Wolverine Worldwide executives were able to highlight some notables for the 2023 fourth quarter and year on a conference call with analysts Wednesday, noting that the company delivered revenue and earnings in line with previous guidance while inventory and debt finished at levels better than anticipated. That said, company President and CEO Chris Hufnagel, who is just six months into his new role, feels the more important news is that the company continues to make great progress in driving Wolverine Worldwide’s turnaround and transformation.

“With a clear vision, a common sense of purpose and a collective effort of our global team, I’m proud and encouraged to say that Wolverine Worldwide is a much different company now than it was just six months ago,” he said when licking off his prepared remarks on the call.

“As we begin 2024, our portfolio is more focused than it has been in over a decade, composed of authentic leading brands, playing desirable consumer categories, and we’re confident this will continue,” he said.

As a reminder, it has been a busy year for Wolverine Worldwide, with ongoing measures to pare the brand portfolio and right-size the organization.

The Keds business was sold in February 2023, the U.S. Wolverine Leathers business was sold in August 2023, and the non-U.S. Wolverine Leathers business was divested in December 2023. The company also transitioned the Hush Puppies North America business to a licensing model in the second half of 2023. To kick off 2024, the company sold off the Sperry business in January.

“The organization is more efficient and more capable of building great global brands with new talent and key brand roles and new centers of excellence created to help enable our brands to build awesome products and tell amazing stories,” Hufnagel continued. “Our business is poised to be much more profitable with an outlook to meaningfully expand operating margin this year as a result of significant gross margin improvements and our restructuring efforts late last year.”

He said the company has the financial capacity to reinvest back into the business with $30 million of incremental investment planned this year for key brand growth initiatives and the tools necessary to support long-term sustainable growth.

Hufnagel also said the product pipeline is stronger with new introductions “already resonating with consumers” and more great collections dropping in the coming months.

“Our balance sheet is much healthier with the company’s lowest debt level in over 2.5 years, approximately 40 percent less inventory than just a year ago, and a clear line of sight to drive further improvement on both metrics this year,” Hufnagel suggested. “And finally, we have a talented, aligned and motivated team driving the business every day. I’m extremely thankful for their exceptional work over the past six months and couldn’t be more excited about the work we’ll do together moving forward.”

He said the team’s urgency and effectiveness in executing the turnaround plan has allowed the company to outpace its expectations in the first chapter of its transformation.

“We’ve largely stabilized the company in just a few short months,” he said, while also noting the team over-delivered on expectations.

“We reduced our year-end inventory by $30 million more than we anticipated,” he detailed. “We said we’d further rationalize our portfolio and deliver $65 million of proceeds in Q4. We ultimately generated $91 million in the quarter and then completed the divestiture of Sperry in January, generating another $130 million in proceeds.

Hufnagel continued, “We said we reduced the company’s debt by around $170 million by year-end and ultimately we reduced our debt by $280 million, and that was before the Sperry transaction. As a result, our bank-defined debt leverage is better than expected.”

The CEO said the second chapter of the company’s turnaround story is focused on transforming Wolverine Worldwide into a builder of great global brands.

“To shift our mindset and add capabilities within our brands, we’ve added more consumer-focused talent in many of our key brand roles over the last year, and we have several more searches underway today to bolster resources and expertise,” Hufnagel shared. “We established the Collective in November, our center of excellence created to elevate consumer insights, market intelligence, trend monitoring and innovation. I’ve been pleased by our quick pivot to a more consumer-obsessed culture as our brands have already begun to incorporate more insights in consumer testing and to the go-to-market processes for products and marketing.”

Ultimately, the Wolverine World Wide portfolio brands should make all our consumers’ lives better. Thanks to recent portfolio management efforts, our brands are tightly aligned around enabling our consumers to have healthier and more productive lives. As a result,

Hufnagel said the company has a great opportunity to increase collaboration across its brands and teams to recognize unmet consumer needs, spur innovation, identify trends and better lever the collective talent of the organization.

“We believe the consolidation of our office footprint will continue that help,” he noted. “We’ve already relocated Sweaty Betty to our Kings Cross office in London and later this year, Merrell and Saucony will be co-located here in our global headquarters. We’re also working to better equip the organization with modernized tools and processes to execute faster, more accurately and with distinction.”

He said the company piloted new best-in-class digital product line management tools with Merrell and is now rolling those tools out across the portfolio. He said they are implementing new integrated business planning processes this year to improve forecasting, inventory management and margin efficiency.

