EBay Inc. reported that mobile users accounted for 40 percent of its new users and accounts in 2013 and generated $35 billion in sales for its merchant partners and brands, up 88 percent from 2012.

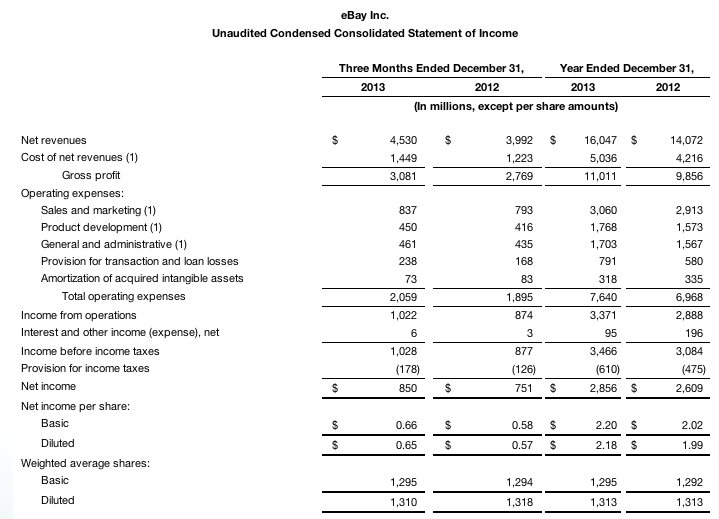

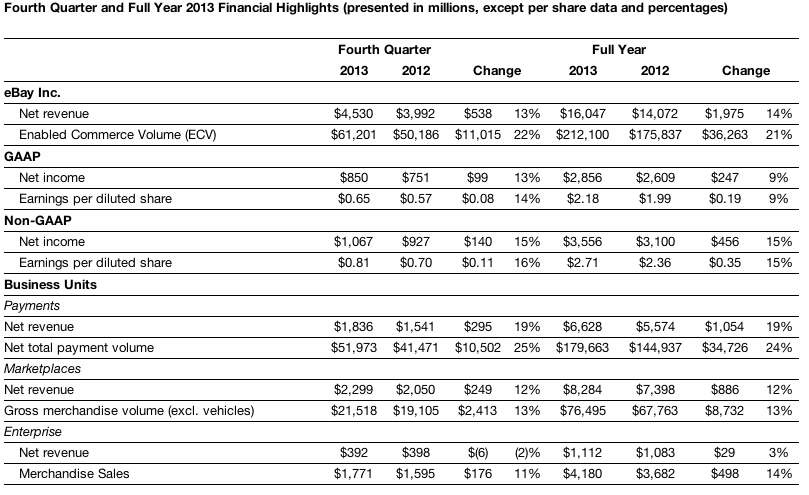

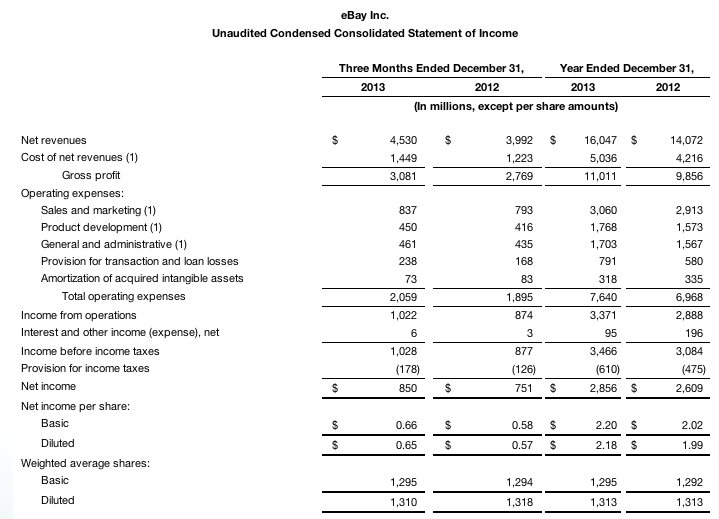

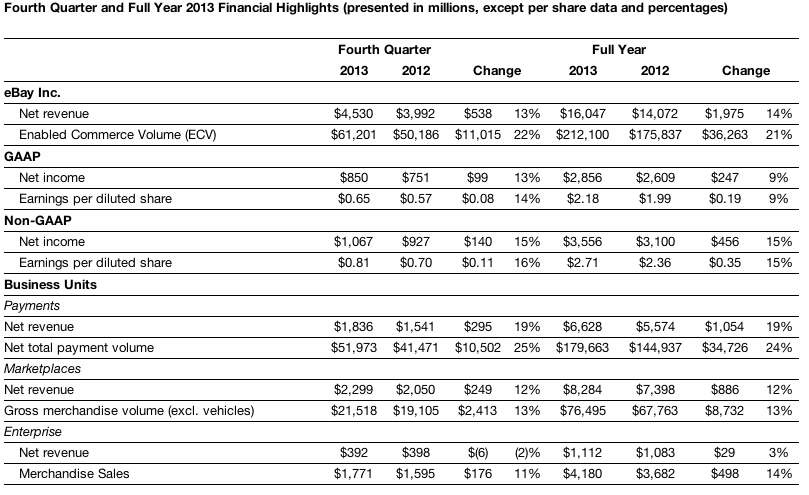

Total revenue for the fourth quarter ended Dec. 31, 2013, increased 13 percent to $4.5 billion, compared to the same period of 2012, EBay reported. The company reported fourth quarter net income on a GAAP basis of $850 million, or 65 cents per diluted share, and non-GAAP net income of $1.1 billion, or 81 cents per diluted share.

Fourth quarter non-GAAP and GAAP earnings per share increased 16 percent and 14 percent, respectively, driven primarily by strong top-line growth. For the full year 2013, revenue grew 14 percent, non-GAAP earnings per share grew 15 percent, and GAAP earnings per share grew 9 percent.

Total company Enabled Commerce Volume (ECV) increased 22 percent in the fourth quarter, accelerating one point, to $61 billion in commerce volume for merchant partners and brands. For the full year, ECV increased 21 percent, accelerating two points to $212 billion. Both Marketplaces and PayPal achieved record mobile results in 2013, each exceeding $20 billion in mobile volume. Mobile users represented 40 percent of eBay's 36 million new users and accounts in 2013, contributing $35 billion in ECV, up 88 percent.

We feel good about our performance and strong finish in the fourth quarter, with the holiday shopping season clearly showing how online, mobile and other omni-channel commerce capabilities are changing how consumers shop and pay, said eBay Inc. CEO and President John Donahoe. Mobile exceeded expectations for the year. Our total mobile commerce volume grew 88 percent, with eBay reaching $22 billion and PayPal hitting $27 billion in 2013. And mobile added more than 14 million customers. PayPal and eBay together create an incredibly strong global commerce ecosystem for consumers and merchants, and we continue to see tremendous growth opportunities ahead.

