JD Sports Fashion Plc, the parent of the JD, Finish Line, DTLR, and Shoe Palace retail brands in the U.S. and JD and others worldwide, reported total revenues for the fiscal year ended February 3 were up 3.6 percent year-over-year (YoY) to £10.5 billion, including a 6.2 percent negative impact from disposals and a 1.4 percent benefit from the 53rd week.

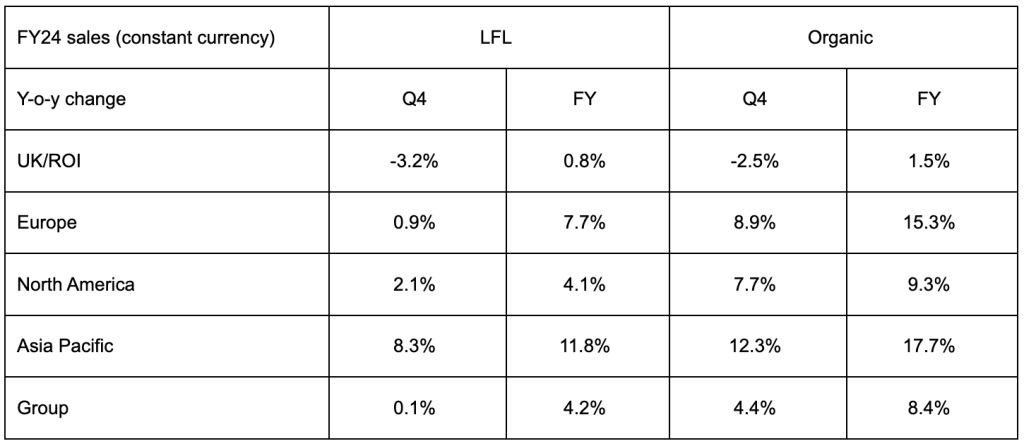

Like-for-like, or comp store sales (LFL), sales in Q4 were marginally ahead of the previous financial year on a constant-currency (CC) basis. The retailer reported January was “slightly down” YoY due to “elevated promotional activity in the market, particularly online, and against a strong comparative of c.25 percent growth” in the prior year.

For the full year, LFL sales were up 4.2 percent, and all regions were ahead of the previous year, with organic sales growth of 8.4 percent. LFL trends are determined by sales at comparable stores open for the year and sales on a 53-week basis for the year.

The group’s consolidated gross margin for the year was 47.3 percent of net sales, down 50 basis points compared to the prior year due to a higher mix of sales from Europe and North America, where the elevated promotional activity in those markets impacted margins.

Profit before tax (PBT) is expected to align with the revised guidance range of £915 million to £935 million.

The company opened 215 new JD stores in the year, and the launch of the new JD Status loyalty program in the UK has reportedly been “very encouraging to date,” with 800,000 downloads so far.

On the balance sheet, JD said it is comfortable with its year-end inventory level across the Group.

The Group ended the year with over £1 billion of net cash.

“In our FY24 financial year, we outperformed the sportswear market, reflecting the strength of our business,” commented Régis Schultz, CEO of JD Sports Fashion Plc. “We achieved like-for-like sales growth of over 4 percent, organic growth of over 8 percent, and our athleisure fascias achieved organic growth of over 10 percent. We made good strategic progress, opening 215 new JD stores, and focusing our effort on developing JD and enhancing EPS through taking full control of ISRG and MIG. We expect profit before tax for the year to be in line with the guided range given in January.

UK/ROI

Fourth quarter LFL sales were reportedly down 3.2 percent in the UK and the Republic of Ireland. JD said there were two drivers of the decline. First, the region has the highest apparel sales mix in the Group, and apparel performance was weaker than footwear; second, JD chose not to participate fully in the significant (mainly online) promotional activity within the UK in Q4. Organic sales were down 2.5 percent.

For the full year, UK/ROI LFL sales were up 0.8 percent, with organic sales growth of 1.5 percent.

Europe

In the fourth quarter, LFL sales were up 0.9 percent in Europe. Within the JD brand, stronger trading in Southern Europe, driven by Portugal and Italy, was said to be offset partially by weaker trading in Northern Europe. This, in part, was reportedly due to a higher apparel mix in the north. The impact of new store openings across Europe helped deliver Q4 organic growth of 8.9 percent.

