VF Corp. reported earnings dipped 2.8 percent in the first quarter but would have been ahead 13 percent on a currency-neutral (c-n) basis. Sales increased 1.9 percent or 8 percent on a c-n basis. Among its major brands, sales on a c-n basis rose 7 percent at The North Face, 16 percent for Vans and 10 percent for Timberland.

“We remain confident in the year ahead, the fundamental strength of our business, and the significant momentum we see across our diverse portfolio of brands,” said Eric Wiseman, VF chairman, president and chief executive officer. “The proven strength of VF’s growth strategy, driven by consistent execution and solid operational discipline, has led us to increase our expectations for full-year currency neutral earnings per share growth putting us on track to deliver another record year to shareholders.”

First Quarter 2015 Highlights

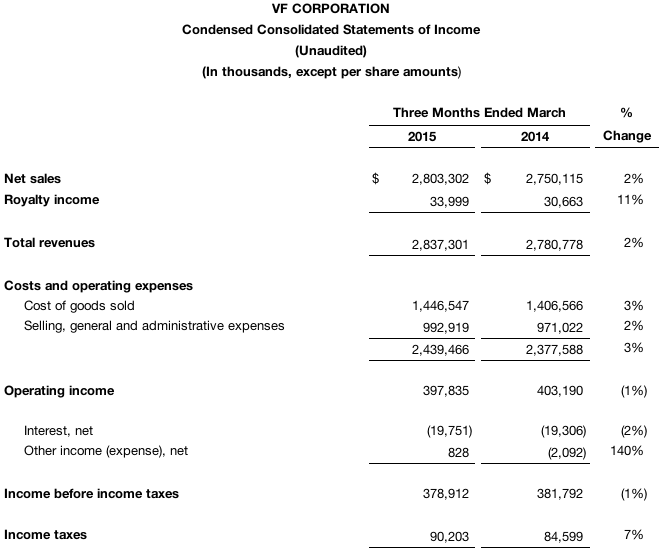

Revenues rose 8 percent on a currency neutral basis including growth in its Outdoor & Action Sports, Jeanswear, Imagewear and Sportswear coalitions, and its international and direct-to-consumer businesses. On a reported basis, revenues increased 2 percent over the 2014 quarter.

Gross margin was 49.0 percent on a reported basis, down 40 basis points compared with the same quarter last year and in line with its expectations. Continued benefit from the shift of its revenue mix toward higher margin businesses was more than offset by the impact of foreign currency. The company continues to expect a 70 basis point improvement for the full year to reach 49.5 percent on a currency neutral basis (49.2 percent reported).

Operating income on a reported basis was down 1 percent to $398 million compared with the same period of 2014. Operating margin on a reported basis declined 50 basis points to 14.0 percent, which includes a 70 basis point headwind from changes in foreign currency rates.

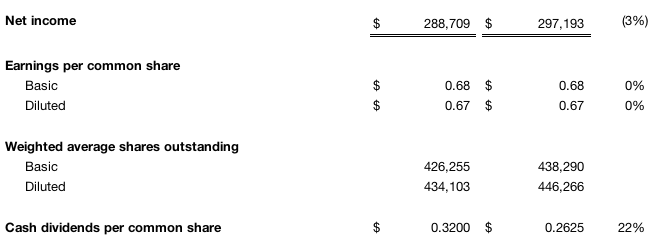

Earnings dipped 2.9 percent to $288.7 million, or 67 cents as share, from $297.2 million, or 67 cents a share. Revenues grew 1.9 percent to $2.8 billion from $2.75 billion. Earnings per share were up 13 percent on a currency neutral basis.

Coalition Review

First quarter revenues for the Outdoor & Action Sports coalition were up 10 percent on a currency neutral basis (up 2 percent reported to $1.6 billion).

In line with its expectations, first quarter currency neutral revenues for The North Face brand rose 7 percent (up 1 percent reported), including a 20 percent increase (up 13 percent reported) in direct-to-consumer business. By region, The North Face brand’s revenues were up at a mid single-digit percentage rate in the Americas, up at a high single-digit rate (down low double-digit reported) in Europe and up at a low double-digit percentage rate in the Asia Pacific region. For the full year, the company’s expectation for low double-digit currency neutral revenue growth for The North Face brand remains unchanged.

Currency neutral revenues for the Vans brand in the first quarter were up 16 percent (up 8 percent reported) including balanced growth in its direct-to-consumer and wholesale businesses. Revenues in the Americas region were up at a high-teen percentage rate (up mid-teen reported), up more than 45 percent in the Asia Pacific region and up at a mid single-digit rate (down low double-digit reported) in Europe. In 2015, the company continues to expect a mid-teen currency neutral percentage rate increase in revenues for the Vans brand.

