DSW reported second-quarter earnings on an adjusted basis slid 24.7 percent but came in ahead of Wall Street's consensus estimate by 5 cents a share. Excluding items related to its merger with RVI as well as the termination of RVI's pension plan, adjusted net income declined to $33.6 million or 37 cents per share, down from $44.6 million or 49 cents, a year ago.

DSW reported second-quarter earnings on an adjusted basis slid 24.7 percent but came in ahead of Wall Street's consensus estimate by 5 cents a share. Excluding items related to its merger with RVI as well as the termination of RVI's pension plan, adjusted net income declined to $33.6 million or 37 cents per share, down from $44.6 million or 49 cents, a year ago.

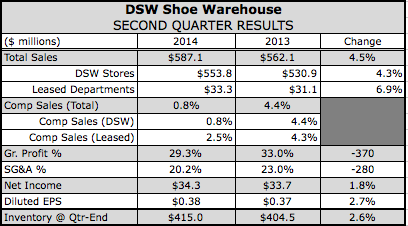

Comparable sales increased 0.8 percent on top of an increase of 4.4 percent last year. Transactions for the DSW segment increased 5 percent. Store traffic declined in the low single-digit range but improved substantially from Q1. Store conversion rate increased in the high single-digit range. AUR declined in the low single-digits, while units per transaction increased in the low single-digits for the segment.

“We saw continuous improvement in our selling metrics throughout the quarter, with comps turning positive for all regions and all categories in the month of July,” said Mike MacDonald, DSW’s president and CEO, on a conference call with analysts.

He said the sell-through pickup benefited from several actions undertaken in response to the weakness seen this spring, including moving slow sellers into clearance faster, reducing prices for select items, and increasing its opportunistic buys to add more value offerings.

“Our selling of clearance outpaced regular priced selling for the quarter as a whole,” said MacDonald. “But we saw sequential improvement in reg-price selling through the quarter.”

Among categories, accessories led the way with a comp gain in the low teens range, driven by growth in its seasonal and core areas and the expansion of jewelry to all doors. Men's and athletic businesses both comped up 2 percent during the quarter with the latter driven by its fashion athletic category.

Women's comped down 1.6 percent although sequential improvement was seen on an overall basis and within regular price. Its women’s dress offerings generated strong positive comps, while women's casual continued to show negative comps against double-digit increases in the prior year. Casual sandals saw a low single-digit decline with a gain in seasonal sandals offset by weakness in its Young Attitude models.

In the Q&A session, Debbie Ferree, vice chairman and chief merchandising officer, said she likes how athletic’s influence is working its way into other casual categories.

“I like the approach the market is taking with really addressing comfort,” said Ferree. “I really call it modern comfort. I like the direction; I think it fits the needs for our customer. I'm highly encouraged by the direction the market is taking, and we will take advantage of that.”

Gross margins declined 320 basis points with 210 basis points of contraction due to aggressive clearance activities and abnormally low markdowns in the prior year because of unusually low clearance levels. Mix and pricing accounted for 40 basis points of the decline. Increased shipping expenses, primarily from higher charge-send sales, accounted for the remaining 70 basis points contraction.

Occupancy and FCDC rates increased by 70 basis points primarily due to one-time items. SG&A expenses were 15 basis points lower than last year with SG&A dollars increasing by 4.4 percent. Lower incentive compensation offset increases in omni-channel and IT expenses.

On a cost per square foot basis, DSW segment inventories decreased 3.3 percent at the end of quarter, excluding inventory for its luxury test last year.

As a result of the better-than-expected performance, DSW raised its guidance for the year to from $1.50 to $1.65 per share, up from its previous guidance of $1.45 to $1.60. The outlook assumes flattish comps and total revenue growth in the mid single digit range. In 2013, it earned $1.88 a share.