The International Council of Shopping Centers (ICSC) quantified the impact of opening or closing physical stores on online sales and retailers’ overall performance. Its latest study, the third installment in its research on the halo effect of brick-and-mortar retail on online sales, is said to again prove the power of physical retail by demonstrating that a new store boosts online sales, while a closed store impedes them.

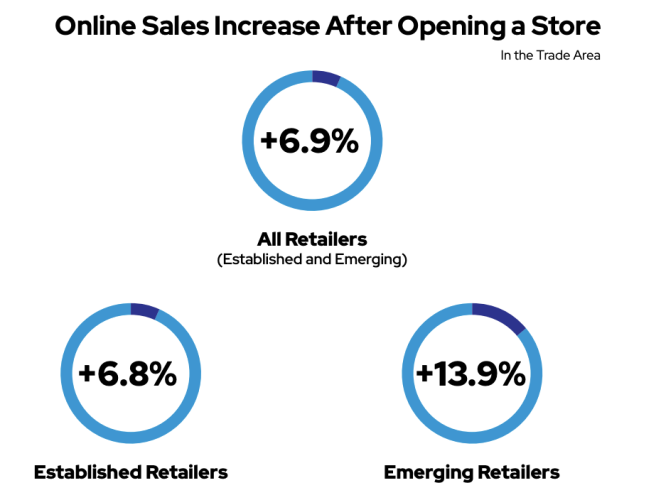

ICSC said its research, spanning in-store and online sales of 69 retailers and 2,103 stores, shows that opening a store boosts online sales in the trade area surrounding that store by an average of 6.9 percent in the immediate weeks following its opening. The benefits for emerging, direct-to-consumer (DTC) brands are even higher, with the correlating halo effect for online sales at 13.9 percent when opening a new store. Conversely, ICSC’s study found that closing stores had an even greater negative impact on retailer performance, resulting in an 11.5 percent drop in sales.

“ICSC’s data has always shown that consumers prefer shopping in-store over other channels,” said ICSC President and CEO Tom McGee. “While our earlier research on the halo effect demonstrated how physical stores drive web traffic and brand awareness, our latest report dives deeper by analyzing actual spend data. The findings quantify just how important brick-and-mortar is to today’s omni-channel consumers and underscore what retail experts already knew: The core of the omni-channel experience is the retail store.”

New Perspectives on the Halo Effect

ICSC’s first report on the halo effect in 2018 established that new stores serve as a billboard for brands, fostering brand recognition that builds customer loyalty (read the report here). The trade association followed up that report in 2019 with a study that quantified how much shoppers spend online after visiting a brick-and-mortar store and vice versa (read the report here).

ICSC’s latest research digs into hundreds of market areas to provide a hyperlocal analysis of how a new store could drive online awareness, reinforcing the brand’s sales cycle. While new stores continue to billboard brand awareness, they also directly correlate to increased online and in-store sales.

“In retail, sales are the great elixir that enables brands to grow, open new locations in new markets, and continue to build their following,” observed R5 Capital Founder and CEO Scott Mushkin.

ICSC said there is reason to be optimistic. In 2021, retail store openings began to eclipse store closings for the first time since 2016, according to ICSC’s data. This is a positive shift when you consider the loss of tangible shopping experiences, the harm to local economies, and the degradation of brands that come with store closings.”

The latest study, which shows nearly $850 billion in credit card transactions over four years, explored the impact of physical stores on emerging retailers, as well as established retailers, in categories including apparel, big box specialty, cosmetics, department stores, discount department stores, and home stores. It found that across nearly all categories, online sales increased following the opening of a store and decreased when it closed.

For instance, among apparel brands, a store opening drives an 11.6 percent increase in online sales, and a store closing drives a 19.4 percent decrease in online sales. Conversely, the study found that when closing a location, home stores and department stores took the biggest hit to their online sales, declining by 32.2 percent and 26.1 percent, respectively, emphasizing the importance of a space where consumers can test, browse and shop for products in those categories.

The study also examined the impact of opening or closing a store on average basket size, revealing that opening a store causes a shopper’s average online basket to increase and confirming the opposite effect.

In addition to proving the direct correlation between physical stores and e-commerce, ICSC said its research shows Gen Z’s vital role in revitalizing physical retail. Despite being known as “digital natives” and growing up with digital technology at their fingertips, the data found that this cohort shops in-store more than Millennials and Gen X and at a similar rate to Boomers.

Look for more reporting from SGB Media on the Halo Effect and ICSC’s latest report in the days ahead.

Methodology

An analysis by the strategy and research firm Alexander Babbage for ICSC examined $848.1 billion of in-store and online spending by zip code to quantify the impact of opening and closing stores. The analysis covered in-store and online sales of 69 retailers, including 2,103 stores in 50 states plus Washington, D.C., from 2019 to 2022. The data was computed by reviewing the 13 weeks following the opening or closing of a store. The study excluded the two weeks before and after the week of the store closing or opening to minimize any final sales for closing or honeymoon periods following the opening of a store. The study included established retailers across six categories: apparel, big box specialty, cosmetics, department stores, discount department stores, and home stores. The study also included emerging retailers identified from a list of 140-plus direct-to-consumer brands across multiple categories. The ICSC analysis of the apparel category highlighted a difference based on momentum. Where applicable, the study highlighted two apparel sub-groups—brands that were mostly expanding their total number of stores and brands that were mostly shrinking their total number of stores.

For more information on ICSC’s latest report, go here.

Graphic courtesy ICSC