On, the Swiss running brand backed by tennis champion Roger Federer, filed for an initial public offering on Monday in the U.S. The company is reportedly seeking a valuation between $4 billion and $6 billion.

The filing comes following a period of explosive growth for the company, which was founded in 2010 in Zürich by Olivier Bernhard, David Allemann and Caspar Coppetti.

According to the filing with the New York Stock Exchange, sales in the first six months rose 84.5 percent to CHF 315.4 million ($345mm) from CHF 170.9 mm a year ago. Net income came to CHF 3.8 million against a loss of CHF 33.1 million a year ago.

In 2020, sales reached CHF 425.3 million ($465mm), up 59.2 percent from CHF 267.1 million a year ago. The net loss in 2020 came to CHF 27.5 million against a loss of CHF 1.47 million a year ago.

On was founded after Bernhard, a three-time World Champion and six-time Ironman champion, was inspired to create “a running shoe that would give him the perfect running sensation,” eventually giving rise to what would become On’s CloudTec technology. On wrote in its prospectus, ‘Dozens of prototypes were developed, but the basic concept—cushioned landing, explosive take-off—remained paramount throughout.”

Olivier joined his friends Coppetti and Allemann to formally establish the brand in Zürich in January 2010. Today, On products can be found in 8,100 premium retail doors worldwide. On said it believes it’s “one of the fastest-growing scaled athletic sports companies in the world,” having grown sales at an 85 percent compounded annual growth rate (CAGR) from inception through 2020

Competitive Strengths

In its prospectus, On pointed to its in-house innovation as one of its foremost competitive strengths. On wrote, “From its founding, On’s objective has been to revolutionize the sensation of running. Transforming how we experience one of the most basic skills of the human body required a radical approach to innovation. We focus our innovation efforts in the areas of performance, design and impact, as we aspire to increase performance for athletes and consumers, apply smarter design thinking to our products and create the path to a more sustainable future.”

The filing cites the brand’s innovations, starting with its CloudTec technology in 2010 to injection-molded Speedboard (2013), Lightweight Trail Missiongrip (2016), ultra-lightweight running apparel (2016), Helion Superfoam (2019), Embedded CloudTec (2019), and Invisible CloudTec (2020).

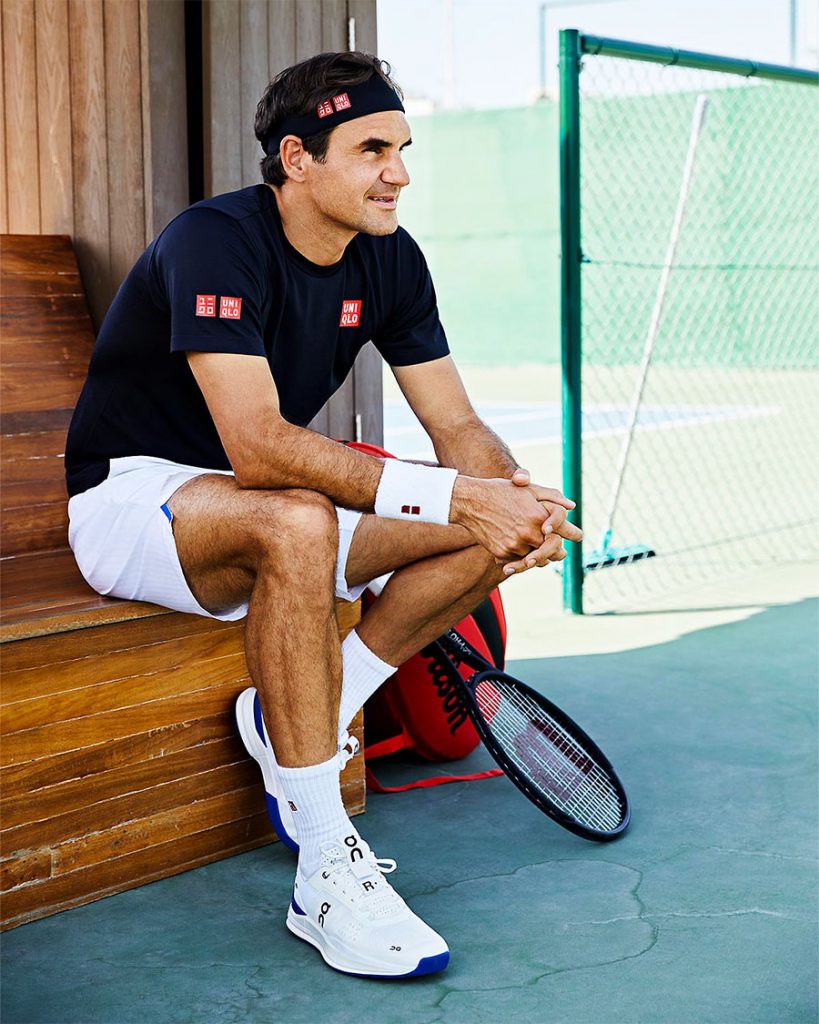

Last year On entered the tennis category with “The Roger” franchise, developed in collaboration with Swiss tennis pro Roger Federer after he joined On as an active co-entrepreneur in 2019 and investor.

