Macy’s, Inc. reported net sales of $4.8 billion for the fiscal first quarter, down 2.7 percent versus the first quarter of 2023. Comparable sales were down 1.2 percent year-over-year (YoY) on an owned basis and down 0.3 percent on an owned-plus-licensed-plus-marketplace basis.

Macy’s, Inc. go-forward business comparable sales, inclusive of go-forward locations and digital, were down 0.9 percent for the quarter on an owned basis and up 0.1 percent on an owned-plus-licensed-plus-marketplace basis.

Nameplate Highlights

Macy’s

Macy’s comparable sales down 1.6 percent in the first quarter on an owned basis and down 0.4 percent on an owned-plus-licensed-plus-marketplace basis for the period.

- Macy’s go-forward business comparable sales, inclusive of Macy’s go-forward locations and digital, were down 1.3 percent on an owned basis and flat on an owned-plus-licensed-plus-marketplace basis.

- Macy’s go-forward locations comparable sales were up 0.1 percent on both an owned and owned-plus-licensed basis.

- First 50 locations comparable sales, included within go-forward locations comparable sales, up 3.3 percent on an owned basis and up 3.4 percent on an owned-plus-licensed basis.

- Non-First 50 go-forward locations comparable sales, included within go-forward locations comparable sales, down 1.2 percent on an owned basis and down 1.3 percent on an owned-plus-licensed basis.

- Macy’s non-go-forward locations comparable sales down 4.5 percent on both an owned and owned-plus-licensed basis.

Bloomingdale’s

Bloomingdale’s comparable sales were up 0.8 percent YoY in the first quarter on an owned basis and up 0.3 percent on an owned-plus-licensed-plus-marketplace basis.

Bluemercury

Bluemercury comparable sales were up 4.3 percent on an owned basis.

Other Revenue

Other revenue was $154 million for the quarter, a $37 million decrease YoY. Represented 3.2 percent of net sales, a decline of 60 basis points from the first quarter of 2023.

Credit Card Revenue

Credit card revenues, net declined by $45 million to $117 million. The decline was attributable to the impact of expected higher delinquency rates and net credit losses within the portfolio.

Macy’s Media Network Revenue

Macy’s Media Network revenue, net rose $8 million to $37 million from increased vendor engagement.

Income Statement Highlights

Gross margin rate for the quarter was 39.2 percent of net sales, down 80 basis points from 40.0 percent in the first quarter of 2023. Merchandise margin declined 100 basis points, primarily reflecting additional discounting for slower-moving warm weather products. Delivery expense as a percent of net sales improved 20 basis points from the prior-year Q1 period, reflecting ongoing efforts to improve supply chain efficiency.

Selling, general and administrative (SG&A) expense was $1.9 billion for Q1, a $39 million decrease YoY. SG&A expense as a percent of total revenue was 38.2 percent, 50 basis points higher than the first quarter of 2023, reflecting the YoY decline in net sales and credit card revenue.

The company said SG&A expense dollars benefited from the its commitment to ongoing expense discipline.

Diluted earnings per share were 22 cents for the first quarter and Adjusted diluted earnings per share of came in at 27 cents per share. This compares to diluted earnings per share of 56 cents and Adjusted diluted earnings per share of 56 cents in the first quarter of 2023.

“We are encouraged by our customers’ response to our Bold New Chapter strategy resulting in sales near the high end of our outlook. Our teams executed with discipline and efficiency, which contributed to first quarter earnings that exceeded our expectations,” said Tony Spring, chairman and chief executive officer of Macy’s, Inc. “At the Macy’s nameplate, go-forward business performance was led by our First 50 locations, which achieved comparable sales growth year over year and are a leading indicator for our go-forward fleet. Although early days, our investments in product, presentation and experience are gaining traction and reinforce our belief that longer-term, Macy’s, Inc. can return to sustainable, profitable growth.”

Inventories

Merchandise inventories were up 1.7 percent at quarter-end, compared to the year-ago quarter-end. Entering the second quarter of 2024, end-of-quarter inventories are well-positioned for the upcoming summer season.

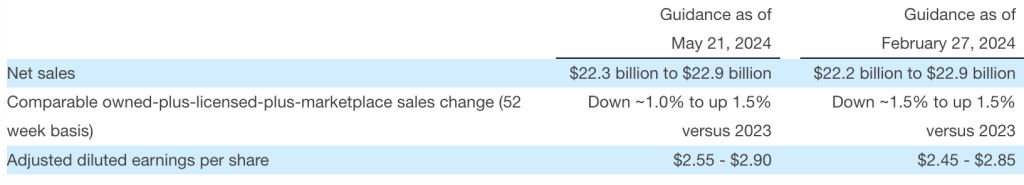

2024 Guidance

The company updated its annual sales and earnings outlook to reflect a portion of first quarter performance, along with the dynamic macro environment. The company continues to view 2024 as a transition and investment year, reflecting investments in key customer-focused strategic initiatives, supported by the company’s strong balance sheet. The updated outlook assumes customers will continue to be discerning in their discretionary purchases and provides flexibility to respond to the competitive landscape and promotional environment.

The full updated outlook for 2024, presented on a 52-week basis.

Macy’s Inc. said Adjusted diluted EPS excludes any potential impact from the credit card late fee ruling, which was stayed on May 10, 2024. Additionally, the impact of any potential future share repurchases associated with the company’s current share repurchase authorization is also excluded.

The company does not provide reconciliations of the forward-looking non-GAAP measures of comparable owned-plus-licensed-plus-marketplace sales change and adjusted diluted earnings per share to the most directly comparable forward-looking GAAP measures because the timing and amount of excluded items are unreasonably difficult to fully and accurately estimate. For the same reasons, the company said in a media release that it is unable to address the probable significance of the unavailable information, which could be material to future results.

Image courtesy Macy’s