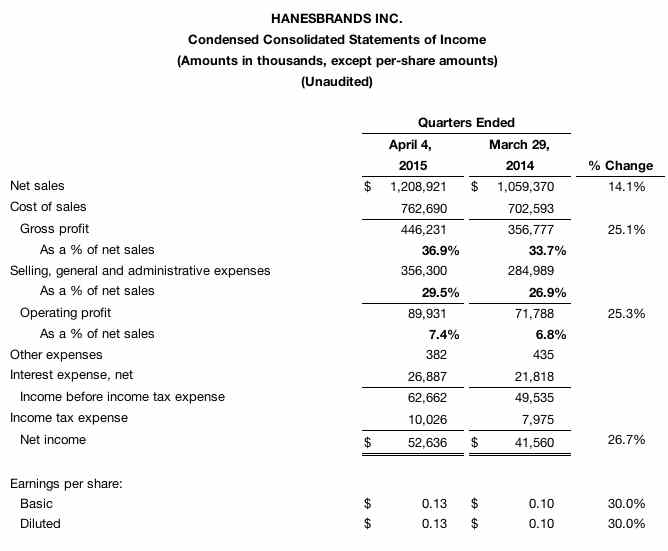

HanesBrands reported sales increased 14 percent to $1.2 billion in the quarter ended

April 4, while adjusted operating profit excluding actions

increased 16 percent to $133 million and adjusted EPS excluding actions

increased 16 percent to 22 cents a share.

The record results reflect the benefits of the company’s multiyear acquisition strategy and continued improvement in base business operating margin.

On a GAAP basis, operating profit increased 25 percent to $90 million and EPS increased 30 percent to $0.13. (Unless noted, all consolidated measures and comparisons in this news release are adjusted to exclude approximately $43 million of pretax charges in both the first-quarter 2015 and 2014 related to acquisitions and other actions. See GAAP reconciliation section below for additional details.)

“We are off to a great start in 2015, once again delivering a double-digit increase in EPS, while tracking to our full-year growth plans,” Hanes Chairman and Chief Executive Officer Richard A. Noll said. “Our acquisition strategy continues to create value with DBApparel, Maidenform and Gear for Sports all contributing substantially to our double-digit growth. In addition, we are raising our 2015 performance outlook to reflect the recent acquisition of Knights Apparel.”

Since the end of the first quarter, Hanes closed on the acquisition of Knights Apparel, a leading seller of licensed collegiate logo apparel in the mass retail channel. Hanes has increased its full-year 2015 guidance to reflect the expected contributions from Knights Apparel and has updated its expectations for currency exchange rates for the rest of the year.

For 2015, Hanes now expects net sales of approximately $5.9 billion to $5.95 billion; adjusted operating profit of $853 million to $873 million; and adjusted EPS of $1.61 to $1.66. The new guidance represents an increase over 2014 results of 10.9 percent to 11.8 percent for net sales, 12 percent to 14 percent for adjusted operating profit, and 13 percent to 17 percent for adjusted EPS.

First-Quarter 2015 Financial Highlights and Business Segment Summary

Key accomplishments for the first quarter of 2015 include:

- Sales Growth Driven by DBApparel Acquisition. DBApparel, a leading marketer of intimate apparel and underwear in Europe that was acquired Aug. 29, 2014, contributed net sales of $184 million (€164 million) in the first quarter.

- Significant Operating Profit and Margin Growth. The company’s adjusted operating profit margin increased 20 basis points in the first quarter. Core adjusted operating margin increased 90 basis points but was partially diluted as expected by the acquisition of DBApparel. The company continues to derive significant benefits from the previous acquisitions of Gear for Sports and Maidenform.

Key segment highlights include:

Innerwear net sales decreased 4 percent in the first quarter, while adjusted operating profit increased 13 percent primarily as a result of strong Maidenform cost synergies. The result was a 310-basis-point improvement in segment operating margin compared with the year-ago quarter. The decline in net sales was due to a retailer’s inventory reduction of approximately two weeks of supply, which has already begun to reverse in early April.

