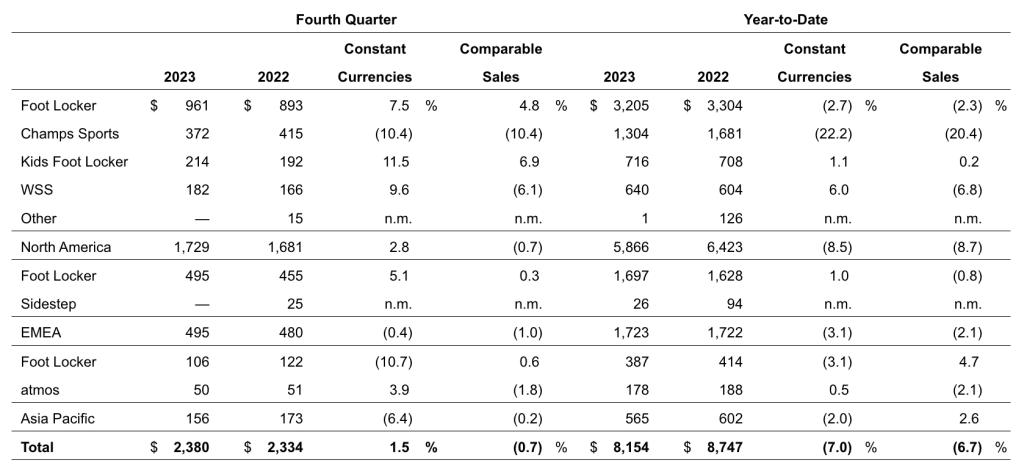

Foot Locker, Inc. reported that total fiscal fourth-quarter sales, inclusive of the 53rd week, increased by 2.0 percent to $2.38 billion compared to sales of $2.33 billion in the fiscal fourth quarter of 2022. Excluding foreign exchange rate fluctuations, total sales for the fourth quarter increased by 1.5 percent.

Comparable sales decreased by 0.7 percent, driven by a 210 basis-point impact from repositioning the Champs Sports banner, consumer softness and changing vendor mix. Combined comparable sales increased 5.2 percent in the Foot Locker and Kids Foot Locker North American banners.

Gross margin declined by 350 basis points compared to the prior-year corresponding period, primarily due to higher markdowns, partially offset by occupancy leverage.

SG&A, as a percentage of sales, increased 10 basis points compared to the prior-year period, with savings from the cost optimization program more than offset by inflation and investments in front-line wages and technology.

Fourth quarter net loss was $389 million, compared to net income of $19 million in the corresponding prior-year period. Net income was $36 million on a non-GAAP basis, compared with $92 million in the corresponding prior-year period.

Fourth quarter diluted loss per share was $4.13, compared to earnings per share of 20 cents in the fourth quarter of 2022. Fourth quarter results include a 12-cent contribution from the 53rd week of 2023. Non-GAAP earnings per share decreased to 38 cents in the fourth quarter, compared to 97 cents in the corresponding prior-year period.

Non-GAAP results exclude, among other items, non-cash charges of $478 million related to the company’s minority investments and $75 million related to the partial settlement of its pension plan obligations. The company assesses the carrying value of its minority investments for impairment whenever events or circumstances indicate that the carrying value may not be recoverable. The pension settlement charge of $75 million represents the acceleration of previously deferred losses. As part of efforts to reduce pension plan obligations, the company transferred the plan’s registered assets and liabilities to an insurance company through the purchase of a group annuity contract, under which an insurance company is required to directly pay and administer pension payments to certain pension plan participants, or their designated beneficiaries.

“We are pleased to report fourth-quarter results ahead of our expectations, including meaningfully accelerated sales trends relative to the third quarter, earnings per share that exceeded our guidance range and improvements across multiple KPIs,” said Mary Dillon, president and CEO of Foot Locker, Inc. “As we continued to deliver on the strategic imperatives of our Lace Up Plan, we built significant momentum through the holiday season, driven by full-price selling in addition to compelling promotions. We also proactively reinvested in markdowns to end the year with leaner inventory levels compared to our expectations.”

Balance Sheet

At quarter-end, the company had cash and cash equivalents of $297 million and total debt was $447 million. As of February 3, 2024, the company’s merchandise inventories were $1.51 billion, 8.2 percent lower than at the end of the fourth quarter in 2022. Excluding foreign currency fluctuations, merchandise inventories decreased by 7.8 percent compared to the 2022 fourth quarter.

