Rapala VMC Corp. reported that its 2023 operating environment remained tough due to the global economic slowdown and high inflation.

The Finland-based fishing equipment and Nordic ski manufacturer and distributor said in its year-end report that the slowdown caused retailers to focus on managing their inventories and left unpredictability in their ordering patterns. Rapala said de-stocking continued through 2023 but started to ease in the latter part.

Consumer spending remained tight due to high inflation and impacted higher ticket item sales. Sports fishing also competed with other recreational activities, which the pandemic had restricted.

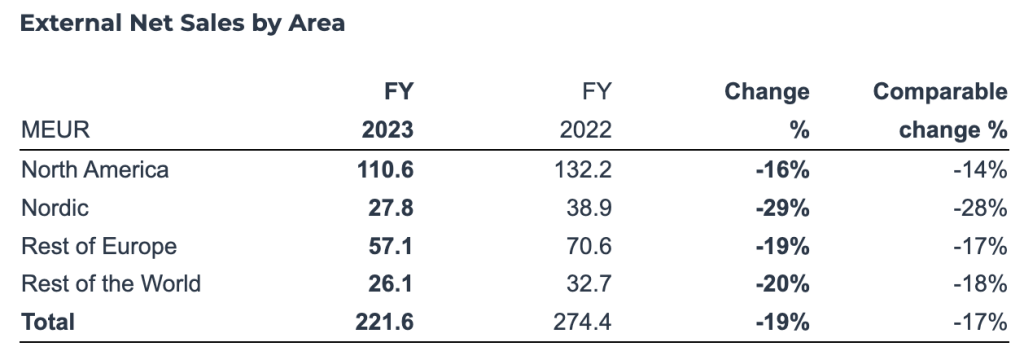

The company’s net sales for full-year 2023 declined 19 percent year-over-year (YoY) to €221.6 million, compared to €274.4 million. Changes in translation exchange rates had a slight negative impact on sales. With comparable translation exchange (CTX) rates, net sales were down by 17 percent versus 2022.

Company President and CEO Lars Ollberg said, “The year 2023 started with difficult trading conditions as de-stocking continued in the market. We focused on executing our €6 million cost-savings program and witnessed positive development in the second half of the year, both in our operations and the trading environment. As a result, our profitability improved in the second half of the year, and our inventories decreased from the end of June by €11.0 million to €87.5 million. This is €30.2 million lower than we had just 18 months ago. We place a special focus on strong cash flow generation and accelerate inventory turnover with our ‘One More Turn’ strategy. The One More Turn strategy offers us flexibility to react quickly to market changes while optimizing the financial performance of our business.

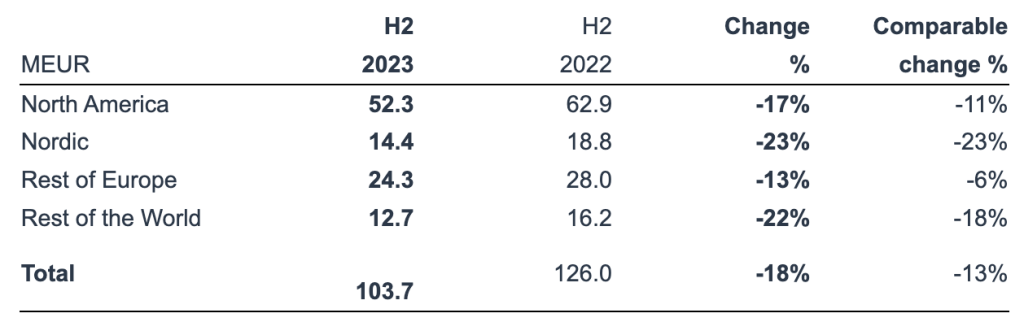

North America

Sales in North America decreased 16 percent (-14 percent CTX) YoY to €XXX in 2023. The majority of the decline was said to be due to sales of Third Party Products following a strategic decision in December 2022 to outsource the supply chain function of 13 Fishing products sold to DQC International (13 Fishing USA). Another negative impact reportedly relates to the ice fishing category in which poor ice conditions in 2022/23 season impacted retail sell-through and replenishment sales. This also reportedly had an impact on pre-season shipments for 2023/24 season.

Excluding these factors, sales increased by ten percent with CTX rates. Growth came from resilient consumer demand for core products such as lures, fishing lines and accessories. The acquisition of DQC International in July 2023 had a positive impact on the consolidated sales even though the rod and reel segment in general remained tough.

Post-COVID excess inventory generated by the unforeseen market slowdown is now gradually deflating and releasing the flow of new products to retailers. The North American economic outlook is still somewhat cautious; however, consumer discretionary spending is said to be steadier with a bigger appetite for consumer goods rather than bigger ticket durable items. Open-water consumable products witnessed a 10 percent increase in sales while the ice fishing business in North America experienced its second year of poor ice conditions impacting sales.