Hufnagel added that the company is also taking bold steps to better manage its brands in the marketplace.

“In the fourth quarter, we created a new centralized brand protection team to help us monitor and address nefarious activity in the marketplace,” he said. “In the short time, across our portfolio, we’ve already identified and shut down nearly 20 customers and partners that have participated in gray market activity and approximately 400 accounts that do not align with our go-forward distribution strategies, with more to come.”

He said the brands are also focused on achieving a healthier sales mix with a stronger emphasis on full-price business this year, suggesting they are already less promotional in the marketplace today and on their direct-to-consumer channels.

“A more disciplined approach to brand management is critical to enhancing and protecting the equity of our brands,” Hufnagel emphasized. “We must begin to establish more of a pull model, and we must continue to strengthen relationships with valued wholesale and distributor partners.”

Hufnagel says that with firmer footing and a clear vision, the company’s brands are accelerating their efforts to reinvigorate growth, focusing squarely on designing awesome products and telling amazing stories.

“While we expect our inflection to growth will follow the meaningful margin improvement we’ve outlined, our brands are moving with great pace to drive improved top-line performance,” he said and highlighted the work Saucony is doing in the running business.

“Saucony is consistently one of the most trusted brands by Elite Runners in the world’s most important marathons,” he noted. “And we now have the opportunity to capitalize on this tip-of-spear success by democratizing the brand’s innovations for the larger casual running market and elevating its style to encourage adoption for the significantly larger lifestyle wearing occasions. The brand intends to do so through a focus on its core four franchises, the Ride, Guide, Triumph and Hurricane.”

As a first step, he said Saucony launched a new Ride 17 several weeks ago, engineered to deliver a more comfortable fit and better ride for the brand’s neutral runner.

“It’s been well received and sell-through was up strong double digits in the important Run Specialty channel,” Hufnagel shared. “The brand followed this launch with a new introduction of its maximum comfort franchise, the Guide 17 with even more cushioning and support.” He said the Guide 17 has only been in the market a couple of weeks and sell-through is already off to a very strong start.

He added that Saucony expects to launch Triumph 22 next quarter, followed by the Hurricane 24 in the third quarter. Hufnagel also said the brand plans to sell into some of the best lifestyle distribution in the marketplace starting this spring with authentic, trend-right, retro tech designs from its archives like the ProGrid Omni and Azure.

“As a result of these important launches and the brand’s improved storytelling, which is just getting started, the brand has started to see an inflection in brand heat with consumers,” he suggested.

He also walked through some products noted for Merrell but the key take-away there was the fact the brand again grew U.S. market share in both hiking and trail in Q4, tapping a year of market share gains for the company’s largest brand. He also noted the brand’s Agility Peak 5 is outperforming the leading trail-running shoes in the marketplace in consumer and expert gear reviews on comfort, quality, and fit, and is up triple digits at the start of the year.

“As with Saucony, the broader opportunity is significant for Merrell. And when we develop on-brand and on-trend styles like the new Wrapt collection, a disruptive look on our barefoot platform, our consumers respond,” Hufnagel said. “This new collection almost sold out entirely on merrell.com in a matter of weeks. And today, we are chasing replenishment for this franchise and plan to reduce new silhouettes later this year.”

At Sweaty Betty, Hufnagel reminded everyone that the branded business was built in direct channels so the brand has always been consumer-obsessed, driving product innovation in response to the feedback received from consumers. He said this is a mindset and approach that can influence the company’s other brands as they “endeavor to become a more consumer-focused organization.”

Through its rapid consumer feedback and response model, Hufnagel said the brand is building on its leading franchise through category extensions and new textures and patterns. The newness is trending well and with recent improvements to the company’s supply chain, the brand can now replenish fast-moving styles “in a matter of weeks.”

He also said the brand is seeing excellent traction with extensions in new categories like outerwear, mid-layers and accessories with very strong double-digit growth in Q4.

“In our business, it always starts with product,” the CEO said. “We are seeing green shoots across the business and the brand’s product pipelines will build momentum throughout the year.”

But while leading with the sugar, Hufnagel had to deliver vinegar at some point, as most know that a company cannot move student-body-left on a dime with developmental timelines what they are today. Booking orders for fall are already in-house. Realistically. analysts realize that any work done this year may deliver some green shoots, but it can’t bear fruit for another year or more. Possibly with that in mind, the CEO also tempered expectations for the year with the analysts on the call.

