SGB took a deeper dive inside the second installment of a recent study conducted by the International Council of Shopping Centers (ICSC), analyzing the data from the ICSC’s third survey regarding the so-called Halo Effect, or the impact that new stores and closing stores have on online retailers, or “the cannibalization of retailer’s own business.”

ICSC reported that its latest research looked at “hundreds of market areas to provide a hyperlocal analysis of how a new store could drive online awareness, reinforcing the brand’s sales cycle.”

While new stores continue to billboard brand awareness, they also directly correlate to increased online and in-store sales. SGB covered the report’s executive summary and Section 1 of the ICSC study, which looks at the effect opening retail stores has on a retailer’s online business.

SGB now assesses ICSC’s reporting in Section 2, “The Eroding Halo,” regarding the effect the closing of retail stores has on a retailer’s online sales.

Closings Cast Shadow on Online Sales

ICSC’s analysis noted that closing a retail store or shuttering a cluster of locations requires retailers to liquidate merchandise, sell furnishings and equipment, reassign sales staff, or dismiss them altogether.

“There are logistics arrangements needed to get rid of inventory as well as the expenses of breaking commercial lease agreements. This was the fate for nearly 1,500 U.S. stores in 2022, according to the data in ICSC’s report.

ICSC’s research in 2018 on the Halo effect established how the closure of brick-and-mortar stores leads to diminished web traffic. However, the association went further in 2023 and looked at what happens to online sales when “retailers close stores and there are fewer opportunities for consumers to touch or think about the product and be reminded that the store exists.” The latest analysis quantifies in dollars how shuttering a physical location leads to an online sales slump.

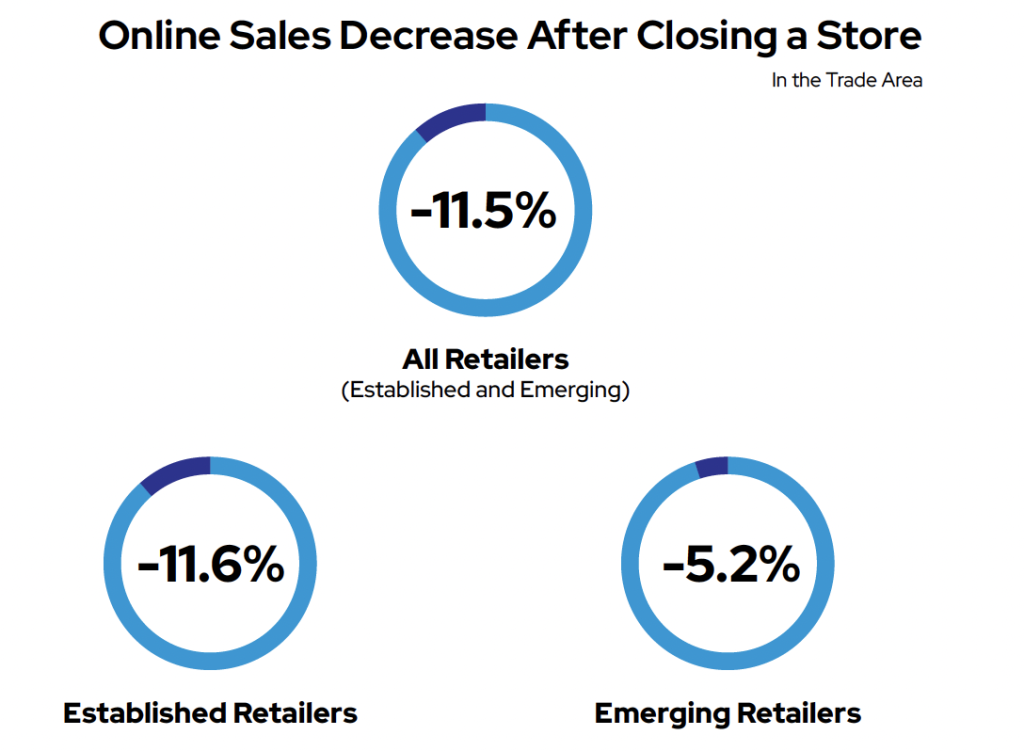

“Across all retailers, we found that closing a store reduced online sales in the trade area surrounding that store by 11.5 percent,” ICSC wrote in their report on the latest survey. “For emerging retailers, there was less of an impact, as online sales for largely DTC brands that closed a store decreased by 5.2 percent.”

