Quiksilver, Inc. reported operating earnings before special items fell sharply in its fourth quarter ended Oct. 31. Sales dropped 11 percent to $401 million. Among brands, Quiksilver was down 12 percent on a currency-neutral basis, Roxy declined 6 percent, and DC Shoes fell 14 percent.

We have successfully completed the organizational restructuring of the company, with every employee now singularly focused on execution, said Andy Mooney, Chairman and Chief Executive Officer of Quiksilver, Inc. Despite a challenging year, we significantly reduced costs and inventory levels, and are excited about our 2015 product offerings. Retail response to our Spring ‘15 product lines across all brands has been encouraging, with feedback on Fall 15 even more positive. Along with more than $160 million of liquidity at year end, we have a strong foundation in place and anticipate revenue stabilization and significant pro-forma adjusted EBITDA growth in the coming year.

As recently announced, the company has reached a definitive agreement to sell its majority ownership interest in Surfdome for net proceeds of approximately $16 million. As a result, the company has reclassified the current and prior year operating results of Surfdome, along with its previously divested Mervin and Hawk businesses, as discontinued operations. All of the results presented below represent the companys continuing operations.

Fourth Quarter Review:

Net revenues, as reported, were $401 million compared with $476 million. Net revenues were down 11 percent, or $50 million, on a constant currency continuing category basis.

- Americas net revenues, as reported, were $172 million compared with $223 million. Americas net revenues were down 18 percent, or $37 million, on constant currency continuing category basis.

- EMEA net revenues, as reported, were $156 million compared with $168 million. EMEA net revenues were down 3 percent, or $4 million, on constant currency continuing category basis.

- APAC net revenues, as reported, were $71 million compared with $83 million. APAC net revenues were down 10 percent, or $8 million, on constant currency continuing category basis.

Gross margin decreased to 46.7 percent from 47.0 percent. The 30 basis point decline in gross margin reflects higher discounting, partially offset by higher sales mix in direct to consumer channels.

SG&A expense decreased $10 million to $210 million from $220 million. The decrease was primarily driven by reduced employee compensation.

Asset impairments totaled $5 million compared with $2 million.

Pro-forma Adjusted EBITDA was $11 million compared with $35 million.

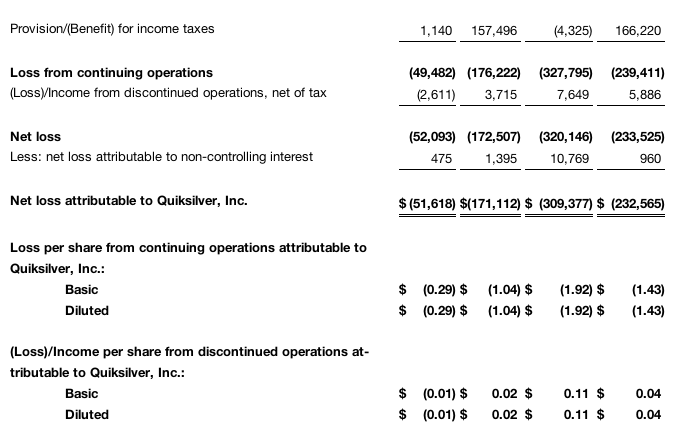

Net loss from continuing operations attributable to Quiksilver, Inc. was $49 million, or $0.29 per share, compared with $175 million, or $1.04 per share. The prior year period included a $157 million income tax charge related to recording valuation allowances against certain deferred tax assets in the companys EMEA segment.

Q4 Net Revenue Highlights:

Net revenues from continuing operations by brand, sales channel and product group for the fourth quarter of fiscal 2014 compared with the fourth quarter of fiscal 2013 were as follows.

Brands:

- Quiksilver net revenues, as reported, were $156 million compared with $190 million. Quiksilver net revenues were down 12 percent, or $21 million, on a constant currency continuing category basis;

- Roxy net revenues, as reported, were $124 million compared with $137 million. Roxy net revenues were down 6 percent, or $9 million, on a constant currency continuing category basis; and

- DC net revenues, as reported, were $112 million compared with $139 million. DC net revenues were down 14 percent, or $18 million, on a constant currency continuing category basis.

Distribution channels:

- Wholesale net revenues, as reported, were $280 million compared with $348 million. Wholesale net revenues were down 14 percent, or $44 million, on a constant currency continuing category basis;

- Retail net revenues, as reported, were $102 million compared with $107 million. Retail net revenues were down 1 percent, or $1 million, on a constant currency continuing category basis. Same-store sales in company-owned retail stores decreased 3 percent. company-owned retail stores totaled 683 at the end of fiscal 2014 compared with 631 at the end of fiscal 2013; and

- E-commerce net revenues, as reported, were $15 million compared with $16 million. E-commerce net revenues were down 3 percent, or $1 million, on a constant currency continuing category basis.

