Rocky Brands reported sales jumped 16 percent in the fourth quarter, riding momentum in Work and Western Footwear styles, combined with ongoing strength in direct-to-consumer business. Rocky Brand officials also spoke enthusiastically about the growth potential from its proposed acquisition of Honeywell’s lifestyle footwear business, including The Original Muck Boot Company and Xtratuf.

“We are very excited about this transformative transaction for many reasons,” said Jason Brooks, Rocky Brands president and CEO, on a conference call with analysts. “First, we are acquiring great brands, led by The Original Muck Boot Company and Xtratuf. Combining our two powerful portfolios will create meaningful growth opportunities with our existing categories, particularly work, and provide an entry into new market segments such as commercial fishing, outdoor, camping, and recreational fishing.

“Second, with innovative and authentic product collections that complement our existing offering with minimal overlap, we will be in a position to strengthen our wholesale relationships and serve a wider consumer audience. Third, we believe there is tremendous upside for leveraging our advanced fulfillment capabilities to improve the distribution of the new brands to wholesale customers and accelerate direct-to-consumer penetration.

“Lastly, and perhaps most importantly, it is a very well-run, profitable business that nearly doubles our sales and is immediately accretive to gross margins and EPS. For 2020, sales of the acquired brands were approximately $205 million, with an adjusted EBITDA of $24.5 million.”

On January 25, Rocky Brands announced it had entered into a definitive agreement to acquire the performance and lifestyle footwear business of Honeywell International, Inc. for a purchase price of $230 million. The acquisition is expected to close next month.

In the quarter ended December 31, sales increased 16.3 percent to $87.6 million.

Fourth-quarter net income increased 91.1 percent to $9.7 million, or $1.33 per diluted share, compared to $5.1 million, or $0.68 per diluted share in the year-ago period. Adjusted net income, which excludes acquisition-related expenses, was $10.3 million, or $1.41, representing a year-over-year gain of 102 percent.

Wholesale sales for the quarter increased 21.7 percent to $59.9 million, while retail sales advanced 13.1 percent to $23.5 million. Brooks said, “Across both channels, we experienced strong full-price selling and very little discounting, underscoring the strong appeal of our brands and products.”

Military segment sales for the fourth quarter were $4.2 million compared to $5.3 million in the fourth quarter of 2019.

Gross margins improved 370 basis points to 41.2 percent due to higher wholesale margins driven by increased full-priced selling with higher retail margins. Operating expenses were reduced to 26.5 percent of sales from 28.7 percent a year ago.

Income from operations improved 93.8 percent to $12.9 million. On an adjusted basis, operating income climbed 103 percent to $13.6 million, or 15.5 percent of sales.

Work And Western Categories Drive Q4’s Top-Line Growth

Work, its largest category, saw sales climb 18 percent, led by Georgia Boot, as the brand’s new collections performed well at key retailers including Tractor Supply, Boot Barn, Coastal Farm & Ranch, and smaller independent accounts, according to Brooks. He said, “We’ve also seen interest spike in several Georgia core items, such as the Romeo and Giant, driven by more casual work-from-home policies that are still in effect in many parts of the country.”

The Western category continued its strong second-half turnaround, with fourth-quarter sales increasing 43 percent year-over-year, following a 27 percent increase in the third quarter.

Said Brooks, “Durango had a fantastic finish to the year, driven by strong demand for perennial top sellers like our Flag boots and other patriotic products and new offerings in core western and western work, two areas we’ve focused on growing the last couple of years.”

Western saw strength across the board in terms of retail performance, with majors including Boot Barn, Rural King, Cavender’s, and Academy Sports up strong double-digits, while smaller farm and ranch field accounts grew even faster. Sales of the Rocky brand also accelerated in the fourth quarter, led by Western, as its “functionally-focused product offering continued to receive strong demand from customers that have experienced little to no downtime during the pandemic,” said Brooks.

The company’s Outdoor business increased 20-plus percent despite less than optimal weather for hunting across much of the country. Said Brooks, “The lack of cold, snowy weather in Q4 was more than offset by the higher participation in hunting and overall enthusiasm for the outdoor lifestyle and our ability to serve consumers with the compelling market-appropriate product.”