Europe’s LFL sales were up 7.7 percent for the full year, and organic sales grew by 15.3 percent.

North America

Fourth quarter LFL sales were up 2.1 percent in North America compared to the previous year, with over 30 percent growth in what was a highly promotional market. New store openings drove organic sales growth to 7.7 percent.

North America LFL sales were up 4.1 percent for the full year, with organic sales growth of 9.3 percent.

Asia Pacific

Fourth quarter LFL sales were up 8.3 percent in Asia Pacific, with contributions from all main markets and strong growth in New Zealand and Thailand. New store openings delivered Q4 organic growth of 12.3 percent.

For the full year, Asia Pacific LFL sales were up 11.8 percent, with organic sales growth of 17.7 percent.

Accounting Policy Changes

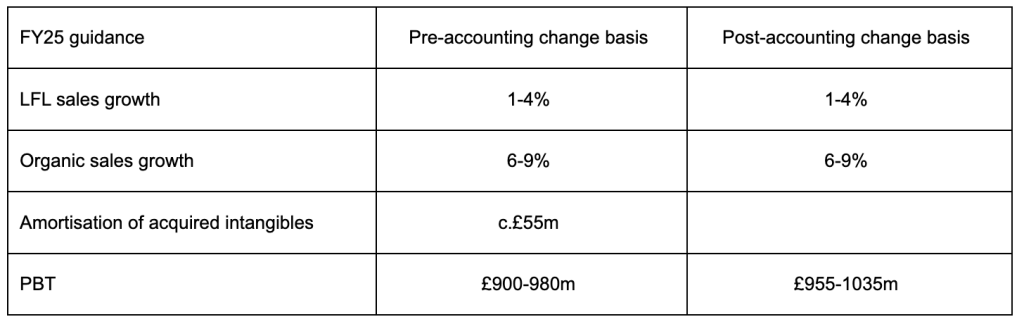

In line with most large, UK-listed retail companies, JD said it would exclude the non-cash amortization of acquired intangibles from its PBT before adjusted items. The retailer will implement the change from Fiscal 2025 and increase PBT by c.£55 million per year. To avoid doubt, JD said it has set out below its PBT guidance for Fiscal 2025 on a pre- and post-accounting change basis.

“The current trading environment remains challenging due to less product innovation and elevated promotional activity, especially online,” Schultz added. “We anticipate trading conditions will improve as we move through the year, helped by a busy sporting summer and softer comparatives with last year. We continue to invest in our people and the infrastructure needed to deliver our long-term growth plan. I am excited about the opportunities for the JD Group going forward and our ability to deliver attractive returns to shareholders.”

Fiscal 2025 Guidance

Since the start of the new financial year, trading has reportedly been in line with expectations.

“The market remains challenging due to less product innovation and elevated promotional activity in key markets, particularly online,” the company said in a release. “We anticipate trading conditions will improve as we move through the year, helped by a busy sporting summer, softer comparatives with last year from Q2, and an improving product pipeline towards the end of the year. Given this, Q1 is likely to be the softest LFL period of the year, and H2 is likely to be stronger than H1. In addition, cost inflation remains elevated, particularly labor, and we will continue to invest in our infrastructure in FY25 to deliver our long-term growth plan.”

JD Sports Fashion guidance is displayed in the table below, split into both the old P&L format, pre-accounting changes, and the new P&L format, post-accounting changes.

Key Outlook Assumptions

- Low- to mid-single-digit market growth;

- The group will outperform the market due to new store openings and the annualization of previous store openings;

- No material impact from exchange rates; and

- An approximately 2 percent impact on total sales from disposals;

- PBT was impacted by a net of approximately £30 million due to no 53rd week, the non-trading of Sprinter/MIG stores as they convert to the JD brand and incremental investment in cyber security and IT OpEx, partially offset by the benefit from no longer incurring losses at SUR

New Segmentation and Reporting Cycle from FY25

JD reported that it will introduce new segmentation commencing in Fiscal 2025. This segmentation will be used for reporting initially at its Q2 trading update in August and then in its interim results in September.

“As well as the FY24 preliminary results, which will be released towards the end of May 2024, we will include a reconciliation to the new segmentation for FY23 and FY24,” the company stated.

Image, data and charts courtesy JD Sports Fashion Plc