Newell Brands, the parent company of Marmot, Ex Officio, Stearns, Bubba, Coleman, and Contigo, among others, reported net sales of $2.0 billion in the third quarter, a 9.1 percent decline compared to the prior-year period, reflecting a core sales decrease of 9.2 percent and a slight headwind from category exits, partially offset by the impact of favorable foreign exchange.

The Outdoor & Recreation segment, which is home to the active lifestyle brands, generated net sales of $231 million in the third quarter, compared with $289 million in the prior-year period, as a core sales decline of 20.9 percent was partially offset by the impact of favorable foreign exchange to net an overall 20.1 percent decline for the quarter. The sales decrease in the third quarter was the fifth consecutive quarter with a segment sales decline in excess of 20 percent. The current year’s Q3 decline of 20.1 percent came on top of a 26 percent decline in the prior-year Q3 period.

The Outdoor & Recreation segment has not seen an increase in quarterly core sales since the second quarter 2022 or an increase in total sales since the first quarter of that year.

The segment’s reported operating loss was $42 million, or negative 18.2 percent of sales, including the impact of a non-cash impairment charge of $22 million, compared with operating income of $6 million, or 2.1 percent of sales, in the prior-year period.

The normalized segment operating loss was $7 million, or negative 3.0 percent of sales, compared with normalized operating income of $16 million, or 5.5 percent of sales, in the prior year period.

Consolidated Newell Brands reported gross margin was 30.3 percent of sales for the period, compared with 29.2 percent in the prior-year period, as the benefits from productivity savings and pricing more than offset the impact of fixed cost deleveraging, inflation and higher restructuring-related charges. Normalized gross margin was 31.3 percent compared with 29.6 percent in the prior-year period, marking an inflection point in the company’s normalized gross margin performance.

Consolidated reported operating loss was $159 million compared with operating income of $40 million in the prior year period. Non-cash impairment charges of $263 million and $148 million were incurred in the current and prior year periods, respectively, related to goodwill and intangible assets. Reported operating margin was negative 7.8 percent compared with positive 1.8 percent in the prior-year period, as the effect of lower net sales, inflation, restructuring and related costs and the non-cash impairment charge more than offset the contribution from pricing, FUEL productivity savings and Project Phoenix savings. Normalized operating income was $167 million, or 8.2 percent of sales, compared with $234 million, or 10.4 percent of sales, in the prior-year period.

Net interest expense was $69 million compared with $57 million in the prior-year period.

Reported tax benefit was $80 million compared with $60 million in the prior year period. The normalized tax benefit was $73 million compared with $57 million in the prior-year period.

The company reported a net loss of $218 million, or 53 cents diluted loss per share, compared with net income of $19 million, or 5 cents diluted earnings per share, in the prior year period.

Normalized net income was $163 million, or 39 cents normalized diluted earnings per share, compared with $208 million, or 50 cents normalized diluted earnings per share, in the prior-year period.

Year-to-date operating cash flow increased by more than $1.2 billion to $679 million compared with an outflow of $567 million in the prior year period.

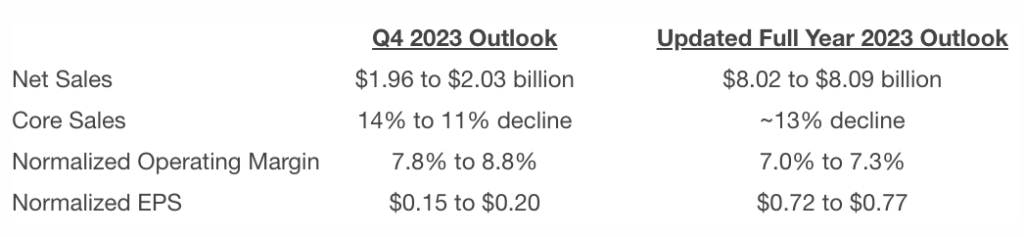

The company updated its full-year 2023 outlook for net sales and normalized earnings per share to $8.02 billion to $8.09 billion and 72 cents to 77 cents, respectively. The company raised its outlook for the full year 2023 operating cash flow to $800 million to $900 million.

Photo courtesy Marmot