Nordic

Full-year 2023 sales in the Nordic market decreased 29 percent (-28 percent CTX) from the comparison period. Retail de-stocking reportedly continued for much of the year but started normalizing towards the end of the year. Rapala said high retail inventories and high inflation hit the sales of summer fishing items and continued to limit replenishment sales in the latter part of the season.

Poor retail sell-through in the ski business, after record-high deliveries in the second half of 2022, reportedly had a significant negative impact on replenishment sales in the early part of 2023. This also had an impact on pre-season deliveries in the 2023 second half. Favorable weather conditions at the end of the year reportedly helped to gain back some of the lost pre-season sales.

Discontinuation of third-party distributorships reduced the sales of this segment by approximately €1 million.

Rest of Europe

Full-year sales in the Rest of Europe market decreased 19 percent (-17 percent CTX) year-over-year. As in Nordic, Rapala said the de-stocking at the retail level continued for much of the year but started showing signs of normalization towards the end of the year. In the Group Products segment, sales of hooks were down as they were supplied to other manufacturers at the beginning of the normalizing value chain. Okuma sales reportedly decreased due to retailers remaining cautious with allocating purchases towards high-ticket items and relying more on supplier inventories.

The largest decline in sales came from discontinued third-party distributorships which accounted for €4 million of the year-over-year decline.

In Europe, consumer discretionary spending remains is said to remain cautious, and retailers are shifting more to in-season purchases and lower pre-sales commitments, relying more on supplier inventories. Winter season in Northern Europe benefited from relatively good weather conditions allowing to release of inventories both at retail and wholesale. The company’s sales network in Europe is extensive for the industry. Overall, the European distribution operations are said to be engaged in improving profitability and efficiency, and the focus is to further streamline and integrate the two major logistics hubs for North and South Europe.

Rest of the World

With reported translation exchange rates, full-year sales in the Rest of the World market decreased 20 percent (-18 percent CTX) year-over-year. Consumers remained cautious throughout the year and discretionary spending reportedly remained low. Rapala said the sales decline came evenly from all product categories. As a highlight of the area, Australia and Brazil reportedly came out strong. China and neighboring markets reportedly witnessed increased competition from local brands as Chinese fishing tackle manufacturers searched for ways to utilize unused capacity.

In Rest of the World segment, the Australian market reportedly continues to grow but other large APAC markets in Japan, Korea and China are not expected to pick up before the second half of 2024. The company is confident its APAC markets will improve their performance in 2024 with local accountability and strong entrepreneurial spirit.

Segment Review

Group Products

With comparable translation exchange rates, Group Products sales decreased €14.7 million, or 9 percent (-7 percent CTX), to €208.1 million, compared to €228.4 million in the prior year. Slow sales in H1 were said to be a result of macroeconomic headwinds resulting in consumer cautiousness and wide de-stocking among retailers. The drop in sales was evident across most categories. As the de-stocking started easing halfway through 2023, most open water categories evidenced growing demand in the latter part of the year. On a positive note, sales of consumable type products such as lures, fishing lines and baits reached prior year sales level.

Ice fishing and winter sports sales remained tough throughout the year. Poor retail sell-through in 2022/23 season was caused by adverse weather conditions and consumer cautiousness. This impacted replenishment sales in the beginning of the year and had a knock-on impact on pre-season deliveries in the latter part of the year. Favorable winter weather in Finland helped to gain some of the lost sales at the end of the year.

Third-Party Products

With comparable translation exchange rates, Third Party Products sales were €30.7 million below the 2022 comparison period. Rapala said €13 million of the decline was explained by the outsourcing of the supply chain function of 13 Fishing products. Before outsourcing, the supply of 13 Fishing products to the associated company DQC International was recorded as sales. The rest of the sales drop comes from the terminations of third-party distributorships and from a decline in winter business sales as highlighted under Chapter Group Products.

Financial Results and Profitability

Comparable operating profit decreased by €9.7 million YoY. Reported operating profit decreased €8.3 million from the prior year and the items affecting comparability had a negative impact of €1.6 million on reported operating profit. Operating profit was €4.0 million in 2023 compared to €12.3 million in 2022. The comparable operating profit was €5.6 million for the year, compared to €15.3 million in the prior year.

Comparable results exclude market-to-market valuations of operative currency derivatives and other items affecting comparability.

Comparable operating profit margin was 2.5 percent for 2023, compared to 5.6 percent in the prior year. The decreased profitability compared to the previous year was said to be driven by lower sales, both in the open water market and in the winter businesses. The production transfer from Vääksy and Sortavala to Pärnu reportedly increased costs temporarily and this is expected to normalize in 2024. The €6 million savings program is reportedly being implemented according to plan and full impact is expected to be realized in 2024, although part of the benefit is expected to be offset by inflationary cost increases.

