Kathmandu Holdings Limited reported sales were up 12.9 percent in the first half to NZ$410.7 million, including a full six-month contribution from Rip Curl.

Rip Curl’s sales from August 2021 to January 2021 reached NZ$251.1 million, up from NZ$134.9 million in the period from the year-ago period from November 2019 to January 2020.

Kathmandu said despite the impacts from COVID-19, Rip Curl contributed NZ$48.7 million to Group underlying EBITDA during 1H FY21, delivering a gross margin of 40 basis points (0.4 percent) higher than the comparable six month period last year, as a result of a higher mix of DTC sales.

Total global sales at Rip Curl were 4.3 percent below the comparable six-month period last year, including three months of sales pre-Kathmandu ownership. COVID-19 restrictions continued to impact the sales performance of Rip Curl stores in airports, Melbourne, Hawaii, Bali, and parts of Europe. The wholesale sell-in period was disrupted during the global lockdowns in April and May 2020, for deliveries in October to December 2020.

Sales growth for Rip Curl was achieved in key markets of Australia, the USA and Europe, despite COVID-19 trading restrictions, highlighting the strength of the Rip Curl brand and product range in core surf geographies around the world. In addition, wholesale order books are back above pre-COVID-19 levels.

DTC same-store sales growth for Rip Curl comprising owned retail stores and online was up 21.0 percent adjusted for COVID-19 lockdowns and 7.4 percent overall. Online sales underwent a step change, up 79 percent vs the comparable six-month period last year, and comprised 11.2 percent of DTC sales.

Sales for the Kathmandu brand reached NZ$127.3 million against NZ$195.5 million, a decline of 34.9 percent.

Multiple headwinds affected the Kathmandu brand’s performance over 1H FY21, with 27 Greater Melbourne stores closed for over 11 weeks and 14 Auckland stores closed for two weeks. Kathmandu was also impacted by low footfall in shopping centers, CBD stores and tourist locations. While there was strong demand for camping products, there was a reduced demand for insulation and rainwear due to a lack of international travelers to the Northern Hemisphere. Same-store sales were down 30.0 percent adjusted for COVID-19 lockdowns and 35.4 percent overall.

Kathmandu brand’s gross margin of 64.2 percent was slightly above 1H FY20 (64.0 percent). Operating expenses include the benefits from restructuring, rent abatements, and net government wage assistance. Online penetration at the Kathmandu brand increased from 10.5 percent of sales in 1H FY20 to 14.4 percent of sales in 1H FY21.

Oboz delivered sales growth of 3.8 percent to the U.S.$22.1 million underpinned by a focus on product innovation. Gross margin was impacted by significant one-off air freight costs of US$1.1 million. The forward order book for Oboz is well above pre-COVID-19 levels, and Oboz will be launching a direct-to-consumer online store imminently, to drive further sales growth.

Commenting on the 1H FY21 results, Group CEO Xavier Simonet said: “Despite operating in challenging conditions over the first half due to the substantial impacts from COVID-19, Rip Curl delivered an outstanding first-half result, validating the Group’s diversification strategy.

“Benefiting from increased participation in surfing in Australia, Europe and the USA, Rip Curl achieved strong sales and profits despite COVID-19 trading restrictions, reflecting the brand’s technical product focus and strong consumer engagement. Pleasingly, Rip Curl’s wholesale order book is back above pre-COVID-19 levels.

“Kathmandu was particularly impacted by COVID-19 related travel restrictions, with reduced demand for insulation and rainwear resulting from a lack of international travelers to the Northern Hemisphere.

“Over the first half, we implemented a rapid response to changes in consumer preference resulting from COVID-19. To respond to increased participation in local travel and adventure, our brands adjusted their focus to product categories in high demand, such as wetsuits and surfboards for Rip Curl, and camping and footwear for Kathmandu. Omni-channel capability allowed our brands to capture record demand for the online channel, with online penetration now making up almost 13 percent of the Group’s direct-to-consumer sales.”

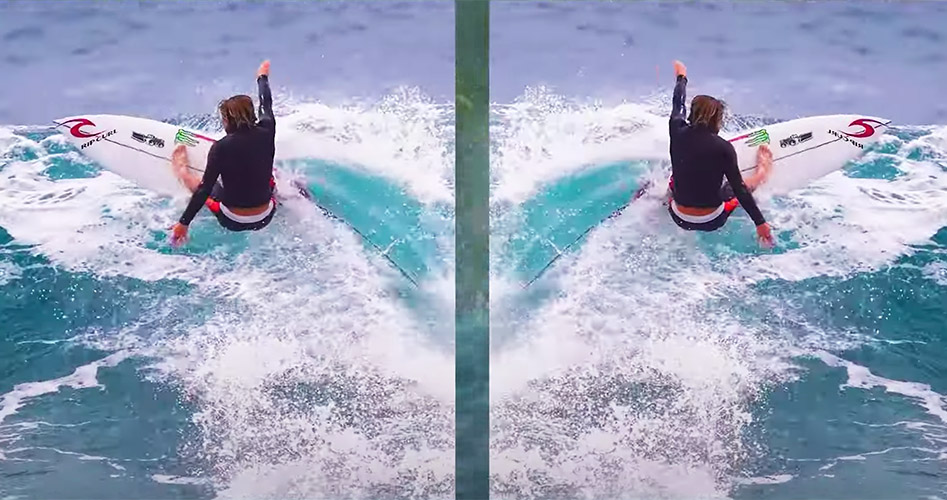

Photo courtesy Rip Curl/Conner Coffin