Iconix Brand Group Inc. reported a loss of $79.4 million in the second quarter after absorbing a write-down for the Mossimo trademark. The company said second quarter results excluding the charge were in line with company’s expectations, although the company now expects earnings to arrive at the lower end of previous guidance.

Peter Cuneo, interim CEO and chairman of the board, commented, “Iconix delivered financial results in line with our expectations for the second quarter, and we do not anticipate any major changes to our full year projections. The highlight of the quarter was the announcement that our iconic brand, Starter, is returning to the Football Field through a collaboration with the Alliance of American Football Association, which is set to commence play in February 2019. Starter will become the official on-field outfitter of all uniforms and sideline apparel for all Alliance teams. We are also exploring additional opportunities to expand marketing and merchandising beyond the field. In other news, we announced that a cooperation agreement has been reached with Sports Direct International pursuant to which Iconix has appointed Justin Barnes to our board of directors. We are pleased to move into the future with a stable board and look forward to Justin’s unique business perspective.”

David Jones, chief financial officer of Iconix, commented, “With a stable balance sheet,we continue to focus on the business and have seen our licensing activity pick up year-over-year. We were pleased to register organic growth in both our Men’s and International segments for both the second quarter of 2018 and the first half of 2018. Our brands in transition continue to draw a lot of interest, and we are working through several promising opportunities. Globally, during the first six months of 2018, we have signed 43 new and replacement license agreements, a 30 percent increase over the prior year. We have also renewed 51 license agreements, a 60 percent increase over the first half of 2017. We enter the second half of 2018 with a continued focus on generating new business, while supporting our existing partners to drive future growth.”

2018 Guidance

- Anticipating lower end of full-year revenue guidance of $190 million to $220 million.

- GAAP net income guidance now a loss of approximately $94.4 million to $104.4 million, principally due to a Q2 trademark and goodwill impairment

- Anticipating low end of full year non-GAAP net income guidance of $20 million to $30 million

- Reiterating full year free cash flow guidance of $50 million to $70 million

It should be noted that GAAP net income will be affected by non-cash adjustments to fair value from the company’s 5.75 percent Convertible Notes as discussed below. Such periodic adjustments to fair value cannot be estimated in advance and thus are not taken into account in guidance.

Non-GAAP net income and free cash flow are non-GAAP metrics, and reconciliation tables for each are included.

Unless otherwise noted, the following represents financial results for continuing operations only.

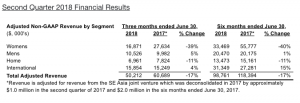

*Revenue is adjusted for revenue from the SE Asia joint venture which was deconsolidated in 2017 by approximately $1.0 million in the second quarter of 2017 and $2.0 million in the six months ended June 30, 2017.

In the first quarter of 2018, the company adopted a new revenue recognition accounting standard (ASU No. 2014-09 Revenue from Contracts with Customers–Topic 606). Adoption of the standard increased Q2 2018 revenue by approximately $0.1 million and decreased revenue by $1.8 million for the six months ended June 30, 2018, but is expected to increase full-year 2018 revenue by approximately $2.5 to $3.0 million.

For the second quarter of 2018, total adjusted revenue was $50.2 million, a 17 percent decline as compared to $60.7 million in the prior year quarter. For the six months ended June 30, 2018, total adjusted revenue was $98.8 million, a 17 percent decrease as compared to $118.4 million in the six months ended June 30, 2017. Such decline was expected principally as a result of the transition of the Danskin, OP and Mossimo DTR’s in the Women’s segment, as previously announced.

The Men’s segment provided organic growth in the second quarter of 2018 and through the six months ended June 30, 2018, primarily from the Umbro and Buffalo brands. The International segment also provided organic growth, primarily from the Umbro and Lee Cooper brands.

The Home segment declined 11 percent for the second quarter of 2018 and six months ended June 30, 2018. However, as previously discussed, a portion of this decrease was due to a shift in Charisma timing which the company anticipates recovering during the balance of the year. In addition, also as previously discussed, revenue in the home segment year-over-year is partially down due to the terms of a renewal of the Waverly inspirations contract with Walmart. Finally, the new revenue recognition standard has a negative effect on the Royal Velvet license agreement, as the company will record less revenue in 2018 than the current guaranteed minimum royalty.

