With a big assist from the sizzling basketball footwear category, Foot Locker Inc. reported second-quarter earnings that handily exceeded Wall Street estimates, helping push the company’s shares past an all-time high. Besides benefiting from its position as the mega-basketball footwear specialist, the company continued to see a vibrant performance from its online operations, running footwear and kids. Also encouraging was signs of an uptick in its women’s business. Marketing outreach, improved markdown rates, strong inventory disciplines and better associate productivity were also credited.

With a big assist from the sizzling basketball footwear category, Foot Locker Inc. reported second-quarter earnings that handily exceeded Wall Street estimates, helping push the company’s shares past an all-time high. Besides benefiting from its position as the mega-basketball footwear specialist, the company continued to see a vibrant performance from its online operations, running footwear and kids. Also encouraging was signs of an uptick in its women’s business. Marketing outreach, improved markdown rates, strong inventory disciplines and better associate productivity were also credited.

“We've achieved 18 consecutive quarters of meaningful sales and profit growth, and the team continues to set records in the key financial and operating metrics we track,” said Ken Hicks, chairman and CEO, on a conference call with analysts.

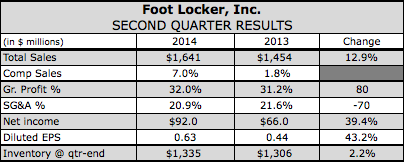

Earnings rose 39.4 percent to $92 million, or 63 cents a share. On an adjusted basis, earnings came in at 64 cents, up from 46 cents a year ago. Results easily beat Wall Street's consensus estimate of 54 cents.

On Friday, shares rose $1.55, or 2.95 percent, after the report’s release to $54.12, reaching an all-time high. For 2014, shares are ahead 32.5 percent through Friday’s close.

Revenues in the quarter jumped 12.9 percent, to $1.64 billion. Excluding the effect of foreign currency fluctuations, total sales increased 11.7 percent. The top-line benefited from a full-quarter’s inclusion of sales of Runners Point Group, with the year-ago period including only one month’s results from the German running chain.

Comps in the quarter climbed 7.0 percent. Comps increased high-single digits in May, mid-single digits in June, and strong mid-single digits in July. So far in August, Foot Locker was seeing gains in the high-single digits with a strong BTS start.

“Our quarterly comparable sales gain of 7 percent is a clear indication that the momentum we have felt in our business in recent years has continued so far into 2014,” said Lauren Peters, EVP and CFO, on the call.

By segment, athletic store sales were up 6.1 percent, while sales in its direct-to-customer segment jumped 14.9 percent.

Within its store divisions, low double-digit comparable sales gains were scored in both its US Foot Locker and Kids Foot Locker chains. Lady Foot Locker rebounded with a gain in the high mid-single digits. Its International division and Footaction were each up mid-single digits. Foot Locker Europe posted a comp sales gain in all 19 countries in which it operates. The Runners Point and its sister Sidestep banners both posted strong mid-single-digit comparable gains.

Foot Locker Canada's mid-single-digit gain represented a rebound from a decline seen in the first quarter due to the extended winter weather. Although its smallest division by store count, Foot Locker Asia Pacific team “has done a terrific job driving both top-line results and their bottom-line productivity, which is now among the highest in our company,” Peters said.

Champs Sports was the only division to show a decline, down by less than 1 percent. Noted Peters, “The biggest challenge at Champs was in apparel and accessories, which is a bigger percentage of their business than it is in our other divisions.”

Within its direct-to-customer segment, the US store banner.com continued its momentum with sales increasing at close to a 40 percent clip. Eastbay was up low-single digits in the quarter, while CCS was down low-single digits. The transition of its skate business from the CCS banner to Eastbay is expected to be complete by this fall.

Gross margin rate in the quarter increased to 32.0 percent from 31.2 percent a year ago. The gain was driven primarily by operating leverage on its relatively fixed occupancy and buying costs. Said Peters, “We improved our markdown rates in the quarter to offset ongoing pressure from lower initial market rates, and lower shipping and handling income, leaving our merchandise margin flat to last year.”

The SG&A expense rate was reduced to 20.9 percent of sales from 21.6 percent last year. Some of the improvement from last year's second-quarter rate was due to better store associate productivity through enhanced training, as well as the utilization of hiring and scheduling tools implemented in the last several quarters.

Inventories were up just 2 percent compared to double-digit top-line gain.

By categories, footwear delivered a comp increase in the high-single digits while apparel and accessories were down mid-single digits.

Basketball led footwear with a gain in the teens. Said Dick Johnson, EVP and COO, “We had good strength in our running business as well, which was also up in the teens with very strong double-digit growth internationally where running is our biggest category, and mid-single-digit growth in the US.”

In basketball, Jordan again continued to be the strongest area.

“Jordan was strong across all its components,” said Johnson. “The Jordan player shoes, including CP and Melo, had solid sell-throughs, as did some of the classic off-court styles such as the True Flight and the Flight Future; and of course, the Jordan Retro releases continued to drive sales and traffic into our stores.”

Marque player shoes were ”another bright spot” in basketball, with gains in LeBron, Kobe and KD.

“While traditional mid- and high-top silhouettes were strong, some of the strength in basketball also relates to the proliferation of low-cut styles within all of those player franchises,” added Johnson. “These shoes are categorized as basketball, although a year ago the same customer may have been buying a running shoe, since he's not necessarily buying the shoes to play basketball or run in. It's also about the look.”

