VF Corporation reported financial results for its fiscal second quarter ended September 28, suggesting that the results demonstrated broad-based year-over-year sequential improvement relative to the fiscal 2025 first quarter, with all key metrics in line with, or above the company’s expectations.

“Our results in the quarter met our expectations and reflect a sequential and broad-based improvement in year-on-year trends,” offered Bracken Darrell, president and CEO, VF Corporation. “At the same time, we made further progress on our four Reinvent priorities and we are on track to reach our previously announced $300 million savings target by the end of FY25.”

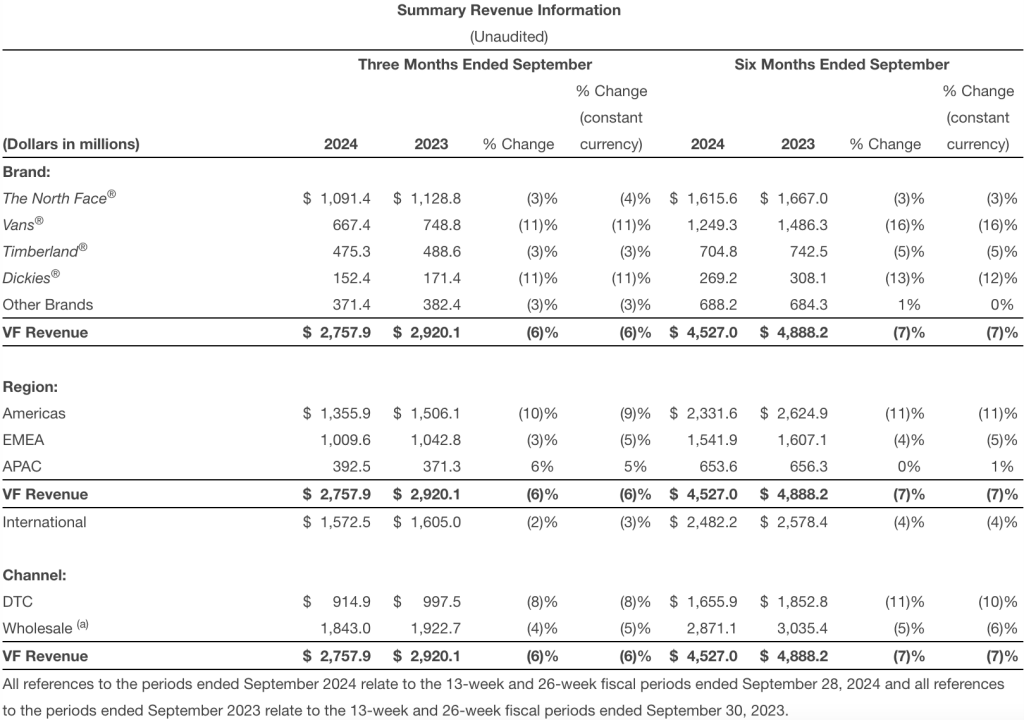

Revenue for the quarter amounted to $2.8 billion, down 6 percent year-over-year from the fiscal 2024 Q2 period. The company said the decline was a sequential improvement from the 10 percent decline in the fiscal first quarter.

“Our Americas regional platform is fully operational and showing promising signs, while the performance at Vans is improving. In summary, we advanced our turnaround plan towards a return to growth and strong, sustainable value creation at VF,” Darrel said.

Revenue Summary

The North Face was down 3 percent year-over-year, or down 4 percent in constant dollars, in the quarter “as expected.” This Q2 performance reportedly cycled against a strong year-ago quarter with revenues up 19 percent (up 17 percent in constant dollars).

Vans down 11 percent year-over-year, relative to the first quarter performance that was down 21 percent year-over-year from fiscal Q1 2024.

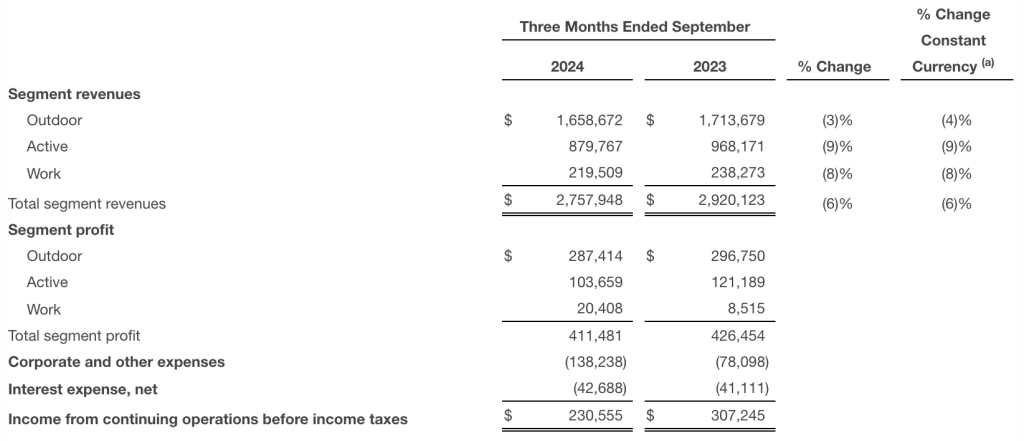

Income Statement Summary

Gross margin was 52.2 percent of net sales, up 120 basis points year-over-year.

Operating margin amounted 9.9 percent, down 210 basis points year-over-year and Adjusted operating margin was down 60 basis points versus fiscal q2 last year to 11.4 percent of net sales.

EPS was 52 cents per share for the quarter, compared to a loss of $1.16 per share in the year-ago quarter. Adjusted EPS was 60 cents per share in Q2, compared to 63 cents in Q2 last year.

Balance Sheet Summary

Inventories were down 13 percent at quarter end, compared to the comparative date last year.

Darrel said that following the completion of the Supreme divestiture on October 1, 2024, the company delivered on its commitment to pay down VF’s $1 billion term loan due December 2024.

Net debt at the end of Q2 was $5.7 billion, down by approximately $446 million relative to the end of Q2 last year. Shortly after the fiscal quarter end, VF received $1.475 billion of net proceeds following the close of the Supreme sale, allowing VF to further reduce net debt.

Financial Outlook

For the fiscal third quarter, VF expects the following on a continuing operations basis:

- Revenue in the range of $2.70 billion to $2.75 billion, down between 1 percent and 3 percent year-over-year in reported dollars, inclusive of an expected negative FX impact of approximately 100 basis points.

- Adjusted operating income in the range of $170 million to $200 million (Q3’FY24: $218 million)

For fiscal 2025, VF expects free cash flow from continuing operations plus proceeds from non-core physical asset sales of approximately $425 million, with core fundamentals in line with previous guidance. Relative to the original full year guidance of $600 million, the change reflects the sale of Supreme and additional reinvestment initiatives in the second half of FY 2025, which are partially offset by the greater than anticipated proceeds for non-core physical asset sales.

Dividend Declared

VF’s Board of Directors declared a quarterly dividend of 9 cents per share. This dividend will be payable on December 18, 2024, to shareholders of record at the close of business on December 10, 2024. Subject to approval by its Board of Directors, VF intends to continue to pay quarterly dividends.

Image courtesy The North Face