Shimano, Inc. reported that the pace of the global economic recovery was sluggish during the first quarter of fiscal year 2024, dragged down by tight monetary policies adopted worldwide that had exerted impacts on the economy in various countries, uncertain conditions in Ukraine and the Middle East, and a slowdown in economic recovery in China.

- In Europe, hikes in energy costs and raw material prices showed signs of easing, but the economy remained lackluster due to the continued downturn in personal consumption.

- In the U.S., despite the ongoing monetary tightening, the economy remained firm, backed by strong employment and a favorable income environment.

- In China, consumer confidence waned due to the prolonged stagnation in the real estate market, and economic recovery slowed down.

- In Japan, economic recovery remained somewhat sluggish, with consumer behavior becoming increasingly budget-minded along with price hikes.

In this environment, the company said demand for bikes and fishing tackle continued to be weak, and for the first quarter of fiscal year 2024, net sales decreased 20.2 percent year-over-year to ¥100,557 million.

Operating income decreased 52.1 percent to ¥13,421 million, ordinary income increased 0.9 percent to ¥28,852 million and net income attributable to owners of parent increased 17.2 percent to ¥23,687 million.

Bike Components

Interest in bikes remained high as a long-term trend. On the other hand, supply and demand adjustments continued, and market inventories remained high globally.

In the European market, the company said the strong interest in bikes continued in its major markets, namely, Germany and the Benelux countries. In other countries, market inventories remained high due to cooling consumer confidence from inflation and economic slowdowns.

In the North American market, although interest in bikes was strong, retail sales of completed bikes softened, and market inventories remained high.

In the Asian, Oceanian, and Central and South American markets, retail sales of completed bikes were weak due to sluggish personal consumption from rising inflation and economic uncertainty, and market inventories were high.

In the Chinese market, aided by the outdoor recreation boom, the popularity of road bikes continued. As a result, retail sales of completed bikes were favorable, and market inventories remained “at an appropriate level.”

In the Japanese market, retail sales were reportedly sluggish as affected by the soaring price of completed bikes due to yen depreciation and pullbacks in consumer spending. Market inventories remained high.

Under these market conditions, the Shimano Group received a favorable reception for its products, including the Shimano 105, equipped with a twelve-speed derailleur and a gravel-specific component Shimano GRX.

As a result, net sales from the Bicycle Components segment decreased 22.6 percent year-over-year to ¥76,090 million, and operating income decreased 52.7 percent to ¥10,471 million.

Fishing Tackle

Demand for fishing tackle that had previously been overly strong globally reportedly cooled down from the previous year. Although sales were weak more recently, adjustments to increased market inventories started to show signs of progress.

In the Japanese market, due to an adjustment of market inventories with stagnant demand, market conditions remained at a standstill, and sales were lackluster.

In the North American market, while market inventories remained high, sales were favorable as demand increased compared to the previous year.

In the European market, sales were lackluster due to adjusting market inventories.

In the Asian market, market inventories remained high, and sales were weak due to cooling consumer confidence due to economic stagnation.

In the Australian market, demand for fishing tackle increased, partially aided by stable weather conditions. As a result, market inventories remained at an appropriate level, and sales were strong.

Shimano said that under these market conditions, order-taking was brisk for the new electric reels Beastmaster MD, the new spinning reels TwinPower, and the new rods Poison Adrena. As a result, net sales for the Fishing Tackle segment decreased 11.9 percent year-over-year to ¥24,369 million, and operating income decreased 49.8 percent year-over-year to ¥2,961 million.

Others

Net sales from the Others segment decreased 5.4 percent year-over-year to ¥97 million and operating loss of ¥11 million was recorded, following an operating loss of 8 million yen for the same period of the previous year.

Assets, Liabilities and Net Assets

As of the end of the first quarter of fiscal year 2024, total assets amounted to ¥908,758 million, an increase of ¥37,027 million compared with the previous fiscal year-end. The principal factors included an increase of 12,653 million in cash and time deposits, an increase of ¥7,498 million in notes and accounts receivable-trade, an increase of ¥6,591 million in construction in progress, an increase of ¥3,140 million in buildings and structures, an increase of ¥2,954 million in investment securities, and an increase of ¥1,985 million in merchandise and finished goods.

Total liabilities amounted to ¥71,977 million, an increase of ¥2,642 million compared with the previous fiscal year-end. The principal factors included

- an increase of ¥2,798 million in income taxes payable,

- an increase of ¥2,263 million in accounts payable trade,

- a decrease of ¥1,321 million in others under current liabilities and

- a decrease of ¥939 million in provision for product warranties.

Net assets amounted to ¥836,781 million at quarter-end, an increase of ¥34,384 million compared with the previous fiscal year-end. The principal factors included

- an increase of ¥25,795 million in foreign currency translation adjustments,

- an increase of ¥6,640 million in retained earnings and

- an increase of ¥1,892 million in unrealized gain (loss) on other securities.

Forecast For Fiscal Year Ending December 31, 2024

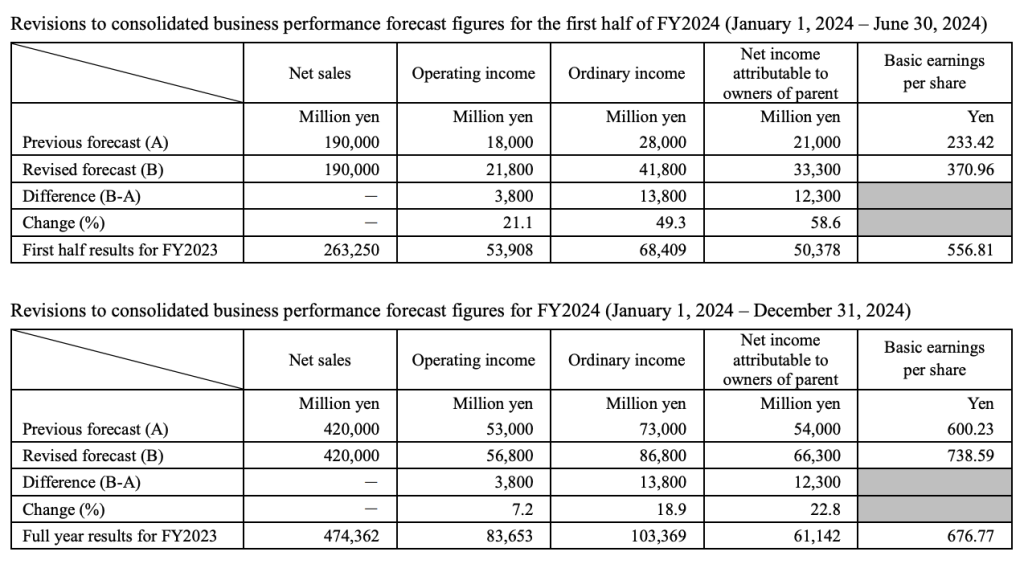

The consolidated business performance forecasts were revised in light of current trends in the first quarter of fiscal year 2024, where market inventories remained high, and the outlook will remain uncertain.

Despite these conditions, non-operating income was recorded due to the depreciation of Asian currencies caused by the stronger U.S. dollar, and gross profit increased due to positive effects produced by accelerated sales of some products that had been scheduled for the second quarter, mainly in the Chinese market, where the popularity of road bikes continued, and to improvement in cost of sales ratio.

Image, Data/Chart courtesy Shimano, Inc.