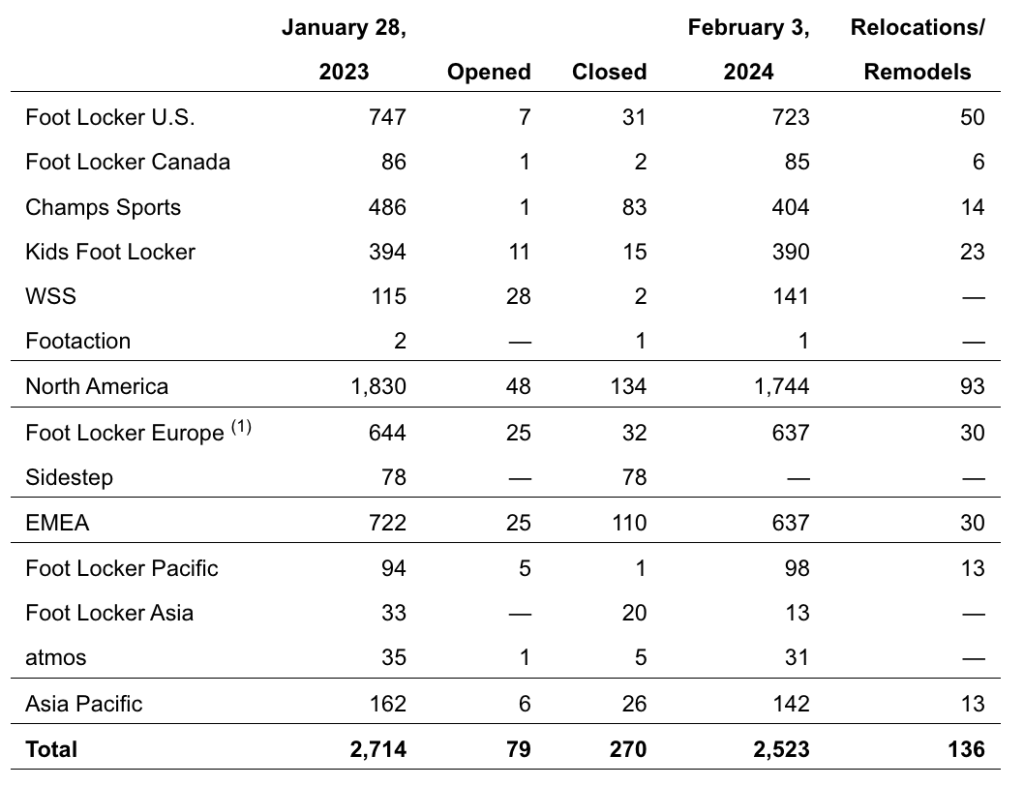

Store Base Update

During the fourth quarter, Foot Locker opened 29 new stores, remodeled or relocated 66 stores and closed 113 stores. As of February 3, 2024, the company operated 2,523 stores in 26 countries, including North America, Europe, Asia, Australia, and New Zealand. In addition, 202 licensed stores were operating in the Middle East and Asia.

Outlook

Foot Locker, Inc. is delaying by two years its previous guidance for an 8.5 percent to 9 percent EBIT margin target while also axing its dividend.

“We maintain conviction in the longer-term earnings potential that our Lace Up plan will generate and reiterate the 8.5 percent to 9 percent EBIT margin target communicated at our March 2023 Investor Day,” shared Mike Baughn, EVP and CFO of Foot Locker Inc. “Given our lower starting point exiting 2023, we expect a two-year delay in achieving that goal and now see reaching that target by 2028.”

Baughn continued, “As our margins and cash flows improve, we will continue to prioritize investing in our business and enhancing financial flexibility to support our strategic objectives. In that context, 2024 will serve as a cash-rebuilding year, and we, therefore, are not resuming a dividend at this time. We are confident, however, that our strategy will unlock longer-term shareholder value, including a return to quarterly dividends and share repurchases over time.”

Foot Locker’s full-year 2024 outlook, representing the 52 weeks ending February 1, 2025, is summarized here:

The company’s full-year EPS guidance includes an approximate 10 cents non-recurring charge in the second quarter of 2024 from the anticipated rollout of its enhanced FLX loyalty program to the rest of North America. This charge is anticipated as loyalty points will be converted into additional benefits for the company’s customers.

* Adjusted Capex includes capitalized Technology expense.

The company said it provides earnings guidance only on a non-GAAP basis and does not provide a reconciliation of its forward-looking EBIT, capital expenditures and diluted earnings per share guidance to the most directly comparable GAAP financial measures because of the inherent difficulty in forecasting and quantifying certain amounts that are necessary for such reconciliations.

FL shares were down in the mid-teens in pre-market trading on March 6, 2024.

Image/Data courtesy Foot Locker, Inc.