First quarter revenues for the Timberland brand were up 10 percent on a currency neutral basis (flat reported) including a 16 percent increase (up 6 percent reported) in its wholesale business. In the Americas region, revenues were up at a high-teen percentage rate driven by significant wholesale growth. In Asia Pacific, revenues in the first quarter were up at a high single-digit rate (up low single-digit reported) and in Europe, the Timberland brand was up at a low single-digit rate (down mid-teen reported). There is no change to the company’s expectation for the Timberland brand revenues to increase at a low-teen percentage rate on a currency neutral basis in 2015.

First quarter operating income for Outdoor & Action Sports was down 5 percent to $261 million (as reported) and operating margin declined 120 basis points to 16.2 percent (as reported), primarily due to changes in foreign currency rates and increased investments in the direct-to-consumer business, including the addition of 116 retail stores on a year-over-year basis.

Jeanswear first quarter revenues were up 6 percent (up 1 percent reported, to $700 million). Revenues for the Americas region improved at a mid single-digit percentage rate. In Europe, revenues were up at a mid single-digit percentage (down mid-teen reported) and in Asia, revenues were up at a high single-digit rate.

Revenues for the Wrangler brand in the first quarter were up 9 percent (up 5 percent reported) driven by strength in the Americas region, which realized low double-digit growth in the U.S. mass channel and a mid single-digit increase in its western specialty business. Wrangler brand revenues in Europe were down at a mid single-digit percentage rate (down more than 20 percent reported) due to weakness in Eastern Europe and up at a low double-digit percentage rate (high single-digit reported) in the Asia Pacific region.

Global revenues, on a currency neutral basis, for the Lee brand in the first quarter were up 4 percent (down 1 percent reported) including a high single-digit percentage rate increase (up mid single reported) in Asia Pacific and a mid-teen percentage increase (down mid single-digit reported) in Europe. The Americas region, which saw a low single-digit percentage decline in revenues, continues to work through ongoing challenges in the U.S. mid-tier channel.

Operating income for Jeanswear in the first quarter rose 2 percent to $132 million (as reported). Operating margin increased 20 basis points to 18.9 percent (as reported) in the quarter, driven by increased volume.

Imagewear revenues were up 8 percent (up 7 percent reported to $283 million) in the first quarter driven by a mid-teen percentage rate increase in the workwear business with continued strong demand for the Red Kap brand. First quarter operating income for Imagewear was up 9 percent to $41 million (as reported), with a 30 basis point improvement in operating margin to 14.6 percent (as reported).

Sportswear first quarter revenues increased 3 percent to $136 million. Nautica brand revenues were up at a low single-digit percentage rate driven by strength in wholesale sales. The Kipling brand’s revenues in the U.S. were up 9 percent compared with the same period last year. In the first quarter, operating income was up 2 percent to $13 million while operating margin was flat at 9.5 percent.

Contemporary Brands coalition first quarter revenues were down 7 percent (down 11 percent reported to $88 million), reflecting ongoing challenges in demand for the sector.

International Review

International revenues, on a currency neutral basis, were up 9 percent (down 5 percent reported) in the first quarter. Revenues in Europe were up 4 percent (down 14 percent reported) and in the Asia Pacific region were up 17 percent (up 13 percent reported). Revenues in the Americas (non-U.S.) region were up 16 percent (up 4 percent reported). On a reported basis, international revenues were 40 percent of total VF first quarter sales compared with 43 percent in the same period of 2014.

Direct-to-Consumer Review

Direct-to-consumer revenues, on a currency neutral basis, grew 11 percent (up 5 percent reported) in the first quarter with positive comparable sales growth in all regions and particular strength in Europe. Twenty-three stores were opened during the first quarter bringing the total number of VF-owned retail stores to 1,395. On a reported basis, direct-to-consumer revenues reached 24 percent of total revenues in the first quarter compared with 23 percent in the same period of 2014.

Balance Sheet Highlights

In line with expectations, inventories were up 7 percent compared with the same period of 2014. During the first quarter, VF purchased a total of 10 million common shares for approximately $730 million under its Board of Directors share repurchase authorization. No additional share repurchases in 2015 are anticipated. Additionally, VF made a discretionary contribution of $250 million to its U.S. qualified pension plan, which is now fully funded.

2015 Currency Neutral Earnings Outlook Raised

Earnings per share, on a currency neutral basis, are now expected to increase by 14 percent compared to adjusted earnings per share of $3.08 in 2014. This is an increase from the previous expectation of 12 percent per share growth provided on February 13, 2015. Earnings per share, on a reported basis, are still anticipated to increase by 4 percent to $3.20 compared to adjusted earnings per share of $3.08 in 2014. As a reminder, 2014 adjusted earnings per share excluded the negative impact of a $0.70 noncash impairment charge recorded in the fourth quarter of 2014 to reduce the carrying value of the goodwill and intangible assets related to the 7 For All Mankind, Ella Moss and Splendid brands. On a reported basis, 2014 earnings per share were $2.38.

Dividend Declared

VF’s Board of Directors declared a quarterly dividend of $0.32 per share, payable on June 19, 2015, to shareholders of record on June 9, 2015.