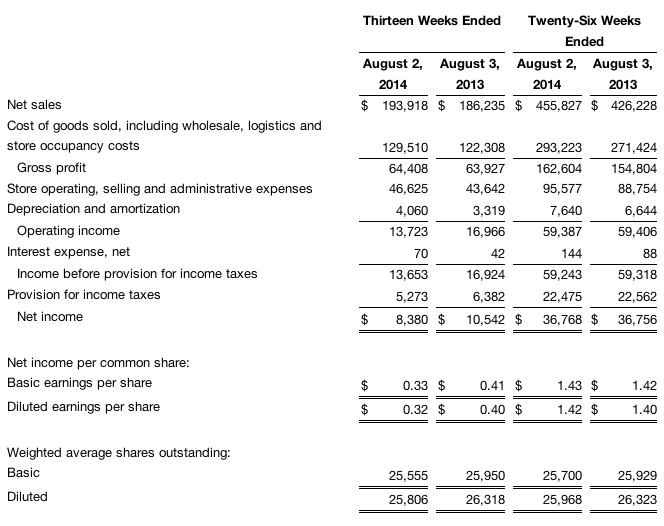

Hibbett Sports, Inc. reported net income slid 20 percent to $8.4

million, or 32 cents a share, compared with $10.5 million, or 40 cents, a year ago. The company had previously projected earnings would range between 30 cents and 32 cents a share. Comparable store sales increased 0.1 percent.

Net sales for the 13-week period ended August 2, 2014, increased 4.1 percent to $193.9 million compared with $186.2 million for the 13-week period ended August 3, 2013.

Gross profit was 33.2 percent of net sales for the 13-week period ended August 2, 2014, compared with 34.3 percent for the 13-week period ended August 3, 2013. The decline was partially due to markdowns related to slow selling and aged inventory. Gross profit was also impacted by store occupancy and logistics costs, as these expenses increased as a percentage of net sales due to lower than anticipated comparable store sales.

Store operating, selling and administrative expenses were 24.0 percent of net sales for the 13-week period ended August 2, 2014, compared with 23.4 percent of net sales for the 13-week period ended August 3, 2013. These expenses were in line with our original expectations, but were higher as a percentage of net sales mainly due to lower-than-anticipated comparable store sales.

Fiscal Year to Date Results

Net sales for the 26-week period ended August 2, 2014, increased 6.9 percent to $455.8 million compared with $426.2 million for the 26-week period ended August 3, 2013. Comparable store sales increased 2.4 percent.

Gross profit was 35.7 percent of net sales for the 26-week period ended August 2, 2014, compared with 36.3 percent for the 26-week period ended August 3, 2013.

Store operating, selling and administrative expenses were 21.0 percent of net sales for the 26-week period ended August 2, 2014, compared with 20.8 percent of net sales for the 26-week period ended August 3, 2013.

Net income for the 26-week period ended August 2, 2014 and August 3, 2013, was $36.8 million. Earnings per diluted share increased to $1.42 for the 26-week period ended August 2, 2014, compared with $1.40 for the 26-week period ended August 3, 2013.

Jeff Rosenthal, President and Chief Executive Officer, stated, “Comparable store sales were softer than expected for the quarter, but we are encouraged by the improvement in traffic in early August. In addition, we are on pace to achieve our goal of 75 to 80 new stores this year, and continue to be pleased with new store performance. Our new wholesale and logistics facility continues to show significant productivity gains, and we look forward to the benefits this facility will provide. This, along with our other major initiatives, gives us confidence that we are positioned well for future success.”

For the quarter, Hibbett opened 16 new stores, expanded 1 high performing store and closed 5 underperforming stores, bringing the store base to 950 in 31 states as of August 2, 2014. Estimated square footage for the store base increased 6.4 percent to approximately 5.5 million square feet at August 2, 2014, compared with 5.1 million square feet at August 3, 2013.

Liquidity and Stock Repurchases

Hibbett ended the second quarter of Fiscal 2015 with $81.4 million of available cash and cash equivalents on the unaudited consolidated balance sheet, no bank debt outstanding and full availability under its $80.0 million unsecured credit facilities.

During the second quarter, the company repurchased 423,263 shares of common stock for a total expenditure of $22.5 million. Approximately $196.4 million of the total authorization remained for future stock repurchases as of August 2, 2014.

Fiscal 2015 Outlook

As previously announced in the recent business update, the company now anticipates that earnings per diluted share will be in the range of $2.63 to $2.73 for the 52 weeks ending January 31, 2015, with comparable store sales increasing in the low single-digit range for the year.