Columbia Sportswear Company said that 2024 started broadly in line with expectations. Still, some progress in expense management enabled the company to “modestly” raise its earnings per share guidance for the year even as it reiterated its full-year net sales outlook for a decrease in revenues.

The company is operating at two ends of the spectrum as Mountain Hardwear is securing more retail space and advancing the brand in the market, while Columbia is using temporary retail stores to sell off inventory at better margins to right-size the business, eliminate inventory exposed to new PFAS restrictions, all while building its balance sheet.

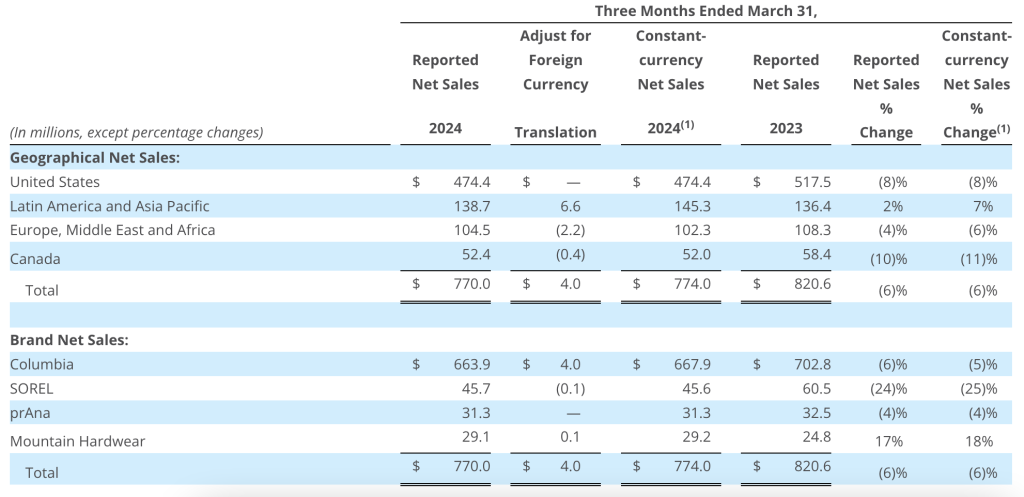

Consolidated first-quarter net sales decreased 6 percent in constant-currency (cc) terms to $770 million, which exceeded the high end of the company’s guidance range, primarily driven by the earlier timing of spring wholesale shipments.

Direct-to-consumer (DTC) net sales increased 3 percent in the quarter, reportedly led by brick-and-mortar growth, including the addition of nearly four dozen temporary stores. E-commerce sales declined as the company anniversaried last year’s promotional activity.

The Wholesale business declined 14 percent year-over-year, primarily reflecting lower spring 2024 orders.

While the company is working toward the longer-term goals of improving the Columbia, Sorel and Prana businesses through investments in innovation and marketing, the company only has to look as far as its Mountain Hardwear brand and new leadership and direction to see early results of similar efforts.

Columbia brand net sales decreased 5 percent cc in Q1, said to reflect lower spring orders but partially offset by DTC brick-and-mortar growth, including the promotional liquidation of excess inventory.

“In our emerging brands, we have new leaders at Sorel and Prana formulating the brand and product strategies that fuel our next phase of growth,” explained company Chairman, CEO and President Tim Boyle. “Mountain Hardwear has strong momentum from its recent brand refresh, and the team is thinking bigger as they ramp up to meaningfully scale the business.”

Mountain Hardwear is reportedly building momentum from its recent brand refresh. In the quarter, net sales increased 17 percent cc, reflecting earlier timing of spring shipments and DTC growth. The product line and brand positioning are said to be on track, and the team is reportedly focused on accelerating growth.

Prana net sales decreased 4 percent cc, driven by a decline in Wholesale, partially offset by “modest DTC growth.” Boyle said the Prana team remains focused on building brand awareness, refining the product assortment and unlocking the brand’s growth potential. He said the company is encouraged by fall 2024 orders and the possibility to return to growth in the second half of the year.

Boyle also walked through the region and channel numbers, pointing out that North America remained the company’s most challenging market.

“We are facing several headwinds in this market, including consumers continuing to grapple with inflationary pressures, which is impacting soft goods demand,” he surmised. “Traditional outdoor category trends are weak, particularly in footwear, and retailers are taking a cautious approach in placing future season orders.”