SG&A Expenses

Total SG&A expenses in the second quarter of 2018 were $28.6 million, a 7 percent increase compared to $26.8 million in the second quarter of 2017. However, 2018 includes $2.7 million of special charges primarily consisting of severance charges for the company’s previous chief executive officer and $2.9 million of costs associated with recent debt financings. Adjusting for these items in 2018 and special charges of $2.5 million in 2017, SG&A decreased approximately $1.2 million or 5 percent. Stock-based compensation was $0.5 million in the second quarter of 2018 as compared to $3.1 million in the second quarter of 2017.

Total SG&A expenses in the six months ended June 30, 2018 were $62.2 million, a 19 percent increase compared to $52.2 million in the six months ended June 30, 2017. However, 2018 includes $5.4 million of special charges, $8.3 million of costs associated with recent debt financings, $2.6 million of restructuring costs and a $1.1 million non-cash purchase accounting adjustment. Adjusting for these items in 2018 and special charges of $4.7 million in 2017, SG&A decreased $2.7 million or 6 percent. Stock-based compensation was $1.5 million in the six months ended June 30, 2018 as compared to $4.7 million in the six months ended June 30, 2017.

Loss on Termination of Licenses

Loss on termination of licenses in the second quarter of 2018 was $5.7 million versus $23.2 million in the second quarter of 2017. The charge in the second quarter of 2018 was related to a litigation settlement with a previous licensee for the Rocawear brand, while the charge in the second quarter of 2017 was related to the transition of a license for the Umbro brand.

Gain on Sale of Trademarks and Gain on De-Consolidation of Joint Venture

Gain on sale of trademarks in the second quarter of 2018 were $0.1 million. The gain on sale of trademarks for the current quarter was related to the completion of the sale of the Sharper Image trademarks from the company’s Iconix Australia joint venture.

Gain on deconsolidation of joint venture was $3.8 million in the second quarter of 2017, for which there was no comparable amount in the second quarter of 2018. The gain on de-consolidation of joint venture was related to the de-consolidation of the Iconix Southeast Asia joint venture.

Trademark and Goodwill Impairment

In the second quarter of 2018, the company recorded a non-cash trademark charge of $73.3 million in the women’s segment related to a write-down in the Mossimo trademark. The company also recorded a non-cash, goodwill impairment charge of $37.8 million in the women’s segment as a result of the impairment of the Mossimo trademark.

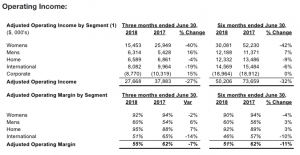

Operating loss for the second quarter of 2018 was $94.6 million, as compared to operating income of $15.9 million in the second quarter of 2017. Operating loss in the second quarter of 2018 included goodwill and trademark impairments of $111.1 million, special charges of $2.7 million, costs associated with recent debt financings of $2.9 million, a loss on termination of licenses of $5.7 million and gain on sale of trademarks of $0.1 million. Operating income in the second quarter of 2017 included special charges of $2.5 million, loss on termination of licenses of $23.2 million and a gain on de-consolidation of joint venture of $3.8 million. When excluding these items, adjusted operating income was $27.7 million and $37.9 million in the second quarter of 2018 and the second quarter of 2017, respectively, and adjusted operating margin was 55 percent and 62 percent in the second quarter of 2018 and the second quarter of 2017, respectively. The decline in adjusted operating income and adjusted operating margin is primarily due to the decline in licensing revenue from the transition of the Danskin, OP and Mossimo DTR’s.

Operating loss for the six months ended June 30, 2018 was $79.1 million, as compared to operating income of $49.5 million in the six months ended June 30, 2017. Operating loss in the six months ended June 30, 2018 included goodwill and trademark impairments of $111.1 million, special charges of $5.4 million, costs associated with recent debt financings of $8.3 million, restructuring costs of $2.6 million, a $1.1 million non-cash purchase accounting adjustment, a loss on termination of licenses of $5.7 million and gain on sale of trademarks of $1.3 million. Operating income in the six months ended June 30, 2017 included special charges of $4.7 million, loss on termination of licenses of $23.2 million and a gain on de-consolidation of joint venture of $3.8 million. When excluding these items, adjusted operating income was $50.2 million and $73.7 million in the six months ended June 30, 2018 and the six months ended June 30, 2017, respectively, and adjusted operating margin was 51 percent and 62 percent respectively. The decline in adjusted operating income and adjusted operating margin is primarily due to the decline in licensing revenue from the transition of the Danskin, OP and Mossimo DTR’s.