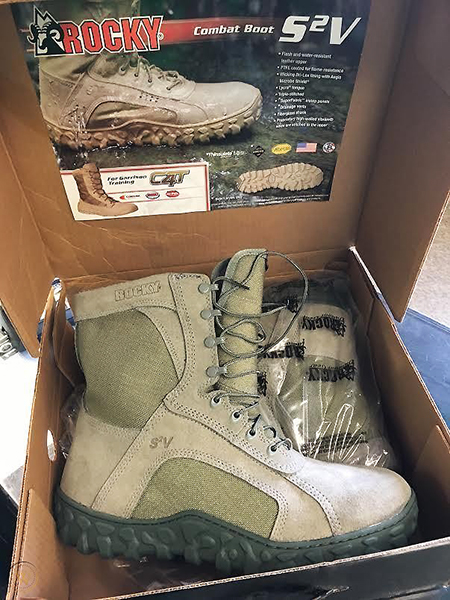

Rocky Work grew high-single-digits as it continued to supply essential workers with safety footwear, combined with a new program for key e-tailer partner. In Rocky’s Commercial Military Division, the S2V Collection saw strong gains as the military transitioned to tactical uniforms requiring Coyote Brown boots. This was offset by softness in consumer-direct transactions as foot traffic at on-base exchanges like AAFES was down due to temporary travel restrictions related to COVID-19.

In Rocky Brands’ Retail segment, strong growth in the e-commerce channel, which consists of its own branded websites and online marketplaces, fueled another double-digit gain in the quarter. Total web sales were up 33 percent, with Georgia, Rocky and Durango all increasing double-digits.

“Even as consumers resume shopping at brick & mortar retail in greater number, we continue to see increased engagement online with both existing and new customers,” said Brooks. “The work we’ve done enhancing the functionality of our branded desktop and mobile sites and expanding our direct-to-consumer efforts on marketplaces, particularly Amazon, where we enjoy Seller Fulfilled Prime status, has provided us the opportunity to capitalize on this change in the buying behavior.”

In the Lehigh Safety Shoe direct business, trends have continued to improve since late spring, when many of Lehigh’s customers were operating with reduced workforces to maintain social distancing. Finally, Rocky Brands’ Contract Military segment was down 21 percent, or a little over $1 million, as the business continues to face headwinds due, in part, to the recent expiration of some multiyear contracts.

Full Year Sales Benefit From Second-Half Bounce Back

For 2020, sales increased 2.6 percent to $277.3 million. Net income increased 20.1 percent to $21.0 million, or $2.86 per share. Adjusted net income for fiscal 2020 was $23.1 million, or $3.14. Brooks said sales in the first half of the year were down 13 percent, but a strong wholesale recovery started in the third quarter drove sales ahead 16 percent in the back-half.

“We attributed this both to the desirability of our products and our ability to replenish channel inventories quickly,” said Brooks. “We made some inventory investments in key styles toward the end of the second quarter that benefited our business in the third and fourth quarters. This was true for Wholesale and our digital channel, which didn’t let up even as physical retail resumed normalized operations.”

Inventory at December 31 increased 1.1 percent compared to the same date a year ago.

Brooks said that Rocky Brands had to adjust production during the back half of the year to keep up with the demand for some key styles and compensate for some suppliers who had faced shipping constraints due to COVID-19-related restrictions. He added, “This ability to dial-up and dial-down our production schedules in response to the market volatility and speed to market underscores the benefits of our vertically integrated manufacturing structure, which we believe is a key competitive advantage. For 2020, we manufactured approximately 40 percent of what we sold.”

For 2021, Tom Robertson, EVP, CFO and treasurer, said Rocky Brands expects revenues, excluding the Honeywell footwear acquisition, to increase in the mid-single-digit range led by its Retail division, followed by Wholesale. Military segment sales are forecasted to be flat. Robertson added, “In terms of margins, we are facing tough comparisons in the second half of the year from strong full-price selling we experienced in 2020 and from the mix of sales in our retail division. That said, we believe we can maintain overall gross margins at, or slightly above, 2020 levels as we leverage costs on higher volumes and gain efficiencies in our factories from increased production.”

Photos courtesy Rocky Brands/Honeywell Boots