“In the U.S., net sales decreased 8 percent, driven by mid-teens percent decrease in Wholesale sales resulting from lower spring 2024 orders,” Boyle detailed. “U.S. DTC net sales were down slightly. Across all channels, we experienced strength in January, fueled by favorable winter weather, followed by softer trends in February and March.”

U.S. DTC e-commerce net sales were down in the mid-teens in the quarter. Sorel.com was hard hit in the first quarter, while the overall e-commerce environment remains challenging.

“Since late last year, we have been proactively managing promotional activity on columbia.com to help establish the site as the best expression of the brand,” Boyle noted. “We know that our site is already an important destination for our younger, active consumers. We want to ensure that when they visit columbia.com, they see our latest products and innovations with enriched brand storytelling.”

U.S. DTC brick & mortar sales increased in high-single-digits in Q1, driven by the contribution from temporary clearance locations, new stores opened over the last year, and, to a lesser extent, improved store productivity.

“In 2023, we used our fleet of outlet stores and temporary clearance locations to profitably liquidate excess inventory,” Boyle explained. “This year, we will continue to leverage these stores to manage inventory levels, including PFAS inventory and to drive sales as consumers seek out value in the marketplace.”

He noted that the company has stronger trends in several markets outside North America, including China, Japan and the Europe direct businesses.

LAAP Region

Latin America, Asia Pacific (LAAP) region net sales increased 7 percent in the quarter in constant-currency terms.

China net sales increased in the high 20 percent range in cc terms, led by exceptional e-commerce performance across the company’s platform partners. Boyle said the team was proud to receive special recognition from TikTok this quarter as one of the fastest-growing outdoor brands on the platform.

“The spring 2024 Transit line, our premium China-specific collection, is outpacing last year’s sell-through and clearly resonating with younger Chinese consumers,” Boyle detailed. “We expect China to continue being one of the fastest growing parts of our business in 2024.”

Japan net sales increased by low double-digits cc as sales benefitted from increasing foreign tourist activity, helping offset softer domestic consumer lending.

Korea net sales declined in mid-single-digits cc in the quarter.

LAAP distributor markets decreased in the high 20s cc, reflecting a greater portion of spring 2024 orders, driven in the fourth quarter of last year compared to the first quarter. Excluding the impact of shipment timing, LAAP distributors were historically relatively flat.

EMEA Region

Europe, Middle East and Africa (EMEA) region net sales decreased 6 percent in the first quarter. The Europe direct net sales were flat as healthy DTC growth was said to offset the impact of lower spring 2024 wholesale orders. Boyle said the Columbia brand continues to perform well in the marketplace measured by healthy DTC and Wholesale sell-through despite economic and geopolitical pressures.

“This quarter, we extended our popular Hike Society program into France, following its successful launch in the UK last year,” Boyle noted. “As a reminder, we have Columbia Hike society programs across several European and Asian direct markets. This series of events allows young hikers to meet like-minded people to explore the outdoors and learn about the Columbia brand’s technologies.”

The EMEA distributor business declined in the low 40s, reflecting a greater portion of spring 2024 orders shipping in the fourth quarter of last year compared to the first quarter of this year.

“Excluding the impact of shipment timing, EMEA distributor sales were down only slightly despite several markets being impacted by geopolitical conflicts,” Boyle noted.

Canada Region

Canada net sales declined 11 percent in Q1 as lower spring 2024 wholesale orders were partially offset by modest DTC growth.

“Similar to the U.S., Canadian consumers are seeking out value in the marketplace, which is driving healthy performance at our outlet stores,” Boyle said.

Still, the near-term focus for the next three years is the company’s Profit Improvement Program, which was discussed after announcing its dreadful fourth quarter and full year 2023 results.

“We’re on track to deliver between $125 million and $150 million in savings by 2026, including $75 million to $90 million in cost savings this year,” shared Boyle. “We are eliminating expenses associated with carrying excess inventory and driving cost efficiencies throughout our supply chain.”

He said the company is taking a disciplined approach to expense management, and the commercial teams are working to maximize sales across all channels. Boyle also said the company’s inventory reduction plan had yielded substantial benefits, with inventory down 37 percent year-over-year exiting the quarter.

