a lower effective tax rate, and were achieved despite the effects of a significant devaluation of the Brazilian Real and a loss on extinguishment of debt.

Other highlights for the March 2015 quarter included:

- Growing demand for synthetic yarn in the NAFTA and CAFTA regions increased textured polyester sales volumes by more than 7 percent;

- Gross profit improved to $22.3 million, or 13.1 percent of net sales, from $19.8 million, or 11.2 percent of net sales, for the prior year quarter;

- Adjusted EBITDA of $14.9 million for the March 2015 quarter, an improvement from $12.6 million for the prior year quarter; and

- The company amended and restated its credit facility to, among other things, extend the maturity date to March 2020, reduce the interest rate on applicable borrowings and allow for potential annual capacity increases

The devaluation of the Brazilian Real adversely affected net sales, and was the principal driver of the $6.4 million net sales decrease, from $176.9 million for the prior year quarter to $170.5 million for the March 2015 quarter. However, higher consolidated sales volumes, as well as higher margins in the Polyester and International Segments, helped yield the strong operating results for the quarter.

“Growth in textured polyester in the NAFTA and CAFTA regions, along with greater demand for our premier value-added yarns in all regions, helped drive our strong operating results in the quarter and for the fiscal year to date,” said Roger Berrier, President and Chief Operating Officer of Unifi. “We recently expanded the production capacity of our texturing operations, and based on the continued success and growth of Repreve, we will be expanding our Repreve Recycling Center and also installing a state-of-the-art plastic bottle processing facility over the next 12-15 months.”

Cash and cash equivalents were $14.8 million as of March 29, 2015, a decrease of $1.1 million compared to $15.9 million as of June 29, 2014, the end of our prior fiscal year. Net debt at the end of the March 2015 quarter was $97.5 million, compared to $83.6 million at June 29, 2014. The company had $67.8 million available under its revolver as of March 29, 2015, compared to $61.1 million as of June 29, 2014.

Net income was $26.5 million, or $1.46 per basic share, for the nine months ended March 29, 2015, compared to net income of $20.1 million, or $1.05 per basic share, for the prior year nine-month period. Adjusted EPS for the year to date period improved $0.16 to $1.30 when compared to the prior year period's Adjusted EPS of $1.14. Net sales increased $1.7 million, or 0.3 percent, to $507.9 million for the current year nine-month period compared to net sales of $506.2 million for the prior year nine-month period, primarily due to improved sales volumes, notwithstanding the substantial offset attributable to the unfavorable currency translation in Brazil.

Bill Jasper, Chairman and CEO of Unifi, added: “We will continue to evaluate opportunities to increase capacity in the CAFTA and NAFTA regions to capitalize on the growth of synthetic apparel and demand for premier value-added yarns. The enhancements to our credit facility, especially the ability to increase our borrowing capacity annually without further amendments to the agreement, provide us an even stronger foundation to support these and other strategic capital projects as we pursue profitable growth-related opportunities over the next few years.”