PayPal delivered a strong fourth quarter performance with accelerating momentum in its merchant services business. Revenue increased 19 percent in both the quarter and the full year, resulting in $6.6 billion in 2013. PayPal gained 5.2 million active registered accounts in the quarter and ended the year with 143 million, a 16 percent increase. PayPal's net total payment volume (TPV) grew 25 percent in the quarter with 3 billion transactions generating $180 billion in net TPV for the full year. On-eBay payment volume grew 14 percent in both the quarter and for the full year, producing $54 billion in net TPV for the year. Merchant Services net TPV increased 31 percent in the quarter and 29 percent for the full year, resulting in $125 billion in net TPV for the year. Mobile was a key catalyst, with payments volume off eBay growing 128 percent for the year. Total mobile payment volume for the year was $27 billion. The fourth quarter also saw the close of the Braintree acquisition.

Marketplaces gross merchandise volume (GMV) excluding vehicles grew 13 percent in both the fourth quarter and full year totaling $76.5 billion in 2013, driven primarily by strong growth in its domestic business. Revenue grew 12 percent in both the fourth quarter and the full year, totaling $8.3 billion in 2013. Marketplaces gained 4.6 million active users in the quarter and ended the year with 128 million active users. Its U.S. business grew 14 percent in the fourth quarter and 15 percent for the full year, generating $30.4 billion in GMV excluding vehicles for the year. Its international business grew 12 percent in the quarter and for the full year, generating $46.1 billion in GMV excluding vehicles for the year. Mobile continued to gain traction during 2013 with 40 percent of all GMV in the fourth quarter involving a mobile device touch point, resulting in $22 billion in mobile commerce volume for the full year. Fixed price GMV excluding vehicles grew 19 percent globally in the fourth quarter and represented 73 percent of total GMV.

