SGB Executive Apparel

Tilly’s Delivers Strongest Comp In Seven Quarters

Share of Tlly’s were trading up around 13 percent in mid-day trading Thursday after the action-sports themed retailer posted the company’s best comp since the third quarter of 2016 while exceeding profit guidance.

Dick’s Blames Q2 Top-Line Shortfall On Under Armour

Dick’s Sporting Goods reported earnings that easily topped Wall Street’s targets but sales came in well below as weakness from Under Armour continued to place a drag on sales. On a conference call with analysts, Ed Stack, CEO, said the company is “repositioning” its Under Armour business, including gaining more exclusives from the brand while finding other product to fill traditional Under Armour space.

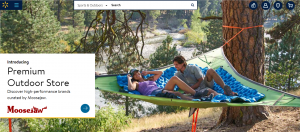

Moosejaw Brings Premium Outdoor To Walmart.com

In an interview with SGB Executive, Eoin Comerford, general manager of Outdoor, Walmart U.S. e-commerce and CEO of Moosejaw, said Wal-Mart’s “whole strategy” in acquiring several specialty e-tailers was to bring a “wider assortment” to the Walmart.com platform. A curated website distinct from the Moosejaw.com website was eventually seen as the best path for both businesses.

Canaccord Genuity Downgrades Hibbett On Q2 Miss

Canaccord Genuity on Monday downgraded shares of Hibbett Sports following the retailer’s wide miss of second-quarter estimates due to sluggish sales and rising operating costs.

Hibbett Sports Shares Tumble 30 Percent After Q2 Miss

Shares of Hibbett Sports Inc. plummeted $8.88, or 30.2 percent, to $20.53 Friday after the company earlier in the day announced a second-quarter loss—Wall Street had expected a profit—and lowered guidance for the rest of 2018.

Foot Locker Not Yet Feeling Nike’s Resurgence

Shares of Foot Locker Inc. fell $4.88, or 9.2 percent, to $48.32 Friday after the sneaker leader reported second-quarter comps that came in slightly below Wall Street’s expectations. Foot Locker officials also continue to expect meager gains in the back-half of the year despite the hype around Nike’s return to growth in North America.

Aisle Talk Week of August 20

Top headlines from the active lifestyle industry you may have missed this week, including 5.11 opening a new store in Reno, NV, as part of a nationwide brick-and-mortar retail expansion.

Athleta’s Momentum Continues In Q2

While the athleisure chain saw some softness in swim, Athleta again churned out strong results in the second quarter for Gap Inc. Art Peck, Gap Inc.’s president and CEO, on a conference call with analysts, said Athleta “delivered another market share gaining quarter and is progressing well against our billion dollar sales objective.”

Under Armour’s Collaboration with “The Rock” Tops List Of Best-Matched Celebrity Endorsements

Wrestler-turned-actor Dwayne Johnson’s endorsement deal with Under Armour earned top ranking among best-matched celebrity-brand partnerships in the fashion and retail sectors, according to a study from Spotted. Also ranking high was Crocs’ partnership with Drew Barrymore, Under Armour and Steph Curry, Reebok and Gal Gadot, Adidas and Lionel Messi, Asics and Novak Djokovic and Marmot and Nick Offerman.

The Storyteller: Joe Prebich Outlines Vision For Mammut North America

Joe Prebich, who was appointed CEO and managing director of Mammut North America in April, spoke with SGB at length about the company’s ambitious plans to grow the 156-year-old, Switzerland-based apparel and gear brand’s presence on this side of the Atlantic.

Urban Outfitters Boosted By Macro Fashion Shift

Riding a strong fashion cycle, Urban Outfitters Inc. reported second-quarter profits rose 85.9 percent to $92.8 million, or 84 cents a share exceeding Wall Street’s consensus estimate of 77 cents. Company officials said a changing fashion silhouette is encouraging consumers to replace their wardrobe closets.

TJX Cos. Finding Off-Price Formula Appealing To Youth

Finding younger consumers being drawn to the company’s deal-driven, treasure hunt experience, TJX Cos. raised the company’s full-year forecast after reporting second-quarter results that handily topped Wall Street’s targets.

Nike, Adidas & Under Armour All Deliver For Kohl’s In Q2

Kohl’s Corp.’s trusty trio of active brands—Nike, Adidas and Under Armour—delivered solid sales in the second quarter, helping the department store top analysts’ earnings and revenue estimates as the company also raised guidance for fiscal 2018.

SGB Executive Q&A: Progression Brands Group’s Ian Widmer

Ian Widmer, the founder of Progression Brands Group (PBG) talked to SGB about his company’s unique hybrid equity/management investment structure, the boutique’s investment criteria and the opportunities and challenges facing emering brands in today’s marketplace.

Analyst Sees Nike Taking Share From Adidas And Others

Susquehanna Financial analyst Sam Poser raised his rating and price target on Nike Inc. as channel checks show that the brand is gaining share from Adidas and others at athletic specialty retailers such as Foot Locker, Finish Line and Hibbett, and is also gaining share within the family footwear channel. Piper Jaffray also upgraded the stock.