Interest Expense, Other Income and Loss on Extinguishment of Debt

Interest expense in the second quarter of 2018 was $14.8 million, as compared to interest expense of $14.1 million in the second quarter of 2017.

In the second quarter of 2018, the company recognized a $32.1 million gain resulting from the company’s accounting for the 5.75 percent Convertible Notes, which requires recording the fair value of this debt at the end of each period with any change from the prior period accounted for as other income or loss in the current period’s income statement. There is no comparable amount in the second quarter of 2017. The company has excluded these amounts from its non-GAAP results.

In the second quarter of 2017, the company recognized a $13.9 million expense related to the early extinguishment of a portion of the company’s 2016 Senior Secured Term Loan, of which there was no comparable amount for the second quarter of 2018.

Provision for Income Taxes

The effective income tax rate for the second quarter of 2018 is approximately 3.6 percent, which resulted in a $2.8 million income tax benefit, as compared to an effective income tax rate of 35.6 percent in the prior year quarter, which resulted in a $5.5 million income tax benefit. The decrease in the effective tax rate for the second quarter is primarily as a result of the benefit associated with the impairment charge of trademark and goodwill which was significantly reduced due to a valuation allowance against the asset. This valuation allowance charge had the effect of reducing the benefit on the loss, which reduces the effective tax rate in the current quarter. Excluding any mark-to-market adjustments from the company’s 5.75 percent Convertible Notes, Iconix expects the full year 2018 tax rate to be approximately (8) percent and approximately 28 percent on a GAAP basis and non-GAAP basis, respectively.

GAAP Net Income and GAAP Diluted EPS

GAAP net loss from continuing operations attributable to Iconix for the second quarter of 2018 reflects a loss of $79.4 million as compared to a loss of $13.9 million for the second quarter of 2017. GAAP diluted EPS from continuing operations for the second quarter of 2018 reflects loss of $1.26 as compared to loss of $0.26 for the second quarter of 2017.

GAAP net loss from continuing operations attributable to Iconix for the six months ended June 30, 2018 reflects loss of $51.7 million as compared to loss of $9.1 million in the six months ended June 30, 2017. GAAP diluted EPS from continuing operations for the six months ended June 30, 2018 reflects loss of $0.91 as compared to loss of $0.19 for the six months ended June 30, 2017.

Non-GAAP Net Income and Non-GAAP Diluted EPS

Non-GAAP net income from continuing operations for the second quarter of 2018 was $7.7 million as compared to $15.2 million for the second quarter of 2017. Non-GAAP diluted EPS from continuing operations for the second quarter of 2018 was $0.12 as compared to $0.26 for the second quarter of 2017.

Non-GAAP net income from continuing operations for the six months ended June 30, 2018 was $13.8 million as compared to $27.9 million for the six months ended June 30, 2017. Non-GAAP net income from continuing operations for the six months ended June 30, 2018 was $0.22 as compared to $0.48 for the six months ended June 30, 2017.

Free Cash Flow

The company generated $14.5 million of free cash flow in the second quarter of 2018, a 37 percent increase as compared to $10.6 million in the second quarter of 2017.

The company generated $31.4 million of free cash flow in the six months ended June 30, 2018, a 33 percent increase as compared to $23.6 million in the six months ended June 30, 2017.

Iconix Brand Group’s brands include: Candie’s, Bongo, Joe Boxer, Rampage, Mudd, Mossimo, London Fog, Ocean Pacific, Danskin, Rocawear, Cannon, Royal Velvet, Fieldcrest, Charisma, Starter, Waverly, Zoo York, Umbro, Lee Cooper, Ecko Unltd., Marc Ecko, Artful Dodger and Hydraulic. In addition, Iconix owns interests In The Material Girl, Ed Hardy, Truth Or Dare, Modern Amusement, Buffalo and Pony brands.