“While developing a competition tennis shoe with Roger, he suggested extending On’s patented technology to a tennis sneaker family to re-invent how age-old tennis sneakers are made,” On wrote in its prospectus. “This is enriching our performance product offering, and we believe Roger’s perspectives and insights as a professional athlete will help improve our product development, marketing and fan experiences.”

On said its Performance Outdoor products stand out with a unique approach to the active outdoor space, by “taking on the mountains: light and fast, with shoes and outdoor apparel engineered to free you from the weight and bulk of traditional outdoor gear.”

The company’s in-house research and development team include sports scientists, engineers, material experts, and designers who in On’s own Labs in Zurich and Ho-Chi-Minh City. Partnerships with leading universities, such as the Swiss Federal Institute of Technology and the Fraunhofer Institute also aid in its developing new technologies.

On wrote, “At On, we aim to give each product a special advantage by including performance-enhancing technology, such as bringing running technology into street sneakers or adding stretch and running-grade breathability to a hiking jacket. On products have an iconic design and are versatile to use, as we synergistically combine engineering solutions with a minimalist Swiss design aesthetic. We believe our relentless focus on innovation, design and Swiss quality leads to advanced products that allow us to maintain premium price points and encourage repeat purchases among our customers.”

A second competitive strength was seen in its positioning as an “Authentic, Premium Global Sports Brand.” The company counts its Swiss heritage as a differentiator that is “strongly reflected in many aspects of the brand, from the Swiss-engineered technology and design to the focus on impact and the global profile that the brand has already achieved.”

The brand also received strong early support from world-renowned athletes and brand ambassadors, including Nicola Spirig who won the Olympic Triathlon silver medal in 2016 and Javier Gomez Noya who won the Triathlon World Champion Long Distance in 2019.

On’s rapid growth has also benefited from its early success with word-of-mouth recommendations that helped it to build a “community of millions” of loyal followers, from marathoners to weekend joggers. On also pointed to the benefits of grassroots marketing as it regularly hosts events, including 132 in 2019, to encourage its fans to become brand advocates.

“Our customers’ affinity for our products is demonstrated by the fact that 43 percent of our customers own more than one pair of On shoes and 75 percent have recommended On to someone else,” On wrote in the prospectus. “Our fans are highly engaged through social media and with 3.5 percent of our users on Instagram acting on our posts.”

On also highlighted its “highly complementary and brand-enhancing” channel strategy. Direct-to-consumer, largely represented by e-commerce, represented 37.7 percent of sales in the first half of 2021 and includes a platform on Tmall and JD.com in China. In 2020, its e-commerce platform recorded more than 60.4 million visits, representing a 136 percent increase compared to 2019.

Last year, the company opened an experiential flagship store in New York City and has four retail stores in China. At wholesale, the brand is available at approximately 8,100 stores across more than 50 countries. On wrote, “The majority of our wholesale partners are premium specialty stores that operate less than five retail stores and play an important role in establishing and reinforcing On’s credibility in their respective communities.”

Other cited strengths included its sustainable commitments. On said it had made “strong progress” towards its goal of using 100 percent recycled polyester, 100 percent recycled polyamide and 100 percent organic certified natural materials by 2024. It also called out the benefits from its adaptable supply chain, established manufacturing and distribution partners and priority in customer service. Operationally, the brand believes it benefits from its “Partnership-Focused Leadership Model” and diverse employee base.

On leadership includes Allemann and Coppetti as executive co-chairmen, its innovation-leader Bernhard as an executive board member, Martin Hoffmann as CFO and co-CEO, and Marc Maurer as co-CEO.

On said its overall team culture is anchored by five core values, referred to internally as “spirits”—Explorer, Athlete, Team, Survivor, and Positive Spirit.

