The adidas Group posted a decline in top-line sales for the third quarter, but the numbers were greatly impacted by currency fluctuations and continued declines at Reebok. The brand adidas business was impacted somewhat in Europe by tough soccer apparel comps versus last year, but also got a boost from increased soccer footwear sales in the lead-up to a big year ahead driven by the European Championship and the Olympics.

The Group again saw a fairly healthy improvement in the brand adidas business in the third quarter offset by declines in the Reebok and TaylorMade-adidas Golf businesses. Still, the business was hampered by a continued tough mall retail environment in the U.S. and Group management took additional steps to re-position and re-price the iconic Superstar shoe.

Currency fluctuations had a negative impact on reported revenues. In Euro terms, Group sales decreased 0.3% to 2.94 billion ($4.04 bn) in Q3, while currency-neutral sales were up 3% for the period (see chart page 2). Another strong double-digit increase in the bottom line can be traced to growth in the gross margin, which improved 360 basis points to 48.6% of sales, compared to 45.0% of sales in Q3 last year. Net income increased 22.2% to 298 million ($410 mm), or 1.37 ($1.88) per diluted share.

From a regional standpoint, total third quarter Group sales increased in all regions except North America, but the decline was seen as sequentially better due to improving business at Reebok and TaylorMade-adidas Golf.

Group revenues in Europe inched up just 0.3% to 1.339 billion ($1.84 bn) in Q3 versus 1.335 million ($1.70 bn) in the year-ago period, with both brand adidas and TM-aG contributing to the gains in the region.

North America sales declined 9.0% to 819 million ($1.13 bn) in the third quarter from 900 million ($1.15 bn) in Q3 last year, and were down 1.9% when measured in U.S. Dollars. The Group saw Asia/Pacific sales increase 9.2% in Euro terms to 579 million ($796 mm) from 530 million ($676 mm) in Q3 last year. Latin America sales surged 30.8% to 174 million ($239 mm) versus 133 million ($170 mm) in the year-ago period.

For the third quarter, brand adidas sales improved 3.7% to 2.01 billion from 1.94 billion in Q3 2006. Brand adidas sales in Europe inched up 0.7% to 1.073 billion ($1.47 bn) from 1.066 billion ($1.36 bn) in the year-ago period, a sluggish growth metric that was attributed to a tough comparison to the first-time launches of the Chelsea and Liverpool jerseys last year. Sales in North America were down 2.9% to 339 million ($465 mm) from 349 million ($445 mm) in Q3 2006, and increased approximately 4.7% when measured in U.S. dollars. Asia/Pacific sales grew 8.8% to 435 million ($598 mm) from 400 million ($510 mm) in Q3 last year. Latin America sales were up 34.5% for the quarter to 148 million ($203 mm) from 110 million ($140 mm) in the year-ago period.

>>> The emerging markets business was particularly robust for brand adidas, with Russia growing more than 35%, Brazil increasing more than 40% and China surging over 45% for the period.

The Sport Performance business continues to carry the torch for the adidas brand, growing 4.4% in Q3 to 1.59 billion ($2.18 bn) from 1.52 billion ($1.94 bn) in the year-ago period. Management said that YTD growth was driven by all major categories except football (soccer), with “particularly strong” increases in running and training. Soccer apparel sales were negatively impacted by the jersey anniversary issue, but soccer footwear sales were up 63% for the period.

>>> Brand adidas performance category backlogs in North America were up in double-digits at quarter-end.

The Sport Style business, which also includes the former Sport Heritage business, swung into positive territory, posting a 1.7% increase in sales to 414 million ($569 mm) from 407 million ($519 mm) in the year-ago period.

Owned-Retail sales for brand adidas were up 21.0% in Euro terms to 346 million ($476 mm) from 286 million ($365 mm) in the year-ago period.

>>> Excluding Owned-Retail, brand adidas sales improved just 0.6% to 1.65 billion ($2.27 bn) in the third quarter.

Brand adidas operating profit increased 8.2% for the period to 395 million ($543 mm), compared to 365 million ($465 mm) in the year-ago period. Gross margin improved 160 basis points in Q3 to 49.3% of sales, which was cited as a record margin for the brand.

