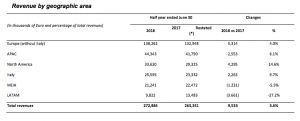

Technogym, based in Cesena, Italy, reported revenues on a currency-neutral basis increased 3.6 percent in the first half ended June 30 to €272.9 million and gained 8.3 percent on a currency-neutral basis. The gains were paced by significant growth in North America.

EBITDA increased 4.7 percent to €44.9 million compared to €42.9 million for the first half of 2017. Net profit increased to €37.7 million, up 99 percent, compared to €19 million for the first half of 2017.

Nerio Alessandri, chairman and chief executive officer, said: “We are proud to confirm that also in the last semester Technogym has grown faster than the sector both in terms of revenues and profitability despite the significant impact of exchange rates. The result is particularly relevant if we consider the April implementation of the new IT system that has led to the postponement of part of May and June revenues to July and August, revenues that today have been recovered as expected. The focus on innovation and the premium positioning of our brand at global level allowed us to record excellent growth rates in key geographies such as the U.S. (+ 28.5 percent) and China (+22.3 percent). These performances more than offset the slowdown recorded in South America, caused by the economic downturn in Brazil.

“Our digital Mywellness platform, widespread in the sectors of sports, fitness and health is a market unique solution; thanks to the combination of IoT and cloud it connects today 15,000 fitness clubs and 10 million users worldwide, allowing them to live a unique and personalized wellness experience. The platform will soon be enriched with media contents, live and on demand coaching services that will be central within our consumer strategy and to consolidate our Technogym 4.0 project. Thanks to the mix of all this elements and thanks to the strength or our team we will close 2018 with a sustainable and profitable growth, a prerequisite for the achievement of our medium-term objectives.”

Technogym said it continues to grow in accordance with the business plans in all the main markets of greatest interest: Europe, North America and APAC. In accordance with trends in recent years, there has been a significant increase in North America (+14.6 percent) a strategic markets for the future growth of the company. Growth is also positive in Europe and Asia Pacific. After two years of strong growth, revenues slowdown in LATAM, mainly because of the unstable macro-economic context in Brasil, which represents the major contributor in the region.

With respect to revenue performance by sales channel: Field Sales continue to be the main channel, registering a growth of 9.3 percent. The Wholesales channel performance was impacted by postpone deliveries due to the IT system change; the companies forecast a full recovery in the second half. The inside sales channel (Ecommerce & teleselling) recorded a negative performance only due to some geographical areas in Europe. The Retail channel has a marginal impact on the company business model, with its main purpose to act as show room support for the other main direct sales channels, from an omni-channel perspective.

Consistently with the change in revenue, the increase in EBITDA was mainly due: (i) to the increase in profit margins in relation to the rise in sales volumes; (ii) the streamlining of industrial activities which had a positive impact on direct production costs; (iii) stable operating costs even though there was an increase in sales volumes.

The net profit increase mainly relates to: (i) increase in the operating income; (ii) the effects of the patent box agreement.