Reported operating profit margin was 1.8 percent for the year, compared to 4.5 percent in the prior year. Reported operating profit included an impact of the mark-to-market valuation of operative currency derivatives of negative €0.2 million. Rapala said net expenses of other items affecting comparability included in the reported operating profit were negative €1.9 million, compared to negative €3.2 million in the prior year. These expenses reportedly come from the restructuring of the company’s Helsinki headquarters and expenses from the integration of DQC International (13 Fishing) fully to the existing U.S. distribution operations.

Total financial (net) expenses were €10.2 million for the year, compared to €3.5 million in 2022. Net interest and other financing expenses were 9.4 million in 2023, compared to €3.6 million in 2022, and (net) foreign exchange expenses were 0.8 million in 2023.

Net profit (loss) for 2023 decreased by €10.6 million to a loss of €6.9 million, or a loss of €0.19 per share, compared to net profit of €3.7 million, or €0.10 per share, in 2022.

Second Half Results

Net sales were €103.7 million, down 18 percent from €126.0 million in 2022. With comparable exchange (CTX) rates sales were 13 percent lower than the prior-year corresponding period.

Second half operating profit was a loss of €0.4 million, compared to a loss of €1.3 million in 2022. Comparable operating profit was €0.3 million compared to an operating loss of €0.2 million for the prior year.

Cash flow from operations was €2.0 million in Q4, compared to negative €4.4 million in Q4 2022.

Net profit (loss) for the 2023 H2 period was a net loss of €5.8 million, or a loss of €0.16 per share, compared to an operating loss of €5.0 million, or a loss of €0.13 per share.

Financial Position

Cash flow from operations increased by €33.5 million YoY to €20.6 million versus negative €12.9 million in 2022. Lower profitability and high financial costs reportedly burdened cash flow but the company said a relentless focus on cash generation and driving down inventory levels resulted in a positive result. During the year, €9.9 million was released from working capital, while in 2022 €28.7 million was tied to working capital.

End of the year inventory in 2023 was €87.5 million, compared to €99.9 million at 2022 year-end. The change in obsolescence allowance decreased inventory value by 0.7 million, and changes in translation exchange rates decreased inventory value by €2.2 million. The acquisition of DQC International increased inventory by some €3 million. Resolving retail level de-stocking and manufacturing capacity adjustments started to show results in the second half of the year and inventory decreased by €11.0 million from June to December.

Net cash used in investing activities decreased from the comparison period amounting to €9.5 million (€10.7). Capital expenditure was €9.5 million (€11.5) and disposals €1.4 million (€0.8). A significant part of the expenses relates to the production transfers from Russia and Finland to the Rapala VMC campus in Pärnu, Estonia. Prior year capital expenditure includes expenses related to the Russian production transfer to Estonia.

The liquidity position of the Group was good. Undrawn committed long-term credit facilities amounted to €35.0 million at the end of the year. The gearing ratio decreased and the equity-to-assets ratio increased from last year following the issuance of a €30 million hybrid capital bond. See section “Issuance of Hybrid Bond” for more details.

In September 2023, the Group and the lending banks agreed to waive the quarterly Q3 financial covenant testing until the terms of the upcoming refinancing have been agreed upon. The Q3 covenant testing eventually became void as the new syndicated refinancing agreement was signed on November 29. At year-end, the leverage ratio covenant landed at 4.92 (limit 6.00) and net debt landed at €81.6 million (limit €95 million). The Group is currently compliant with all financial covenants and expects to comply with future bank requirements as well. The Group’s cash position remains good, and cash and cash equivalents amounted to €20.0 million at December 31, 2023.

Short-term Outlook and Risks

Trading outlook for 2024 is improving as evidenced by better operational performance in the second half of 2023. Retail inventories are reportedly finally returning to regular levels allowing a normalized flow of goods to the market. The North American economic outlook is still somewhat cautious; however, consumer discretionary spending is steadier with a bigger appetite for consumer goods rather than bigger ticket durable items. The ice fishing business in North America experienced its second year of poor ice conditions which will negatively impact presales of the season 2024/25. In Europe, consumer discretionary spending remains cautious, and retailers are shifting more to in-season purchases and lower presales commitments, relying more on supplier inventories.

In operations, 2024 will be the first full year of centralized manufacturing operations in our Pärnu facility. At the same time our European distribution operations are engaged in improving profitability and efficiency, and the focus is to further streamline and integrate the two major logistics hubs for North and South Europe. Lastly, the full integration of 13 Fishing products into our strong US sales network is expected to release synergies.

Consequently, the Group expects full-year comparable operating profit to increase from the previous year as the trading outlook for 2024 is improving after witnessing better operational performance in the second half of 2023.

Proposal for Profit Distribution

The Board of Directors proposes to the Annual General Meeting that no dividend will be paid for 2023, camped to a €0.04 dividend per share in 2022.

Rapala Group said it presents alternative performance measures to reflect the underlying business performance and to enhance comparability between financial periods. The company cautioned that alternative performance measures should not be considered in isolation as a substitute for measures of performance in accordance with IFRS.

Image courtesy Rapala