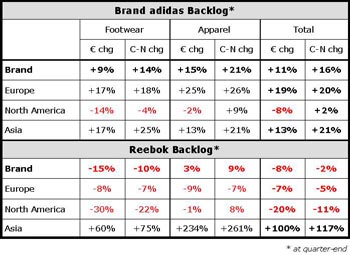

Based on the 16% currency-neutral increase in brand adidas backlogs at quarter-end, which was said to be the largest backlog gain in over nine years, management increased full-year expectations for the adidas brand, now expected to increase revenues in the high-single-digits for the year on a currency-neutral basis, compared to previous expectations in the mid-single-digits.

A big reason for the improved outlook for the fourth quarter is the European Championships scheduled for this coming spring. The latest rendition of the popular Predator boot will launch this week and the national jerseys will be introduced over the next month. Finally, adidas will launch the official match ball on December 2.

Reebok division revenues were up approximately 0.8% to $1.00 billion from $992 million in the year-ago period when measured in U.S. Dollar terms. In Euros, the division declined 6.4% in the third quarter to 728 million from 778 million in Q3 last year. In U.S. Dollar terms, a double-digit increase in Reebok/CCM Hockey revenues and a low-single-digit gain at Rockport offset a small decline at the Reebok brand. Reebok brand sales were off 0.7% in U.S. Dollar terms for the period to $787 million from $793 million in the year-ago period. The Rockport business was up 1.7% in U.S. Dollar terms to $115 million for the quarter, compared to $113 million in Q3 last year. For the Rbk/CCM business, which also includes Koho and JOFA, sales increased 10.5% to $96 million versus $87 million in the year-ago period.

Gross margins for the Reebok business jumped 380 basis points to 40.2% of sales, thanks primarily to sales mix improvement, both regionally and by trade channel. A reduction in the mall business helped the channel business while increased sales in higher margin regions such as Asia helped the regional improvement. The business also saw upside from the non-recurrence of the purchase price allocation included in the year-ago numbers.

Management suggested that the Foot Locker pull-back on forward orders represented roughly eight points of the 22% currency-neutral backlog decline for Reebok footwear in North America.

Operating profit at the Reebok division was up roughly 56% to $115 million, compared to $74 million in the third quarter last year.

TaylorMade-adidas Golf revenues increased 5.5% in U.S. Dollar terms to $261 million in the third quarter, compared to $247 million in the 2006 quarter. Currency-neutral sales growth was pegged at 4% for the period. The third quarter and YTD period were impacted by the divesture of the Greg Norman Collection business. Management indicated that currency-neutral like-for-like sales would have been up 14% for the third quarter. Management pointed to a surging metalwoods category as a primary driver, increasing 27% in the quarter. TM-aG cited data that indicate that the two new drivers introduced this year had a 50% share in drivers, while the overall metalwoods share was at 30% of the market. They also said they had the highest share ever in irons at 20% of the market. Management said that adidas has held the top share position in golf footwear for the four months.

Due in large part to the GNC impact, TM-aG sales in the North America region declined 5% for the third quarter to $128 million from $135 million in Q3 last year, and saw a 12% decrease when measured in Euros. Asia/Pacific sales increased 18% in U.S. dollar terms to $99 million from $84 million in the year-ago period. In Europe, TM-aG sales jumped 13% in U.S dollar terms to roughly $30 million (22 mm) from $27 million (21 mm) in the year-ago period.

Gross margins for TM-aG improved 60 basis points to 44.3% of sales, due primarily to the divesture of the GNC business. Operating profit for the quarter was up roughly 8% to $21 million (15 mm) from $19 million (15 mm) in Q3 last year.

The Group is maintaining its guidance for the Reebok and TM-aG divisions, with Reebok expected to post a low-single-digit currency-neutral increase for the year and TM-aG forecast to deliver a mid-single-digit currency-neutral like-for-like gain for the full year. However, due to the GNC divesture, TM-aG sales are likely to decline for the year.

In 2008, adidas Group revenues are forecasted to increase at a high-single-digit rate on a currency-neutral basis. Net income will grow at a higher rate compared to 2007.