Spending Slows

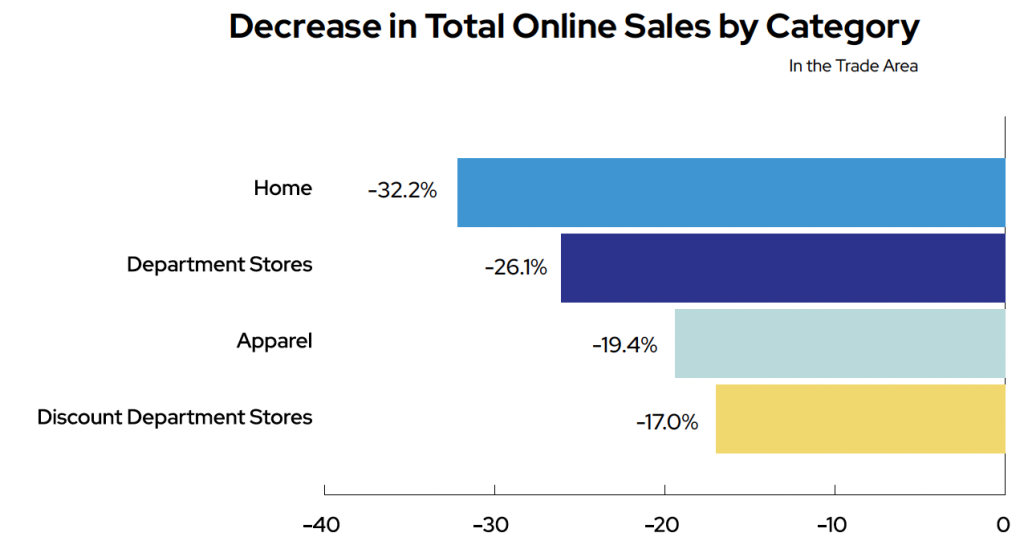

Three retail categories in the ICSC study found the most significant drop in online sales followed the closure of physical stores within a market area. Home stores experienced a 32.2 percent decrease, department stores followed with a 26.1 percent di, and apparel chains took a 19.4 percent hit in online sales. These top three categories mainly include discretionary products.

“When a store within these categories closes, consumers may be less likely to shift online to purchase products in those categories that benefit from in-person discovery, like a shirt, lamp, or bath towel,” the ICSC reported.

In Section 1, ICSC established that opening a new store caused apparel brands to expand their total number of stores to experience a larger positive halo effect than apparel brands, reducing their total number of stores. The opposite is also true. For apparel brands reducing their total number of stores, ICSC said online sales declined at double the rate (-22.4 percent) compared to online sales for apparel brands expanding their total number of stores (-11.1 percent).

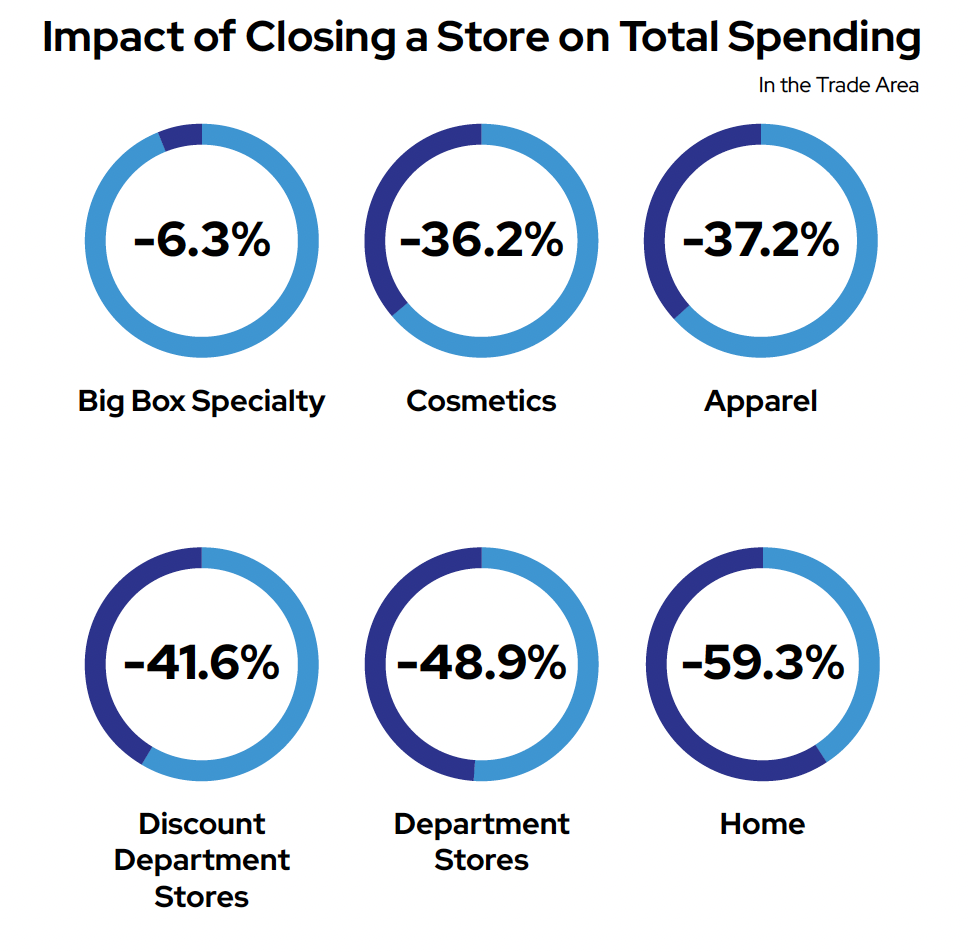

ICSC also noted that the impact of closing a physical store is more pronounced on total spending (for both in-store and online channels). According to its latest report, home stores saw a 59.3 percent drop in total spending, department stores saw a 48.9 percent decline, and discount department stores saw a 41.6 percent decrease.

