American Outdoor Brands, the owner of Smith & Wesson, Battenfeld Technologies and Crimson Trace, reported sales in the third quarter slumped 32.6 percent to $157.4 million, compared with $233.5 million for the third quarter last year.

Other highlights for the quarter include:

- Gross margin for the quarter was 29.8 percent, compared with 42.5 percent for the third quarter last year.

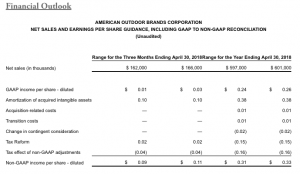

- Quarterly GAAP net income was $11.4 million, or $0.21 per diluted share, compared with net income of $32.5 million, or $0.57 per diluted share, for the comparable quarter last year. Included in the January 31, 2018 results is an estimated, one-time, income tax benefit of $9.4 million resulting from the impact of Tax Reform on deferred tax assets and liabilities.

- Quarterly non-GAAP net income was $4.7 million, or $0.09 per diluted share, compared with $37.6 million, or $0.66 per diluted share, for the comparable quarter last year. GAAP to non-GAAP adjustments to net income exclude a number of acquisition-related costs, including amortization, fair value inventory step-up and backlog expense, one-time transition costs, corporate rebranding expenses, changes in contingent consideration, the impact of Tax Reform and discontinued operations, as well as the associated tax effect on non-GAAP adjustments.

- Quarterly non-GAAP Adjusted EBITDA was $20.0 million, or 12.7 of net sales, compared with $67.6 million, or 28.9 of net sales, for the comparable quarter last year.

Sales came in below company guidance but earnings were above. When it reported second-quarter results on December 7, the company expected sales in the range of $ 170 million and $180 million, GAAP income in the range of 1 and 4 cents and non-GAAP income per share in the range of 7 to 10 cents.

James Debney, American Outdoor Brands Corporation president and chief executive officer, commented, “Our results for the third quarter reflected a continuation of challenging market conditions in the consumer market for firearms. Lower shipments in our Firearms business were driven by a reduction in wholesaler and retailer orders versus the prior year, and were partially offset by double-digit revenue growth within our Outdoor Products and Accessories segment. Overall, our long-term strategy remains focused on being the leading provider of quality products for the shooting, hunting and rugged outdoor enthusiast.

“While our new product pipeline is robust and channel inventory levels appear to be improving, we believe that the new, lower levels of consumer firearm demand we saw reflected in the January NICS results may continue for some time. Going forward, we will operate our business under the assumption that the next 12-18 months could deliver flattish revenues in Firearms. Should market conditions change, our flexible manufacturing model would allow us to quickly ramp production. In the meantime, we will continue to focus on organic growth in our Outdoor Products and Accessories business and on company-wide cost reduction efforts. At the same time, we will continue to invest in our new distribution center, an important strategic initiative designed to lower our overall cost structure,” concluded Debney.

Jeff Buchanan, executive vice president, chief financial officer and chief administrative officer, commented, “We ended the quarter with cash of $38.2 million and net debt of approximately $200 million. Our focus on reducing production levels during the quarter helped to lower inventories of our firearms–internally and at distributor locations. Cash flow for the quarter was positive, so during the quarter we utilized $50 million in cash to reduce our outstanding line of credit, and subsequent to the end of the quarter we paid down an additional $25 million. In addition, yesterday, we effectively extended the maturity on our $75 million Senior Notes to August 2020. Thus, our balance sheet remains strong with no short-term debt and we anticipate positive cash flow for our fiscal fourth quarter.”

Brands in the Firearms segment include Smith & Wesson, M&P, Thompson/Center Arms and Gemtech. Brands in the Outdoor Products & Accessories include Smith & Wesson, M&P, Thompson/Center Arms™, Crimson Trace, Caldwell Shooting Supplies, Wheeler Engineering, Tipton Gun Cleaning Supplies, Frankford Arsenal Reloading Tools, Lockdown Vault Accessories, Hooyman Premium Tree Saws, BOG POD, Golden Rod Moisture Control, Schrade, Old Timer, Uncle Henry, Imperial, Bubba Blade and UST.