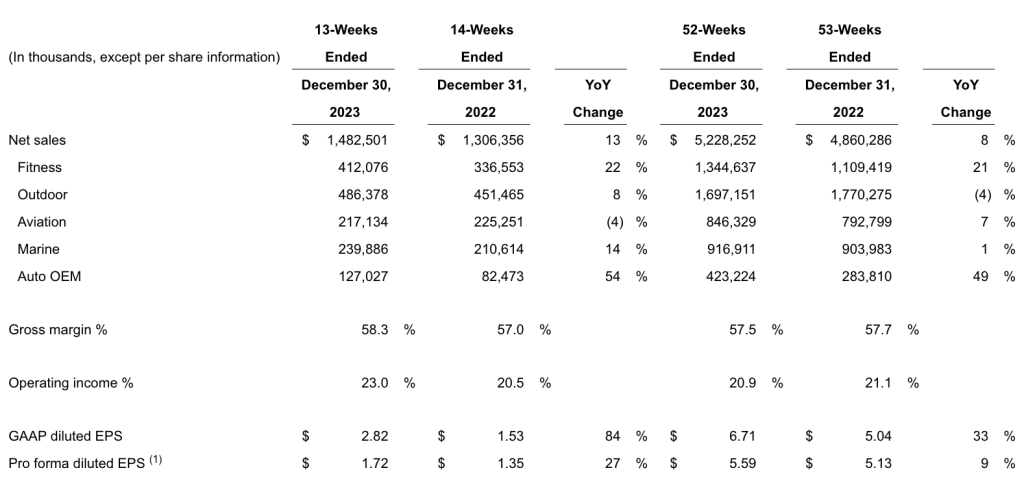

Garmin, Ltd. reported that consolidated revenue for the fourth quarter was $1.48 billion, a 13 percent increase compared to the prior-year quarter, with growth across all segments except Aviation. Consolidated gross margin expanded 130 basis points to 58.3 percent of sales, compared to 57.0 percent in the prior-year quarter.

Operating income was $340 million, a 27 percent increase compared to the prior-year quarter. Operating margin was 23.0 percent compared to 20.5 percent in the prior-year quarter.

GAAP EPS was $2.82 per share and pro forma EPS was $1.72, representing 27 percent growth in pro forma EPS over the prior-year quarter.

GRMN shares were up in mid-single-digits in pre-market trading Wednesday morning.

Fitness

Revenue from the fitness segment increased 22 percent to $412.1 million in the fourth quarter with growth across all categories led by strong demand for wearables. Gross and operating margins were 56 percent and 22 percent, respectively, resulting in $93 million of operating income. At the recent Consumer Electronics Show, the Venu 3 was recognized with three CES Innovation Awards, including the prestigious Best of Innovation honor for outstanding design and engineering.

Outdoor

Revenue from the outdoor segment increased 8 percent to $486.4 million in the fourth quarter with growth across multiple categories led by adventure watches. Gross and operating margins were 65 percent and 34 percent, respectively, resulting in $164 million of operating income. During the quarter, Garmin said it expanded its lineup of dive offerings with the introduction of the Descent G1 Solar – Ocean Edition, its first-ever product made with recycled ocean-bound plastics.

Aviation

Revenue from the aviation segment decreased 4 percent to $217.1 million in the fourth quarter as growth in OEM categories was more than offset by decreases in aftermarket categories. Gross and operating margins were 75 percent and 26 percent, respectively, resulting in $57 million of operating income.

Marine

Revenue from the marine segment increased 14 percent to $239.9 million in the fourth quarter due to contributions from the acquisition of JL Audio. Gross and operating margins were 53 percent and 16 percent, respectively, resulting in $37 million of operating income.

Auto OEM

Revenue from the auto OEM segment increased 54 percent to $127.0 million during the fourth quarter, said to be primarily due to increased shipments of domain controllers. Gross margin was 21 percent, and the operating loss narrowed to $10 million. Domain controller deliveries to the BMW Group continued to ramp up across multiple models and regions.

Total operating expenses in the fourth quarter were $524 million, a 10 percent increase over the prior-year quarter. Research and development increased 10 percent, said to be primarily due to engineering personnel costs. Selling, general and administrative expenses increased 10 percent, reportedly driven primarily by personnel-related expenses and incremental costs associated with the acquisition of JL Audio. Advertising expenses increased 6 percent primarily due to higher cooperative advertising.

Garmin reported a $159 million income tax benefit in the fourth quarter of 2023. Excluding $181 million of income tax benefit due to the revaluation of certain Switzerland deferred tax assets, and $12 million of income tax benefit due to auto OEM manufacturing tax incentives in Poland, the company’s pro forma effective tax rate in the fourth quarter of 2023 was 9.0 percent compared to 8.9 percent in the prior-year quarter.

In the fourth quarter of 2023, Garmin said it generated an operating cash flow of $466 million and a free cash flow of $417 million. The company paid a quarterly dividend of approximately $140 million and repurchased approximately $19 million of the company’s shares within the quarter, completing the share repurchase program authorized through December 29, 2023.

The company ended the quarter with cash and marketable securities of approximately $3.1 billion.

“We are very pleased with our 2023 financial performance resulting in record full-year consolidated revenue and record full-year revenue in three of our five segments,” offered Cliff Pemble, president and CEO of Garmin, Ltd. “We are entering 2024 with strong momentum from our robust product lineup and have many product launches planned during the year. I am very proud of what we accomplished in 2023 and look forward to all that 2024 will bring.”

Fiscal Year 2023 Highlights:

- Record consolidated revenue of $5.23 billion, an 8 percent increase compared to the prior year;

- Aviation, Marine and Auto OEM segments each posted record full-year revenue;

- Gross margin of 57.5 percent compared to 57.7 percent in the prior year;

- Operating income of $1.09 billion, a 6 percent increase compared to the prior year;

- Operating margin of 20.9 percent compared to 21.1 percent in the prior year; and

- GAAP EPS of $6.71 and pro forma EPS of $5.59, representing 9 percent growth in pro forma EPS over the prior year.

Fourth Quarter and Full Year Results:

2024 Fiscal Year Guidance

Garmin Ltd. expects full-year 2024 revenue of approximately $5.75 billion, an increase of approximately 10 percent over 2023. The company said it expects full-year pro forma EPS to be approximately $5.40 based upon gross margin of approximately 56.5 percent of sales, operating margin of approximately 20.0 percent of sales, and pro forma effective tax rate of approximately 15.5 percent.

Image courtesy Garmin Ltd.