Product groups:

- Apparel and accessories net revenues, as reported, were $317 million compared with $371 million. Apparel and accessories net revenues were down 9 percent, or $31 million, on a constant currency continuing category basis; and

- Footwear net revenues were $84 million compared with $104 million. Footwear net revenues were down 18 percent, or $18 million, on a constant currency continuing category basis.

Net revenues from emerging markets, as reported, were $54 million compared with $61 million. Net revenues from emerging markets were down 6 percent, or $3 million, on a constant currency continuing category basis.

Fiscal 2014 Full Year Review:

Net revenues, as reported, were $1.57 billion compared with $1.81 billion. Net revenues were down 11 percent, or $189 million, on constant currency continuing category basis.

- Americas net revenues, as reported, were $723 million compared with $893 million. Americas net revenues were down 16 percent, or $135 million, on constant currency continuing category basis.

- EMEA net revenues, as reported, were $584 million compared with $632 million. EMEA net revenues were down 8 percent, or $53 million, on constant currency continuing category basis.

- APAC net revenues, as reported, were $262 million compared with $282 million. APAC net revenues were up 1 percent, or $2 million, on constant currency continuing category basis.

Gross margin increased to 48.6 percent from 48.2 percent. The increase was primarily driven by the sales mix shift into higher gross margin direct to consumer channels and regional segments.

SG&A expense decreased $31 million to $827 million from $858 million, primarily due to reduced expenses related to sponsored athletes and events, employee compensation, facility expenses and consulting fees, partially offset by increased bad debt expense.

Asset impairments totaled $189 million compared with $12 million, primarily reflecting a non-cash charge of $178 million in the third quarter of fiscal 2014 to write-off the carrying value of goodwill attributable to the companys EMEA reporting segment.

Pro-forma Adjusted EBITDA decreased to $39 million from $118 million.

Net loss from continuing operations attributable to Quiksilver, Inc. was $327 million, or $1.92 per share, compared with $239 million, or $1.43 per share.

Fiscal 2014 Net Revenue Highlights:

Net revenues from continuing operations by brand, sales channel and product group for the full year of fiscal 2014 compared with the full year of fiscal 2013 were as follows.

Brands:

- Quiksilver net revenues, as reported, were $628 million compared with $721 million. Quiksilver net revenues were down 10 percent, or $68 million, on a constant currency continuing category basis;

- Roxy net revenues, as reported, were $480 million compared with $511 million. Roxy net revenues were down 4 percent, or $22 million, on a constant currency continuing category basis; and,

- DC net revenues, as reported, were $427 million compared with $542 million. DC net revenues were down 19 percent, or $99 million, on a constant currency continuing category basis.

Distribution channels:

- Wholesale net revenues, as reported, were $1.04 billion compared with $1.29 billion. Wholesale net revenues were down 16 percent, or $199 million, on a constant currency continuing category basis;

- Retail net revenues, as reported, were $445 million compared with $447 million. Retail net revenues were up 1 percent, or $5 million, on a constant currency continuing category basis. Same-store sales in company-owned retail stores were flat; and,

- E-commerce net revenues, as reported, were $77 million compared with $69 million. E-commerce net revenues were up 12 percent, or $8 million, on a constant currency continuing category basis.

Product groups:

- Apparel and accessories net revenues, as reported, were $1.17 billion compared with $1.35 billion. Apparel and accessories net revenues were down 10 percent, or $134 million, on a constant currency continuing category basis; and

- Footwear net revenues, as reported, were $397 million compared with $457 million. Footwear net revenues were down 12 percent, or $55 million, on a constant currency continuing category basis.

Net revenues from emerging markets, as reported, were $201 million compared with $191 million. Net revenues from emerging markets increased 14 percent, or $25 million, on a constant currency continuing category basis.

Outlook:

The company provided the following guidance for continuing operations assuming October 31, 2014 currency exchange rates.

Fiscal year 2015 net revenues are expected in the range of $1.48 billion to $1.55 billion, an increase of 1 percent to 5 percent on a constant currency continuing category basis versus the prior period. Gross margins are expected in the range of 49.5 percent to 51 percent. SG&A, excluding any restructuring and special charges, is expected within the range of $750M to $765M. Pro-forma Adjusted EBITDA is expected in the range of $80 million to $90 million. Capital expenditures are expected to be below $25 million.

First quarter 2015 net revenues are expected to be approximately $340 million, which is a reduction of approximately 7 percent on a constant currency continuing category basis versus the prior period. Gross margins are expected to be approximately 51.3 percent. SG&A, excluding any restructuring and special charges, is expected to be approximately $187 million. Pro-forma Adjusted EBITDA is expected to be approximately $6 million.

The foregoing outlook updates and supersedes all previous guidance provided by the company.