Ebay Enterprise generated $1.8 billion in Merchandise Sales in the fourth quarter and $4.2 billion for the full year, up 11 percent in the quarter and 14 percent for the full year. It produced $1.1 billion in revenue for the full year with growth pressured by merchant and channel mix and reduction in take rate. eBay Enterprise enabled its clients to grow same-store sales 13 percent in the quarter and 15 percent for the full year, outpacing ecommerce growth rates in the U.S. Enterprise clients are increasingly adopting technology from across the eBay portfolio: PayPal has 97 percent coverage with growing utilization of Bill Me Later; Marketplaces has 33 Enterprise accounts live on its platform and growing penetration of its eBay Now platform.

On Jan. 15, eBay said Chris Saridakis, president of ebay Enterprise, had resigned for personal reasons. The company said it will conduct an external search for a successor and, until that search is complete, Saridakis will be succeeded by vice president of omnichannel operations and international, Tobias Hartmann.

Saridakis had served as president of eBay Enterprise since June 2011, a division that is the successor to GSI Commerce Inc., a business eBay acquired for $2.4 billion.

Other Selected Financial Results

Operating margin GAAP operating margin increased to 22.6 percent for the fourth quarter of 2013, compared to 21.9 percent for the same period last year. Non-GAAP operating margin increased to 29.2 percent for the fourth quarter, compared to 28.5 percent for the same period last year.

Taxes The GAAP effective tax rate for the fourth quarter of 2013 was 17 percent, compared to 14 percent for the fourth quarter of 2012. For the fourth quarter of 2013, the non-GAAP effective tax rate was 20 percent compared to 18 percent for the fourth quarter of 2012. The increase in the GAAP effective tax rate was due primarily to an increase in earnings in higher tax jurisdictions.

Cash flow The company generated $1.7 billion of operating cash flow and $1.4 billion of free cash flow during the fourth quarter. For the full year the company generated $5.0 billion of operating cash flow and $3.7 billion of free cash flow.

Stock repurchase program The company repurchased approximately $254 million of its common stock in the fourth quarter.

Cash and cash equivalents and non-equity investments The company's cash and cash equivalents and non-equity investments portfolio totaled $12.8 billion at December 31, 2013.

Proposal from Carl Icahn The company also announced today that it has received a notice from Carl Icahn indicating that he has nominated two of his employees to its Board of Directors and submitted a non-binding proposal for a spinoff of its PayPal business into a separate company. The notice stated that companies controlled by Icahn had, earlier this month, acquired shares and derivative securities that give him an economic interest of approximately 0.82 percent in the company.

Ebay welcomes the opportunity to listen to the perspective of all of its shareholders, including Icahn. His Board nominations will be passed on to the Boards Corporate Governance and Nominating Committee, which will consider them in the ordinary course of business. We would note that eBay has a world-class board of directors with directors who have significant experience in technology and financial services.

Regarding Icahns separation proposal, eBays Board of Directors routinely assesses the companys strategic direction and has explored in depth a spinoff or separation of PayPal. eBays Board of Directors has concluded that the company and its shareholders are best served by the current strategic direction of the company and does not believe that breaking up the company is the best way to maximize shareholder value. As part of eBay Inc., PayPal is able to leverage the companys technology capabilities, commerce platforms and relationships with retailers, brands and large merchants worldwide. Payment is part of commerce, and as part of eBay, PayPal drives commerce innovation in payments at global scale, creating value for consumers, merchants and shareholders.

eBay Inc.s Board of Directors and management remain focused on delivering sustainable results and driving long-term value for all shareholders.

Business Outlook

2014

First quarter 2014 eBay expects net revenues in the range of $4,150 – $4,250 million with GAAP earnings per diluted share in the range of $0.51 – $0.53 and non-GAAP earnings per diluted share in the range of $0.65 – $0.67, which includes dilution of $0.02 and $0.01, respectively, resulting from the Braintree acquisition.

Full year 2014 eBay expects net revenues in the range of $18,000 – $18,500 million with GAAP earnings per diluted share in the range of $2.40 – $2.45 and non-GAAP earnings per diluted share in the range of $2.95 – $3.00, which includes dilution of $0.08 and $0.03, respectively, resulting from the Braintree acquisition.

2015

Full year 2015 eBay now expects net revenues in the range of $20,500 – $21,500 million with non-GAAP earnings per diluted share growth of greater than 10 percent.

