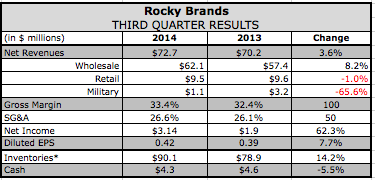

Rocky Brands, Inc. reported third-quarter sales increased 3.6 percent to $72.7 million. Earnings advanced 6.9 percent to $3.1 million, or 42 cents per share. On a conference call with analysts, David Sharp, president and CEO, said that following a strong first half of the year, sales growth moderated during the third quarter.

Rocky Brands, Inc. reported third-quarter sales increased 3.6 percent to $72.7 million. Earnings advanced 6.9 percent to $3.1 million, or 42 cents per share. On a conference call with analysts, David Sharp, president and CEO, said that following a strong first half of the year, sales growth moderated during the third quarter.

We believe consumer interest in our innovative product lines remains high; however, sell-through was hampered by a warm, dry September across much of the U.S., said Sharp. In addition, our wholesale dealers are now buying closer to their need which is shifting sales for our insulated and waterproof cold weather boots into the fourth quarter.

Among its segments, Work, its largest category, increased sales by 3 percent, driven by a high single-digit gain for the Rocky Work footwear coupled with flat performances for Georgia Boot and its private label business with Tractor Supply. While new products sold in well and in line with expectations, warm, dry conditions in many parts of the country reduced replenishment orders below forecasts in September. Said Sharp, The good news is that as the climate has turned colder and wetter in many parts of the U.S. in October, sales of our Work lines especially our insulated products have started to accelerate.

Western, its second largest category, saw sales increased 5 percent, driven by another strong quarter for Durango, up 17 percent. With shipments up meaningfully at major accounts including Amazon, Groupon and Dicks Sporting Goods, Durango is being helped by strong demand for its more fashion-forward casual boots under the Rebel and Lady Rebel collections.

In Hunt, Rocky Brand sales increased 9 percent for the quarter, driven by the launch of an update to its legendary Corn Stalker boots collection. A more- -lightweight-and-athletic inspired Silent Hunter Boots update was also well received. While Septembers weather didnt support the hunt category, we are again encouraged by October sales trends and are confident that our product stories will help drive a solid fourth quarter for our hunting business with national accounts such as Bass Pro Shops, Cabelas, Shoe Shelf, Dicks Sporting Goods, as well as our network of regional and independent dealers across the country, said Glass.

The Commercial Military business, after a 27 percent gain in the first half, was down in the mid-teens due to the timing of orders and changes in uniform regulations. Glass added, The good news is that we believe each is temporary and addressable.

Creative Recreation, the sneaker brand acquired in December 2013, is starting to see improvements as a result of efforts to improve its supply chain processes, including timely delivery. Said Glass, There is still work to be done in order to Creative Recreation to generate the growth we believe the brand is capable of but we know we are moving in the right direction and expect that will start contributing to profitability in the very near future.

Gross margins in the quarter improved to 33.4 percent from 32.4 percent, driven by higher wholesale margins which were attributable to improved operating efficiencies in the companys owned manufacturing facilities. SG&A expenses increased slightly to 26.6 percent of sales from 26.1 percent a year ago, reflecting additional expenses associated with Creative Recreation.

Based on current momentum and visibility, Rocky Brands said it feels comfortable with external fourth quarter projections calling for approximately 20 percent top-line growth over last year, inclusive of sales of Creative Recreation.

Glass said the fourth quarter is off to a solid start and will benefit from the pickup of sales that shifted out of the third quarter as select retailers pushed out some deliveries of its insulated and waterproof boots closer to need.

If anything, we feel stronger about the health of the business heading into the holiday season and looking out to next year than we did three months ago given what we are seeing so far in October and the feedback from our major retail partners about our product pipeline, said Glass.