“I’m proud of our team’s efforts to navigate the supply chain challenges over the last several years while generating healthy gross margins,” Boyle said. “We are now shifting our focus towards longer-term supply chain goals, including improving inventory turns and enhancing the speed and efficiency of our operations.”

He also acknowledged that growth is vital for the company’s success, suggesting that Columbia Sportswear has implemented strategies across the brand portfolio to accelerate the business.

“For Colombia, we’re focused on bringing younger active consumers into the brand through a reinvigorated product line that further emphasizes innovation, performance, and style,” touching on a key point from the last conference call with analysts.

“On the marketing front, we’re targeting a more balanced, full-funnel approach to drive consideration from new customers,” he explained. “We are also focused on elevating our product assortment and enhancing our in-store retail presentations across all channels. We have several proof points across the globe that this strategy is successful. We’ve driven meaningful growth in recent years in China and several markets across our Europe direct and distributor businesses.”

Boyle said they know they can win in the marketplace by targeting the right consumers with the right product.

Income Statement

Gross margin expanded 190 basis points 50.6 percent of sales in the quarter, an improvement attributed to lower inbound freight costs and favorable region and channel mix that more than offset the gross margin impact of inventory reduction promotional efforts in the company’s direct-to-consumer brick & mortar business.

SG&A expenses were essentially flat as higher DTC expenses were offset by lower supply chain and variable demand creation spending. SG&A expenses were $349.3 million, or 45.4 percent of net sales in the quarter compared to $347.4 million, or 42.3 percent of net sales, for the 2023 Q1 period. The largest changes in SG&A expenses were said to primarily reflect higher DTC expenses, partially offset by lower supply chain costs and decreased variable demand creation expenses.

Operating income decreased 21 percent to $44.7 million, or 5.8 percent of net sales, in Q1, compared to operating income of $56.4 million, or 6.9 percent of net sales, for the 2023 Q1 period.

Net income decreased 8 percent to $42.3 million, or 71 cents per diluted share, in the first quarter, compared to net income of $46.2 million, or 74 cents per diluted share, for the comparable period in 2023. EPS decreased 4 percent for the quarter.

Balance Sheet

Cash, cash equivalents and short-term investments totaled $787.7 million at quarter-end, compared to $460.6 million as of March 31, 2023.

The company had no borrowings as of March 31, 2024 or March 31, 2023.

Inventories decreased 37 percent to $607.4 million at quarter-end, compared to $959.2 million on March 31, 2023.

“We updated our inventory turns up to about three, and we see great opportunities with friendly automation we have in place now around estimating our demand and actualizing the demand according to the plan,” Boyle added during the Q&A segment of the call. We think, frankly, there’s still more room for us to improve our inventory utilizations.”

One strategy the company uses to great benefit is the addition of temporary stores, with about 44 operating during the first quarter.

“We’re operating at just under 2 percent of sales, I think, in the quarter,” shared company CFO Jim Swanson. “And then for the year, it will be a like amount, it will be slightly above that 2 percent of sales, and from an overall profitability standpoint, these stores are contributing very little to the overall operating margins. But, they are obviously a great vehicle for us to liquidate inventory through a much more profitable vehicle and less disruptive than going through the wholesale closeout or value channel.”

Tim Boyle added his take on the temp stores, explaining that the off-price retailers like TJ Maxx and Marshalls were “frankly flooded with inventory.” He said the best approach for Columbia was to take the inventory and sell it themselves in the temporary stores.

“So, as that inventory has come down at decent margins, certainly by comparison to what the other liquidation method work,” Boyle explained. “We will begin to close those temporary stores up and go back to our standard operating stores. So I think it really gives us an opportunity to flush the inventory, and it didn’t have the kind of broad impact on the marketplace that something a big discount in our e-com business would have done.”

Outlook

“Looking to fall 2024, our teams are continuously working to minimize any shipment delay resulting from disruptions we will see,” Boyle said. “At this time, delays appear manageable. The vast majority of our product line is expected to be delivered on time and in full.”