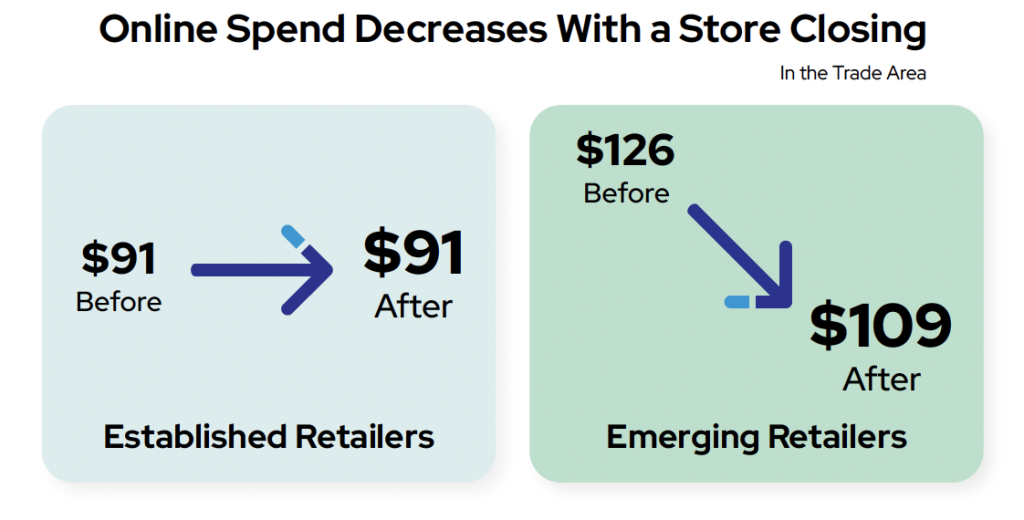

“Just as there is a positive impact on the average online basket when stores open, for emerging retailers, there is a negative impact when they close physical stores,” ICSC said, noting that the average online basket dropped from $126 to $109 after a store’s closing. While emerging retailers experienced a 13.5 percent decrease in the average online basket when closing a store, established retailers, typically having more stores, experienced no impact on the average online basket, which remained at $91, the report said.

“Stores are not just sales drivers, but they can also help emerging retailers drive brand awareness and build trust with consumers,” ICSC offered.

Brand Loyalty Sustains Some Sales

ICSC noted that online sales remain strong in some categories after a store closes, suggesting brand loyalty could keep customers engaged online even when companies shutter a physical store. For instance, ICSC noted that while cosmetics stores saw a 23.7 percent rise in online sales following a store closure, big box specialty stores saw a 6.8 percent rise in online sales.

“Still, while some of those big box specialty and cosmetics sales transferred online, the total impact in the trade area was a reduction in overall sales,” ICSC wrote. “The overall impact of closing a big box specialty store was a 6.3 percent drop in sales. The result was even more dramatic at cosmetics stores, with a 36.2 percent drop in overall sales.”

Simeon Siegel, BMO Capital Markets senior retail analyst, observed that, historically, store closures don’t raise profits, so retailers would be well served to weigh the potential harm to the brand by closing stores.

“Stress test what the return will be, what that recapture rate will be, and what you’ll save by removing the fixed costs when closing stores,” Siegel recommended. Instead, he suggested retailers should look at refocusing their price strategies within stores rather than losing valuable customers. “If your stores have a gross margin issue, it’s more beneficial to focus on elevating the product margin by improving what makes you special by driving or heightening scarcity value,” Siegel said. “I think companies are much better off losing volume by cutting promotions than losing volume by closing stores.”

Methodology: An analysis by the strategy and research firm Alexander Babbage for ICSC examined $848.1 billion of in-store and online spending by zip code to quantify the impact of opening and closing stores. The analysis covered in-store and online sales of 69 retailers, including 2,103 stores in 50 states plus Washington, D.C., from 2019 to 2022. The data was computed by reviewing the 13 weeks following the opening or closing of a store. The study excluded the two weeks before and after the week of the store closing or opening to minimize any final sales for closing or honeymoon periods following the opening of a store. The study included established retailers across six categories: apparel, big box specialty, cosmetics, department stores, discount department stores, and home stores. The study also included emerging retailers identified from a list of 140-plus direct-to-consumer brands across multiple categories. The ICSC analysis of the apparel category highlighted a difference based on momentum. Where applicable, the study highlighted two apparel sub-groups—brands that were mostly expanding their total number of stores and brands that were mostly shrinking their total number of stores.

To read the ICSC report, go here. Graphics courtesy ICSC

***

To read SGB Media’s additional ICSC research, click on the coverage below.

Study: The Retailers Getting the Most Online Benefit from New Stores