“It’s important to pause here and set the near expectations for the business,” he said after reviewing the key brands’ upside. “Encouragingly, this year we expect the business to be much more profitable and again, generate strong cash flow, as our model has done so effectively in the past, driven by significant gross margin expansion and our aggressive and proactive profit improvement initiatives we’ve executed over the past few months.”

He observed that the business is starting the year from a challenging position, which will weigh on full-year revenue results.

He said the issue was meaningful for Saucony, followed by Merrell and Wolverine, but the company anticipates a sequential improvement in top-line performance as the year progresses.

“We expect the positive impact of our corrective actions will accelerate and be bolstered further in the second half by reduced rogue selling, cleaner inventories, better alignment with global partners and lapping easier year-over-year comparisons while contributing to an inflection in growth in the second half of the year and acceleration into 2025,” he said.

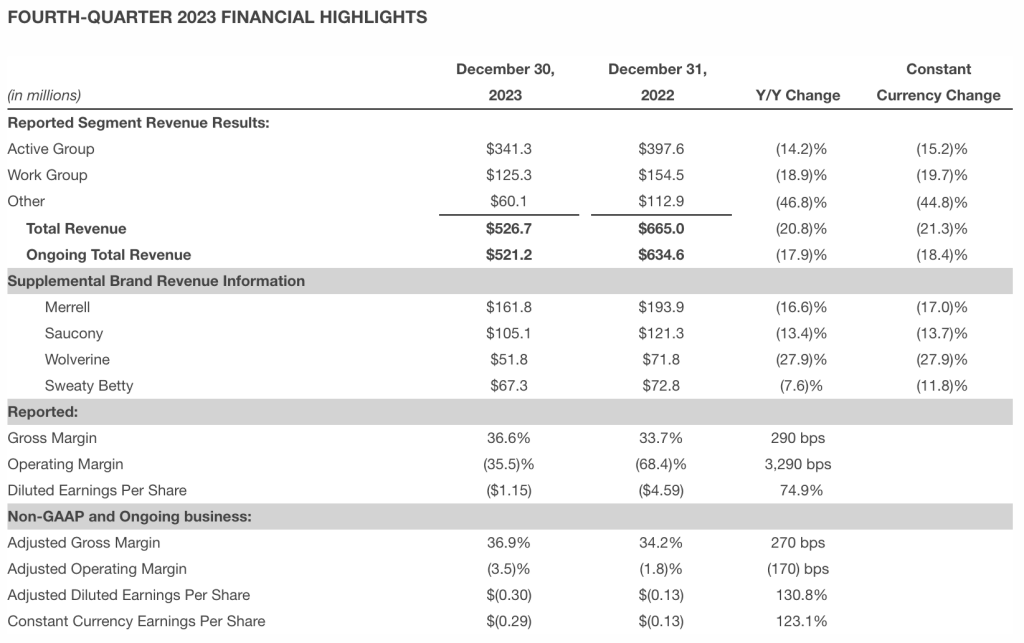

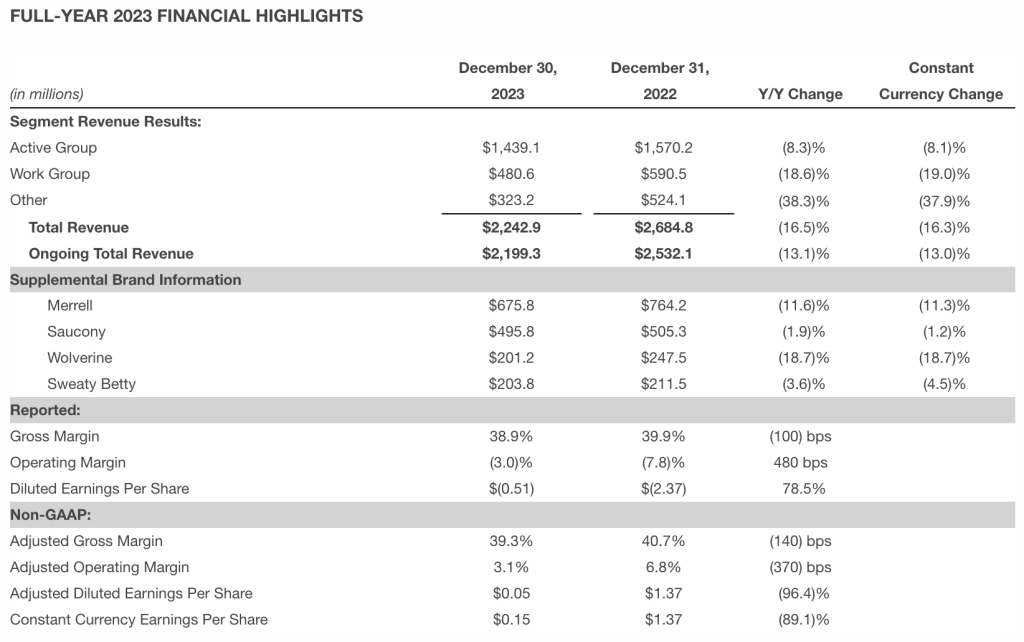

Turning to the results of the fourth quarter and the year, CFO Mike Stornant said Q4 revenues fell 20.8 percent year-over-year (YoY), or 21.3 percent on a constant-currency basis (CC), to $526.7 million. Revenue from the ongoing business was reported at $521.2 million, declining 18.4 percent on a constant-currency basis.

The ongoing business excludes the impact of Keds (sold in February 2023), the U.S. Wolverine Leathers business (sold in August 2023) and the non-U.S. Wolverine Leathers business (sold in December 2023). It reflects an adjustment for the transition of the Hush Puppies North America business to a licensing model in the second half of 2023.

Gross margin was 36.6 percent of sales in Q4, compared to 33.7 percent in the prior-year Q4, and reportedly improved due to fewer promotional e-commerce sales and fewer inventory markdown provisions due to “much healthier inventory levels.” The company said it offset the benefits from profit improvement initiatives by selling the last tranche of higher-cost inventory containing transitory supply chain costs from 2022.

The CFO noted that the adjusted gross margin of 36.9 percent of sales was better than the company’s outlook of approximately 36.0 percent, with a better gross margin in the e-commerce channel helping to drive this result.

Stornant said that adjusted SG&A expense of $210.5 million, or 40.4 percent of revenue, includes $5 million of incremental performance marketing investment tested during key moments of the holiday season, which helped the company deliver more full-price sales in the e-commerce channel and acquire nearly 200,000 new consumers.