On wrote in the prospectus, “These five spirits guide us in our approach to making a positive contribution in the right way. For ourselves. For runners. And for our planet. We believe how we do things is just as important as what we do. As a brand built around encouraging and supporting movement, we believe that it is the human spirit, not just the human body, that drives people to dream the big idea and move to make that dream a reality. Everything we do at On is designed to deliver on our mission: To ignite the human spirit through movement.”

Growth Strategies

On plans to grow the business by raising brand awareness, further expanding across geographies and adding new categories, On sees opportunities to attain market share in the approximately $300 billion global sportswear industry by driving brand awareness. The company noted that its unaided brand awareness outside of Switzerland remains below established sportswear peers, “providing us with a clear runway ahead.”

On said, “Authenticity gained through word of mouth, recommendations from athletes, influencers, tastemakers, and a global community of runners and explorers has proved extremely valuable in organically and credibly growing the On brand.”

Strategies to elevate awareness include engaging global community members who are active within its social channels, partnering with athletes and grassroots campaigns. Especially effective has been its ‘Try On’ events where customers try On shoes, its owned event series, including the 5K run crew ‘Squad Races,’ or the brand’s yearly ‘Run Your Local Mountain’.

On said, “Our internal agency team collaborates across the business to ensure we are integrated directly into decision making for premium product storytelling, new innovative services, authentic community growth and shareable moments. At its heart, our marketing philosophy is simply to work with those who love our product, which we believe supports our high marketing efficiency and authenticity.”

On geographic expansion, On believes its growth has benefited from seeking to expand globally “from the very beginning and today we have a fast-growing presence across a number of international markets including Germany (first entered in 2011), the United States (2013), Japan (2013), China (2018), and Brazil (2018).

On said it’s in a “growth phase in almost all of our international markets, and we believe we have opportunities for continued market share gains.”

The brand noted that while it has generated net losses in recent years, significant net sales growth historically has been achieved as it has entered new markets. For example, On entered the U.S. in 2013 and has grown net sales to CHF 202 million in 2020 and CHF 157 million in the six-month period ended June 30, 2021. In its home market, Switzerland, sales grew to CHF 52 million in 2020 and CHF 27 million in the first six months of 2021. On entered China in 2018, has reached CHF 5.5 million in 2020 and generated CHF 8 million in the first of 2021.

“We believe that pioneering a true multi-channel strategy will ultimately lead to superior outcomes, lower cost of customer acquisition, higher customer retention, and repeat purchases,” On said. “Our wholesale and our DTC channels are mutually beneficial to each other because we always put the customer first.”

While its initial focus at wholesale was the run specialty channel, the brand has added premium retail partners to reach a broader audience, “building on the initial momentum and brand halo gained by our presence in specialty stores.” On sees “significant room” to add additional premium doors and generated higher sales per door by working closely with its retail partners.

DTC is largely e-commerce, and On had approximately 900,000 active online customers in 2020.

On opened its first flagship retail location in New York City in 2020 and plans to “selectively build physical stores to showcase our brand and products, which we believe will further strengthen our local community, reach global travelers and create additional brand visibility.”

Physical retail is expected to be a “key growth pillar” in China. On currently operates four mall-based mono-brand stores in Shanghai and Chengdu and is preparing to open similar-format stores in China in 2021.

Regarding broadening categories, On sees opportunities beyond run to address adjacent lifestyles, including fitness, everyday use, outdoors, tennis, apparel and accessories. On wrote in its prospectus, “While we expect to always be deeply rooted in running, consumers around the world have shown an interest in our other products, significantly increasing On’s total addressable market.”

From a profitability perspective, On expects to realize ever-greater economies of scale as it grows. The rollout of e-commerce and select retail stores is also expected to boost margins and eventual conversion of distributor partnerships in some countries to direct sales. A recent move to insource product development from an external sourcing agent and the free trade agreement between the EU and Vietnam, are also expected to boost profitability.

On wrote, “At the same time, we plan to continue to invest into all areas of the business as part of our geographical and product expansion. Looking toward the future, we believe that these initiatives will provide a robust foundation for growth and position us to continue capturing market share.”

The Zurich-based company in its filing Monday listed the size of the offering as $100 million, a placeholder that will change when it sets terms for the share sale. It has applied for the NYSE listing symbol “ONON.” Goldman Sachs Morgan Stanley and J.P. Morgan are among the underwriters for the offering. Proceeds will be used for general corporate purposes, including working capital, operating expenses, and capital expenditures.

In April, sources told Bloomberg that On had started preparing for its IPO that was projected to value the business at about $5 billion. Sources told Reuters in April that the company could seek a valuation of between $4 billion and $6 billion in its IPO.

Photos courtesy On/Roger Federer