In January 2014, the company's board of directors authorized an additional $5 billion stock repurchase program. Together with the $640 million remaining under the companys prior stock repurchase program authorized in June 2012, the company's total repurchase authorization as of January 22, 2014 is $5.6 billion. In addition to offsetting dilution from its equity compensation programs, the company expects, subject to market conditions and other factors, to make opportunistic repurchases of its common stock to reduce outstanding share count. Any share repurchases under the companys stock repurchase programs may be made through open market transactions, block trades, privately negotiated transactions (inclu… ding accelerated share repurchase transactions) or other means.

Fourth quarter non-GAAP and GAAP earnings per share increased 16 percent and 14 percent, respectively, driven primarily by strong top-line growth. For the full year 2013, revenue grew 14 percent, non-GAAP earnings per share grew 15 percent, and GAAP earnings per share grew 9 percent.

Total company Enabled Commerce Volume (ECV) increased 22 percent in the fourth quarter, accelerating one point, to $61 billion in commerce volume for merchant partners and brands. For the full year, ECV increased 21 percent, accelerating two points to $212 billion. Both Marketplaces and PayPal achieved record mobile results in 2013, each exceeding $20 billion in mobile volume. Mobile users represented 40 percent of eBay's 36 million new users and accounts in 2013, contributing $35 billion in ECV, up 88 percent.

We feel good about our performance and strong finish in the fourth quarter, with the holiday shopping season clearly showing how online, mobile and other omni-channel commerce capabilities are changing how consumers shop and pay, said eBay Inc. CEO and President John Donahoe. Mobile exceeded expectations for the year. Our total mobile commerce volume grew 88 percent, with eBay reaching $22 billion and PayPal hitting $27 billion in 2013. And mobile added more than 14 million customers. PayPal and eBay together create an incredibly strong global commerce ecosystem for consumers and merchants, and we continue to see tremendous growth opportunities ahead.

PayPal delivered a strong fourth quarter performance with accelerating momentum in its merchant services business. Revenue increased 19 percent in both the quarter and the full year, resulting in $6.6 billion in 2013. PayPal gained 5.2 million active registered accounts in the quarter and ended the year with 143 million, a 16 percent increase. PayPal's net total payment volume (TPV) grew 25 percent in the quarter with 3 billion transactions generating $180 billion in net TPV for the full year. On-eBay payment volume grew 14 percent in both the quarter and for the full year, producing $54 billion in net TPV for the year. Merchant Services net TPV increased 31 percent in the quarter and 29 percent for the full year, resulting in $125 billion in net TPV for the year. Mobile was a key catalyst, with payments volume off eBay growing 128 percent for the year. Total mobile payment volume for the year was $27 billion. The fourth quarter also saw the close of the Braintree acquisition.

Marketplaces gross merchandise volume (GMV) excluding vehicles grew 13 percent in both the fourth quarter and full year totaling $76.5 billion in 2013, driven primarily by strong growth in its domestic business. Revenue grew 12 percent in both the fourth quarter and the full year, totaling $8.3 billion in 2013. Marketplaces gained 4.6 million active users in the quarter and ended the year with 128 million active users. Its U.S. business grew 14 percent in the fourth quarter and 15 percent for the full year, generating $30.4 billion in GMV excluding vehicles for the year. Its international business grew 12 percent in the quarter and for the full year, generating $46.1 billion in GMV excluding vehicles for the year. Mobile continued to gain traction during 2013 with 40 percent of all GMV in the fourth quarter involving a mobile device touch point, resulting in $22 billion in mobile commerce volume for the full year. Fixed price GMV excluding vehicles grew 19 percent globally in the fourth quarter and represented 73 percent of total GMV.

Ebay Enterprise generated $1.8 billion in Merchandise Sales in the fourth quarter and $4.2 billion for the full year, up 11 percent in the quarter and 14 percent for the full year. It produced $1.1 billion in revenue for the full year with growth pressured by merchant and channel mix and reduction in take rate. eBay Enterprise enabled its clients to grow same-store sales 13 percent in the quarter and 15 percent for the full year, outpacing ecommerce growth rates in the U.S. Enterprise clients are increasingly adopting technology from across the eBay portfolio: PayPal has 97 percent coverage with growing utilization of Bill Me Later; Marketplaces has 33 Enterprise accounts live on its platform and growing penetration of its eBay Now platform.

