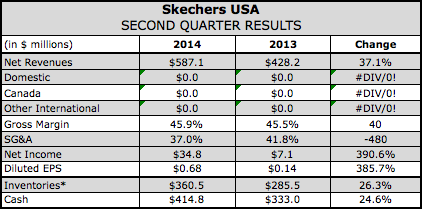

Marking the highest quarterly sales in the company's 22-year history, Skechers USA, Inc. reported second quarter sales jumped 37.1 percent to $587.1 million. Earnings jumped more than four-fold to $34.8 million, or 68 cents a share, from $7.1 million, or 14 cents, a year ago. Results crushed Wall Street’s consensus estimate of 40 cents a share. On a conference call with analysts, David Weinberg, Skechers COO and CFO, said the company saw double-digit increases in its domestic and international wholesale businesses. A robust performance by its retail stores was marked by a 13.9 percent comp increase.

Marking the highest quarterly sales in the company's 22-year history, Skechers USA, Inc. reported second quarter sales jumped 37.1 percent to $587.1 million. Earnings jumped more than four-fold to $34.8 million, or 68 cents a share, from $7.1 million, or 14 cents, a year ago. Results crushed Wall Street’s consensus estimate of 40 cents a share. On a conference call with analysts, David Weinberg, Skechers COO and CFO, said the company saw double-digit increases in its domestic and international wholesale businesses. A robust performance by its retail stores was marked by a 13.9 percent comp increase.

“With key sales drivers across both genders and multiple categories, Skechers' growth was widespread across many product lines and our brand presence was visible around the world,” says Weinberg.

In its domestic wholesale business, sales increased 35.4 percent, or $67 million, for the quarter with a 30.1 percent increase in pairs shipped and a 4 percent increase in average price per pair. The quarter benefited from Easter shift into the second quarter and back-to-school shipments that were pulled forward from July into June.

Double-digit growth in its domestic wholesale segment was seen across men's, women's and kids'. Women's Sport and Sport Active lines grew at triple-digit rates while Skechers Kids', Men's Sport, and men's and women's Skechers USA and Work Lines increased double-digits. Said Weinberg, “The focus in our lifestyle and lifestyle athletic footwear is comfort and we see an opportunity in every division to develop product that is both stylish and comfortable.”

Multiple TV commercials in the quarter, including ones featuring TV personality Brooke Burke-Charvet and NFL Hall of Famer Joe Montana, supported its lifestyle offerings.

Its men's and women's Skechers Go lines experienced double-digit sales growth in the quarter, fueled by Meb Keflezighi‘s win at the Boston Marathon. Weinberg added, “Sales of the in demand Skechers GOwalk accelerated due to new styles reaching the market on the proven outsoles, as well as the new product innovations of Skechers GOwalk 2 Supersock and the Goga Mat Technology.”

During the second quarter, Skechers GOwalk and several styles from its Skechers Sport Division placed in the top 25 shoes in the U.S., according to SportScan weekly report, including the number two position. Weinberg added, “The 35.4 percent increase in our domestic wholesale business, our ranking on the SportScan charts, and the positive anecdotal reports from our third-party retail, as well as our accelerated backlogs, gives us confidence that demand for our footwear is stronger than ever.”

In its International wholesale segment, total international subsidiary joint venture and distributor sales increased by 54 percent. Its subsidiary and joint venture sales grew 42.7 percent and its distributor sales ran up 87.3 percent. Weinberg noted that the increase came in spite of the continuation of political issues in the Ukraine and parts of the Middle East and South America.

“We have seen a strong rebound to our business in Europe and believe the demand for our brand is at an all-time high across nearly every region where we directly distribute our product resulting in triple-digit growth in two of our subsidiaries and double-digit growth in all but one of the remaining subsidiary countries,” he added.

Skechers’ Southeast Asia joint ventures saw combined growth of 31.4 percent for the quarter, including a 60 percent jump in China.

The international distributor growth was primarily the result of triple-digit growth in Australia, New Zealand, Mexico, South Africa, South Korea, Turkey and the UAE and double-digit gains in the Philippines, Russia and Taiwan.

Weinberg said its international distributor business “mirrored the strength of our domestic wholesale and international subsidiary businesses as our comfort and walking footwear resonated with consumers around the globe.”

Skechers company-owned retail stores sales climbed 28.8 percent for the quarter with domestic sales improving 20.9 percent and international sales jumping 75.1 percent. The performance included positive comp store sales of 12.1 percent domestically and 24.6 percent internationally for a 13.9 percent increase worldwide.

Companywide, gross margins improved slightly, to 45.9 percent from 45.5 percent due to a combination of higher sales, strong sell-throughs and a positive mix within distribution channels.

SG&A expenses were reduced to 27.9 percent of sales compared to 32 percent a year ago due to sales leverage. Selling expenses increased 27.8 percent to $53.8 million to support its momentum across categories.

“From a product, marketing and distribution standpoint, the company has never been better positioned,” said Weinberg. “The record first half of 2014 along with continued increased backlogs at the end of June, incoming order rate and revenues in July leads us to believe that our record quarterly sales trend will continue for the balance of the year.”