Max Air from Nike with models such as the Max 90, the Thea for women, and Fingertrap Max drove the running footwear category across banners and geographies. The Roshe Runs “has also become a global success, producing significant gains in dollars and units.”

“The ZX Flux from Adidas was certainly a popular choice in running, especially in Europe, but also in the US, where we expect it to continue to build,” said Johnson. “We're also seeing gains out of New Balance, particularly in the 574 program. Within lifestyle footwear, the Air Force 1 franchise continues to perform well, as do classic styles from Puma and Vans.”

In apparel, its US soccer division, which includes Foot Locker, Kids Foot Locker, Lady Foot Locker, and Footaction, generated a comp gain in the mid-single digits. The improvement was led by branded tank tops, T-shirts, shorts, and hats that coordinated with footwear. Socks continued to sell well, especially Nike multi-packs, Stamps and NBA socks, which are offsetting a slowdown in Elite socks.

On the downside, apparel saw a double-digit decline in Foot Locker Europe and mid-single digit drop at Champs Sports.

“Both divisions were impacted by a fashion shift away from certain programs that had helped drive their results in the past, and both divisions are working diligently to adjust their apparel assortments,” said Johnson.

Foot Locker Europe overall benefited from a strong double-digit footwear gain in the quarter. Champs also had “strong” footwear sales in the quarter and overall, “remains a very productive chain and a strong profit producer for our company.”

Johnson said Champs was one of the first to benefit from efforts to differentiate banners, delivering several quarters of double-digit comp gains as a result. With additional remodels, which are outperforming the balance of the chain, enhanced vendor partnerships as well as select assortment and presentation changes, “we believe that we have the capability for Champs Sports to get back to being a strong contributor to our comp growth, and increase its profits to even higher levels,” he added.

Touching on efforts to turnaround women’s overall, Johnson said Lady Foot Locker delivered a high mid-single digit gain, including its nine 602 doors. Women's was up in most of the banners that sell women's products. At the Lady Foot Locker division itself, footwear was up mid-single digits, while apparel was up in the teens.

“In short, the customers are finding us,” said Johnson. “They like the new performance-oriented assortments we offer in both 602 and most Lady Foot Locker stores, and we're clearly on the right track. We're encouraged enough by our test results so far, and the comp trends, to expand our tests and remodels to drive the turnaround in this business. However, we still need a bit more time to finalize the model before we commit to a large-scale rollout plan. We'll be sure to keep you updated as our plans solidify over the coming months.”

Hicks described the comp gain seen in women’s as “a beautiful thing, and was especially gratifying for the team that's been working so hard to make our women's business the success we believe it will be. However, we're still in the nurture and development stage, and the team is doing a great job. I give them all the credit in the world.”

We performed even better than that in Q2, and we're off to a solid top-line start to back-to-school with a high single-digit comparable sales gain so far in August. However, I have mentioned a few timing factors such as the final liquidation of CCS merchandise this fall, marketing expenses that shifted into Q3, and additional store closing expenses, which will yield more leverage opportunity in the fourth quarter than the third.

In summing up Foot Locker’s overall continued momentum, Hicks credited a laundry list of successes, including double-digit growth in its online operations and kids overall, as well as strong vendor relationships that have led to successful in-store shop concepts and a “very significant portion of exclusive product in our assortments.”

Hicks said the company’s geographic reach allows it to “to spot, capitalize on, and even develop trends around the world” while its multiple banners have enabled it to reach a broader range of customers through differentiation efforts. “Creative marketing” that adds “fun and humor” to its banners as well as its strong capital structure that allows it to reinvest in its operations was also credited.

On apparel, Hicks said it’s “taking longer to gain consistent traction” as expected but Foot Locker expects to benefit from efforts to enhance store environments and extensive remodeling investments. Said Hicks, “We plan to capitalize on the exciting store environments we're creating through our extensive remodel initiatives. For example, we're working closely with Nike on Jordan and women's apparel, and closely with Under Armour as we're exploring opportunities to bolster both of our businesses.”

Other efforts in apparel include emphasizing private brands such as Sneaker Freak, Champs Sports Gear and Actra and expanding underpenetrated areas such as women’s and kids. Foot Locker still has a goal of returning close to 30 percent, a level it reached a decade ago.

Almost 100 stores were remodeled in the second quarter, double the number in the first quarter, and they continue overall to exceed expectations. The company is on pace to remodel 20 percent of the Foot Locker stores in the US, and close to 30 percent of the Champs stores by year end. Footaction remodels continue to be tested along with 602 and Lady Foot Locker.

Hicks said the remodels – along with its strong marketing push and “great pipeline” of product – has helped Foot Locker buck the trend of declining traffic noted by many other retailers in their quarterly reports. Said Hicks, “Most of our banners, in fact, have experienced increased traffic, this year to last.

In footwear, both units and average selling prices were up in the second quarter. We're working hard to be able to say the same thing about apparel in the future.”

For the full year, Foot Locker continues to expect a mid-single-digit comp gains; 20 to 40 basis points of leverage gains in gross margin; 30 to 50 basis points of SG&A rate improvement; and a double-digit increase in EPS.