On Jan. 15, eBay said Chris Saridakis, president of ebay Enterprise, had resigned for personal reasons. The company said it will conduct an external search for a successor and, until that search is complete, Saridakis will be succeeded by vice president of omnichannel operations and international, Tobias Hartmann.

Saridakis had served as president of eBay Enterprise since June 2011, a division that is the successor to GSI Commerce Inc., a business eBay acquired for $2.4 billion.

Other Selected Financial Results

Operating margin GAAP operating margin increased to 22.6 percent for the fourth quarter of 2013, compared to 21.9 percent for the same period last year. Non-GAAP operating margin increased to 29.2 percent for the fourth quarter, compared to 28.5 percent for the same period last year.

Taxes The GAAP effective tax rate for the fourth quarter of 2013 was 17 percent, compared to 14 percent for the fourth quarter of 2012. For the fourth quarter of 2013, the non-GAAP effective tax rate was 20 percent compared to 18 percent for the fourth quarter of 2012. The increase in the GAAP effective tax rate was due primarily to an increase in earnings in higher tax jurisdictions.

Cash flow The company generated $1.7 billion of operating cash flow and $1.4 billion of free cash flow during the fourth quarter. For the full year the company generated $5.0 billion of operating cash flow and $3.7 billion of free cash flow.

Stock repurchase program The company repurchased approximately $254 million of its common stock in the fourth quarter.

Cash and cash equivalents and non-equity investments The company's cash and cash equivalents and non-equity investments portfolio totaled $12.8 billion at December 31, 2013.

Proposal from Carl Icahn The company also announced today that it has received a notice from Carl Icahn indicating that he has nominated two of his employees to its Board of Directors and submitted a non-binding proposal for a spinoff of its PayPal business into a separate company. The notice stated that companies controlled by Icahn had, earlier this month, acquired shares and derivative securities that give him an economic interest of approximately 0.82 percent in the company.

Ebay welcomes the opportunity to listen to the perspective of all of its shareholders, including Icahn. His Board nominations will be passed on to the Boards Corporate Governance and Nominating Committee, which will consider them in the ordinary course of business. We would note that eBay has a world-class board of directors with directors who have significant experience in technology and financial services.

Regarding Icahns separation proposal, eBays Board of Directors routinely assesses the companys strategic direction and has explored in depth a spinoff or separation of PayPal. eBays Board of Directors has concluded that the company and its shareholders are best served by the current strategic direction of the company and does not believe that breaking up the company is the best way to maximize shareholder value. As part of eBay Inc., PayPal is able to leverage the companys technology capabilities, commerce platforms and relationships with retailers, brands and large merchants worldwide. Payment is part of commerce, and as part of eBay, PayPal drives commerce innovation in payments at global scale, creating value for consumers, merchants and shareholders.

eBay Inc.s Board of Directors and management remain focused on delivering sustainable results and driving long-term value for all shareholders.

Business Outlook

2014

First quarter 2014 eBay expects net revenues in the range of $4,150 – $4,250 million with GAAP earnings per diluted share in the range of $0.51 – $0.53 and non-GAAP earnings per diluted share in the range of $0.65 – $0.67, which includes dilution of $0.02 and $0.01, respectively, resulting from the Braintree acquisition.

Full year 2014 eBay expects net revenues in the range of $18,000 – $18,500 million with GAAP earnings per diluted share in the range of $2.40 – $2.45 and non-GAAP earnings per diluted share in the range of $2.95 – $3.00, which includes dilution of $0.08 and $0.03, respectively, resulting from the Braintree acquisition.

2015

Full year 2015 eBay now expects net revenues in the range of $20,500 – $21,500 million with non-GAAP earnings per diluted share growth of greater than 10 percent.

In January 2014, the company's board of directors authorized an additional $5 billion stock repurchase program. Together with the $640 million remaining under the companys prior stock repurchase program authorized in June 2012, the company's total repurchase authorization as of January 22, 2014 is $5.6 billion. In addition to offsetting dilution from its equity compensation programs, the company expects, subject to market conditions and other factors, to make opportunistic repurchases of its common stock to reduce outstanding share count. Any share repurchases under the companys stock repurchase programs may be made through open market transactions, block trades, privately negotiated transactions (inclu… ding accelerated share repurchase transactions) or other means.