SGB Executive Sportsmans

Canada Goose Q4 Benefits From DTC Expansion

DTC revenues nearly tripled in the quarter to Canadian$36.5 million (U.S.$27 mm) and drove an improvement of 950 basis points in gross margin.

Boot Barn Facing Headwinds From Oil-Dependent States

Boot Barn said same-store sales have improved in the first two months of the current quarter in states impacted by oil and other commodities. The company also announced the acquisition of the Country Outfitters e-commerce site.

Aisle Talk, Week Of May 29

Top headlines from the active lifestyle industry you may have missed this week.

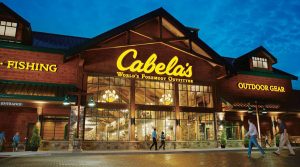

Cabela’s Details Bass Pro Merger Process

Cabela’s Inc. was quietly considering selling the company in early 2015, months before activist investor, Elliott Management, pushed the retailer to explore strategic alternatives, including a sale. That’s according to recently-filed documents by Cabela’s with the Securities & Exchange Commission that details the background that led to Bass Pro’s blockbuster deal to merge with Cabela’s. […]

Aisle Talk, Week Of May 15

Top headlines from the active lifestyle industry you may have missed this week.

Dick’s To Rein In Expansion After Rocky Q1

Said Ed Stack, chairman and CEO, “In 2017 we expect to open approximately 43 Dick’s stores, of which 19 are former TSA stores. In 2018 we expect to open between 15 to 20 stores – most of these leases are already signed. And in 2019 it can be as few as 5 to 10.”

Remington Sees More Than Post-Election Hangover In Firearms Slowdown

Beyond the “lower expectations of potential legislation,” Remington sees the slowdown, particularly in MSRs, reflecting increased competitive pressures from reduced consumer demand and excess inventories, increased manufacturing capacity, low barriers to entry in the MSR segment, lack of differentiation and “true value” in the segment, and higher imports.

Vista Outdoor Sees Firearms Sales Normalizing Mid-Year

Said CEO Mark DeYoung on a conference call, “We anticipate channel inventories will stabilize by mid FY’18 and we are determined to improve the performance in the second half of this fiscal year.”

Aisle Talk, Week Of May 8

Top headlines from the active lifestyle industry you may have missed this week.

Sport Chek Stung By Weather Woes In Q1

Winter jackets and winter boots categories declined due to the arrival of warm weather in January but athletic, hockey, accessories, licensing and ski/snowboard all showed gains.

Under Armour Off To Stellar Start At Kohl’s

Under Armour exceeded “a very aggressive launch” sales plan at Kohl’s with strong results across all categories, including men’s, women’s and children’s apparel, as well as footwear, said Kevin Mansell, the retailer’s CEO.

Sturm, Ruger Sees Sales Through Independent’s Slide

The firearms giant said it encountered lower overall retailer demand as some retailers committed inventory dollars to certain product categories such as modern sporting rifles in the third and fourth quarters of 2016 in advance of the November elections.

Wolverine’s Shares Climb On Upbeat Q1 Results

Among its major brands, Merrell grew low single-digits, Sperry was down low-double digits and Saucony was off mid-single digits.

Camping World Owner Vows To Revive Gander Mountain

Marcus Lemonis, chairman and CEO of Camping World, has pledged to bring back at least 70 Gander Mountain locations. He expects the chain will greatly benefit from lease renegotiations, a merchandise overhaul and localizing assortments by market.

Aisle Talk, Week Of May 1

Top headlines from the active lifestyle industry you may have missed this week.