“We also implemented a $4 million supplemental incentive program in the quarter for non-executive team members tied to important inventory and net debt metrics,” he added.

He said the program helped deliver better-than-expected results for inventory, cash flow and net debt in the quarter. “Our team is motivated, aligned and focused on improving the company’s financial performance,” Stornant added.

Reported diluted EPS was a loss of $1.15 per share, compared to a loss of $4.59 per share in the 2022 fourth quarter. Adjusted diluted earnings per share for the quarter was a loss of 30 cents per share, in line with our outlook, but up considerably from the 13 cents per share loss in Q4 2022.

Stornant said the team made meaningful progress to further improve inventory, net debt and liquidity during the fourth quarter.

Inventory, excluding Sperry and the company’s China JV, was reported at $374 million at quarter-end, down nearly 40 percent compared to the prior year-end, and approximately $30 million better than expected.

“We delivered this improvement by leveraging a rigorous inventory management process while operating in a more normal and predictable supply chain environment,” Stornant noted.

“While pleased with the meaningful improvements in 2023, we believe we can further optimize inventory levels over the coming quarters,” he added. “Shorter supply chain lead times, implementation of our integrated planning processes and heightened focus on SKU productivity should allow us to drive inventory levels down by at least $70 million during 2024. Active portfolio management has also been a key focus, helping to unlock value and narrow our focus on businesses with the highest return opportunities.”

Stornant said strong working capital management and the sale of certain non-core assets generated approximately $200 million of cash in the quarter, exceeding expectations. As a result, WWW ended the quarter with a net debt of $740 million and a bank-defined leverage ratio of 2.9x.

Outlook

Looking ahead, Stornant said the critical stabilization work executed over the last three quarters puts the company on solid footing. He said the teams can more fully focus on efforts towards transforming the company while driving an inflection to growth in the back half of 2024.

“Our guidance reflects the expected performance of our ongoing business, which now excludes Sperry,” he noted.

Fiscal 2024 revenue is expected in the range of $1.7 billion to $1.75 billion. Compared to revenue from the company’s ongoing business of $1.99 billion in 2023, the range represents a decline of 13.4 percent at the mid-point of the range.