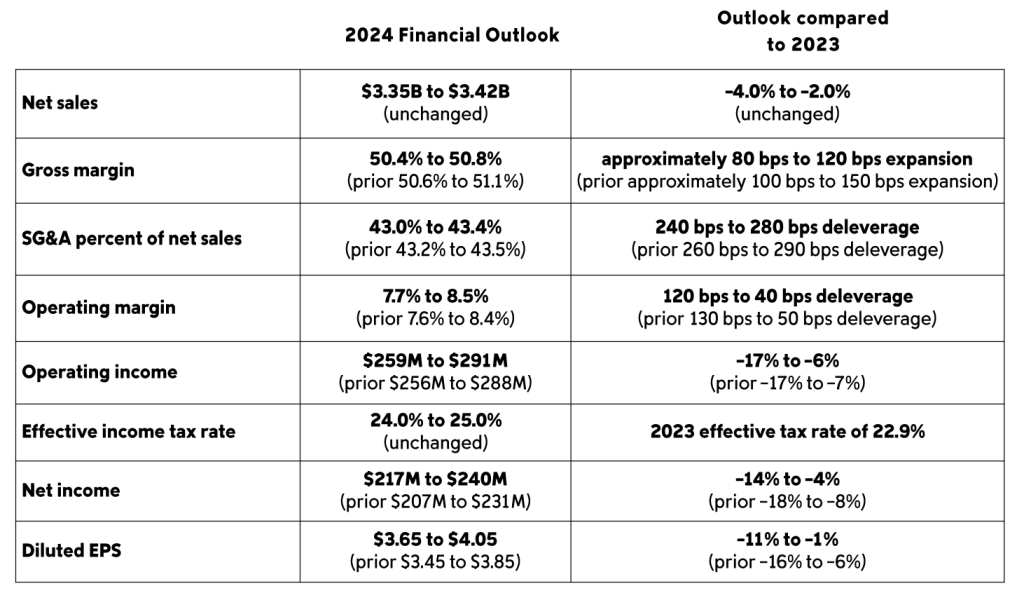

Boyle said the company is reiterating its full-year 2024 net sales outlook of a 2 percent to 4 percent decline year-over-year. “While there are modest changes across our portfolio, our overall net sales expectations have not meaningfully changed,” he added.

“Our U.S. business, we contemplate being down mid-single-digit percent year-over-year for the full year,” forecast CFO Swanson. “That’s not different than where we thought we would be 90 days ago. And when you look at the wholesale business, the wholesale business will still be down in the second half of the year, that’s more than by and large or partially offset, I should say, by the direct-to-consumer business through a combination and led by our brick-and-mortar business, so we continue to annualize new stores that have opened coupled with these temporary clearance stores that have been operating.”

Gross margin is now expected to expand approximately 80 basis points to 120 basis points to, a range of 50.4 percent to 50.8 percent of net sales. “We were expecting modestly higher clearance and liquidation activity as consumers seek value. We will continue to opportunistically work down inventory levels and maximize sales,” Boyle said.

“As it relates to our full-year outlook and the revision we’ve made to the gross margin, there’s some puts and takes in terms of our revenue, and it was held the revenue constant with our prior outlook,” added Swanson during the Q&A. “But when you get into the underlying composition, there’s been some shifts in parts of the business. We took down our Sorel outlook slightly. We took our e-commerce business down slightly. The area of our business that we took up was the case of our brick-and- mortar with our outlet and clearance stores, and we continue to operate those through the balance of the year. And, as a result of that change in the mix of our business and with an increased dependence on the outlet clearance locations, that’s effectively driving a portion of the margin coming down.”

SG&A is expected to be in the range of 43.0 percent to 43.4 percent of net sales, leading to an operating margin range of 7.7 percent to 8.5 percent of net sales.

The diluted earnings per share outlook has increased modestly to a range of $3.65 to $4.05 per share, driven by higher interest income, licensing income and a lower share.

Boyle said the company expects strong operating cash flows of at least $350 million in the year.

Second Quarter 2024 Financial Outlook

- Second-quarter net sales are expected to be $557 million to $576 million, representing a decline of 10 percent to 7 percent from $620.9 million for the comparable period in 2023.

- Operating loss is expected to be $42 million to $27 million, resulting in an operating margin of negative 7.6 percent to negative 4.7 percent, compared to an operating margin of 1.0 percent in the comparable period in 2023.

- Diluted earnings (loss) per share is expected to be a loss of 46 cents to a loss of 26 cents, compared to EPS of 14 cents for the comparable period in 2023.

Image, data and chart courtesy Columbia Sportswear Company