Tilly’s, Inc. reported earnings slumped 69.8 percent in the second quarter to $1.3 million, or 5 cents a share, in line with expectations. Comparable-store sales decreased 7.1 percent and gross margins eroded 40 basis points.

“Our second quarter financial results were in line with our expectations, reflecting the continuation of challenging market conditions and the planned reduction in our clearance inventory. We continued to deliver healthy product margins and began the third quarter with a merchandise offering that was well positioned for the back-to-school selling period,” commented Daniel Griesemer, president and CEO. “I am proud of our team’s ability to remain focused on the long-term health and growth opportunities of our business, and am encouraged by improvements in sales trends so far in the third quarter.”

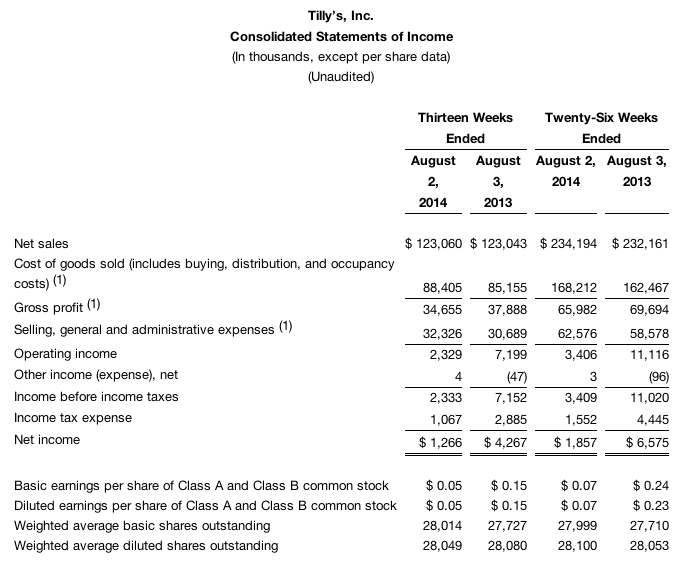

For the second quarter ended August 2, 2014:

- Total net sales were $123.1 million compared to $123.0 million in the second quarter of 2013.

- Comparable store sales, which include e-commerce sales, decreased 7.1 percent compared to the same 13-week period in 2013.

- Gross profit was $34.7 million compared to $37.9 million in the second quarter of 2013. Gross margin was 28.2 percent compared to 30.8 percent in the second quarter of 2013, declining primarily due to deleverage of occupancy costs and a 40 basis point decrease in product margins.

- Operating income was $2.3 million and compares to operating income of $7.2 million in the second quarter of 2013.

- Net income was $1.3 million, or $0.05 per diluted share, based on a weighted average diluted share count of 28.0 million shares and an effective tax rate of approximately 46 percent, reflecting a higher rate than expected due to certain stock option forfeitures. This compares to net income in the second quarter of 2013 of $4.3 million, or $0.15 per diluted share, based on a weighted average diluted share count of 28.1 million shares and an effective tax rate of 40 percent.

For the twenty-six weeks ended August 2, 2014:

- Total net sales were $234.2 million compared to $232.2 million for the first two quarters of the prior year.

- Comparable store sales, which include e-commerce sales, decreased 6.9 percent compared to the first two quarters of 2013.

- Gross profit decreased 5.3 percent to $66.0 million compared to $69.7 million in the first two quarters of 2013. Gross margin was 28.2 percent, compared to 30.0 percent in the prior year period. Product margins increased 10 basis points, offset primarily by deleverage in occupancy costs as a result of the negative comparable store sales.

- Operating income was $3.4 million compared to $11.1 million in the first two quarters of 2013.

- Net income was $1.9 million, or $0.07 per diluted share, based on a weighted average diluted share count of 28.1 million shares. This compares to net income in the first two quarters of 2013 of $6.6 million, or $0.23 per diluted share, based on a weighted average diluted share count of 28.1 million shares.

Balance Sheet and Liquidity

As of August 2, 2014, the company had $57.4 million of cash and marketable securities and no borrowings or debt outstanding on its revolving credit facility.

Third Quarter 2014 Outlook

We expect third quarter comparable store sales to decline in the mid single digits, and net income per diluted share to be in the range of $0.09 to $0.13. This assumes an anticipated effective tax rate of approximately 41 percent and a weighted average diluted share count of 28.1 million shares. Third quarter 2013 net income was $6.1 million, or $0.22 per diluted share, based on a weighted average diluted share count of 28.2 million shares.

As of Aug. 27, Tilly's operated 206 stores.