“Discrete items in 2023 totaling $165 million in revenue will not recur in 2024,” Stornant outlined. “These include approximately $70 million of extraordinary end-of-life inventory liquidation, heavily weighted to the first half of 2023, approximately $55 million in business model changes, including the transition of our China JV to a distributor model for both Merrell and Saucony and approximately $40 million in a timing shift of international distributor shipments that benefited Q1 2023.”

Excluding those discrete items, the CFO said the mid-point decline would be approximately 5.5 percent for 2024.

- Active Group revenue is expected to decline in the mid-teens.

- Merrell is expected to decline in the low-double-digit range with inflection to growth expected in the second half of the year.

- Saucony is expected to decline in the low-20s range with sequential improvement each quarter.

- Sweaty Betty is expected to be flat.

- Work Group revenue is expected to decline in the high-single-digits, with Wolverine brand expected to be down mid-single-digits.

- Adjusted gross margin is expected to be approximately 44.5 percent at the mid-point of the outlook range, a record high for the company, and up approximately 460 basis points compared to 2023.

Key contributors to the gross margin expansion include approximately $50 million of supply chain transitory costs expensed in 2023 that will not recur in 2024 and approximately $45 million from profit improvement initiatives related to product and logistics costs. Stornant said part of the upside is the bigger direct-to-consumer mix in the profile for the gross margin, including the inclusion of the Sweaty Betty business.

“In addition, we expect that healthier inventory levels and increased brand protection actions will lead to a lower promotional cadence during 2024, especially in the back half of the year,” Stornant offered. “This gross margin benefit is expected to be offset by foreign currency headwinds that impact inventory costs.”

Adjusted SG&A expenses are expected to be approximately $650 million at the mid-point of the outlook range, or 37.5 percent of sales, compared to $716 million, or 36 percent of sales, in 2023.

“The lower operating cost structure includes $95 million of savings from the 2023 restructuring and other profit improvement initiatives,” added Stornant. “Partially offset by $30 million of incremental investments for demand creation, modernization of systems and building important organizational capabilities, $25 million of normalized incentive compensation expense and $15 million for normal inflationary increases.”

Adjusted operating margin is expected to be approximately 7 percent at the mid-point of the outlook range compared to 3.9 percent in 2023.

Interest and other expenses are projected to be approximately $40 million, down from $63 million in 2023 and benefiting from the significant debt reduction achieved last year.

The effective tax rate is projected to be approximately 18 percent for 2024.

Adjusted diluted EPS is expected to be in the range of 65 cents to 85 cents, including a 10-cent negative impact from foreign currency exchange fluctuations. This compares to 15 cents in 2023 for the ongoing business.

Stornant said working capital and cash flow optimization remains a priority in 2024.

“We expect inventory to decline by at least $70 million during the year as we continue to work through specific areas of excess inventory,” he detailed.

Operating free cash flow is expected in the range of $110 million to $130 million with approximately $40 million of capital expenditures. Stornant said they expect net debt to improve by nearly $165 million to $575 million at year-end.

For the first quarter, WWW expects first-quarter revenue of approximately $360 million, a decline of approximately 30 percent.

“Many of the discrete items occurring in 2023 and noted in our annual revenue outlook are especially impactful to the first quarter,” Stornant outlined. “This includes $23 million of extraordinary end-of-life inventory liquidation in Q1 2023, a $40 million shift in international distributor shipments that benefited Q1 2023 and $13 million in business model changes.”

Excluding these discrete items, the projected first-quarter revenue decline would be approximately 18.5 percent, similar to the fourth quarter of 2023.

First quarter gross margin is expected to be approximately 46 percent of sales, up 480 basis points from last year’s first quarter. Significantly lower supply chain costs, lower sales of end-of-life inventory and a better distribution channel mix are all contributors to the gross margin improvement.

“We expect first quarter operating margin to be approximately 3.5 percent and adjusted diluted earnings per share to be approximately breakeven, the CFO concluded.

Image courtesy Wolverine World Wide/Merrell

***

See below for more SGB Media coverage of Wolverine Worldwide

Wolverine World Wide Expects 2023 Results In Line with Estimates

Wolverine Transforming Saucony and Merrell Model in China; Sells Asia Leathers Business

EXEC: Inside Wolverine’s Plan for the Future—and the New Realities of 2023

EXEC: New Wolverine Worldwide CEO to Focus on Building Brands After Q2 Results Disappoint