Activewear net sales increased 1 percent in the first quarter, while adjusted operating profit decreased 3 percent. Results were affected by the timing of Champion retail space gains for 2015, many of which will occur in the second quarter.

Despite currency headwinds and Target’s exit from Canada, International sales and operating profit increased significantly, with strong contributions from DBApparel, Japan and Latin America.

The DBApparel integration planning has progressed on schedule. Presentations to the appropriate works councils and unions in Europe have begun. The company expects to begin implementing the integration plan, pending negotiations, in the fourth quarter.

2015 Financial Guidance

Overall, first-quarter results were consistent with the company’s expectations. Hanes has increased its full-year 2015 growth expectations and financial guidance to reflect the expected contributions of the Knights Apparel acquisition and reflect updated assumptions for currency exchange rates for the remainder of the year. The updated assumptions for currency will adversely affect expected net sales but will not have a material effect on operating profit.

For 2015, Hanes expects net sales of approximately $5.9 billion to $5.95 billion, up from previous guidance of $5.775 billion to $5.825 billion. The company expects approximately $160 million in added sales from Knights Apparel, while the further deterioration since January in currency-exchange-rate expectations will reduce previous sales guidance by approximately $35 million.

Adjusted operating profit is expected to be $853 million to $873 million, up from the previous range of $835 million to $855 million. The guidance reflects a contribution of approximately $18 million in adjusted operating profit from Knights Apparel. Guidance for operating profit is unaffected by updated currency expectations as a result of the company’s prior decision to hedge transaction currency impacts.

Guidance for adjusted EPS excluding actions has increased to a range of $1.61 to $1.66, up from previous guidance of $1.58 to $1.63 as a result of a $0.03 expected contribution from Knights Apparel.

The company continues to expect net cash from operating activities to total $550 million and $600 million in 2015. Interest expense and other expense are expected to be approximately $95 million to $100 million combined, up $5 million from previous guidance as a result of additional debt to finance the Knights Apparel acquisition. The 2015 full-year tax rate is expected to be approximately 13 percent, similar to 2014. The tax rate is expected to vary by quarter with the rate being higher in the first half of the year.

The company has made a 2015 pension contribution of $100 million, and capital expenditures are expected to be approximately $80 million to $85 million. The company expects approximately 410 million weighted average fully diluted shares outstanding in 2015.

Charges for Actions and Reconciliation to GAAP Measures

In the first quarter of 2015, Hanes incurred approximately $43 million in pretax charges related to acquisitions, primarily DBApparel, and other actions, while in the first quarter of 2014, the company incurred approximately $43 million in pretax charges related to acquisitions, primarily Maidenform, and other actions. See Table 5 attached to this press release for more details on pretax charges for actions.

Adjusted EPS, adjusted net income, adjusted operating profit (and margin), adjusted SG&A, adjusted gross profit (and margin) and EBITDA are not generally accepted accounting principle measures. Adjusted EPS is defined as diluted EPS excluding actions and the tax effect on actions. Adjusted net income is defined as net income excluding actions. Adjusted operating profit is defined as operating profit excluding actions. Adjusted gross profit is defined as gross profit excluding actions. Adjusted SG&A is defined as selling, general and administrative expenses excluding actions. EBITDA is defined as earnings before interest, taxes, depreciation and amortization..

For 2015 guidance, adjusted EPS is defined as diluted EPS excluding actions and the tax effect on actions, and adjusted operating profit is defined as operating profit excluding actions. Hanes’ current estimate for pretax charges in 2015 for acquisition, integration and other actions is approximately $200 million or more, but actual charges could vary significantly. The company believes guidance for adjusted EPS and adjusted operating profit provides investors with an additional means of analyzing the company’s performance absent the effect of acquisition-related expenses and other actions.

On a GAAP basis, full-year 2015 diluted EPS will vary depending on actual performance, charges and tax rate. GAAP diluted EPS could be in the range of $1.17 to $1.23. GAAP operating profit for 2015 could be in the range of $653 million to $673 million.

The company's brands include: anes, Champion, Playtex, DIM, Bali, Maidenform, Flexees, JMS/Just My Size, Wonderbra, Nur Die/Nur Der, Lovable and Gear for Sports.