Celsius Holdings, Inc., the manufacturer of the brand Essential Energy drinks, reported record Q1 2024 financial results.

John Fieldly, company chairman and CEO, said: “Celsius reported its best first quarter ever driving record revenue and contributing 47 percent of the quarterly year-over-year growth in the energy drink category. Our category share of 11.5 percent as of April 142 reflects the early impact of shelf space gains that we are earning from company records and ongoing retailer resets, which we believe will serve as a flywheel for our continued growth. Celsius product innovation this year has delighted consumers with the most refreshing products we’ve ever created.”

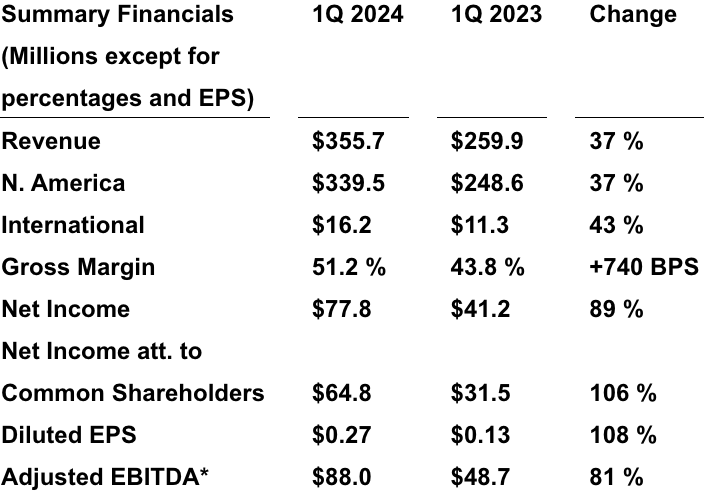

Jarrod Langhans, Celsius Holdings CFO, said, “Celsius’ first quarter revenue of $356 million and year-over-year growth of 37 percent is a record, despite changes in days on-hand inventory by our largest customer. Our solid 51 percent first-quarter gross margin reflects a balanced and disciplined approach to leveraging while simultaneously building the business and expanding globally, as well as an accelerated benefit from raw materials pricing and reduced freight costs.”

The company reported financial results by generally accepted accounting principles in the United States (GAAP). However, management believes that disclosure of Adjusted EBITDA may provide additional insights into operating performance.

Financial Highlights Q1 2024

- Revenue for the first quarter increased 37 percent to $355.7 million compared to $259.9 million for the prior-year period, driven by its North American business and consumer demand growth, delivering innovation and overall channel growth, offset, in part, by inventory movement within its largest distributor where first quarter 2024 inventory days on-hand declined versus the fourth quarter resulting in an approximate $20 million impact, while first quarter 2023 revenue benefited from an inventory buildup of approximately $25 million.

- Ongoing inventory fluctuations may be expected in subsequent quarters because the company’s largest distributor constituted 62 percent of its total North American sales during the first quarter of 2024. However, retail sales of Celsius in total U.S. MULOC grew by 72.1 percent in the first quarter of 2024 year-over-year, and subsequent period sales show ongoing consumer demand, as reported by Circana for the period ended April 21, 2024. L1W +48.8 percent YoY; L4W +51.0 percent YoY; YTD +67.2 percent YoY. Revenue from U.S. and Canadian sales are reported together as North America.

- International sales of $16.2 million increased 43 percent from $11.3 million for the prior-year period, driven by ongoing velocity improvements and product launches.

- Gross profit for the first quarter of 2024 increased 60 percent to $182.2 million compared to $113.8 million for the prior-year quarter. Gross profit, as a percentage of revenue, was 51 percent for the three months ended March 31, 2024, up from 44 percent for the prior-year period, resulting from lower freight and materials costs.

- Diluted earnings per share for the first quarter increased 108 percent to $0.27 compared to $0.13 for the prior-year period driven by improvements in gross margin and leverage across SG&A.

Business Operations and Company Highlights

Share Growth

Celsius reported it held an 11.5 percent share in the energy drink category in total U.S. MULOC for the last four weeks ended April 14, 2024, a one-point increase over the prior quarter and approximately four points higher than one year ago. This share performance delivered quarter-over-quarter sales growth for Celsius of 9.6 percent when the energy category declined 0.4 percent. Sugar-free segment sales in the first quarter were approximately 50 percent of the energy drink category.

Average SKUs per retailer increased in the first quarter of 2024 by 20.6 percent from 13.5 percent in the prior year period. TDPs for the quarter grew 55 percent year-over-year and 27 percent sequentially.

Celsius estimated that retailers’ spring shelf resets were approximately one-third complete as of March 31, and, once concluded, reports it expects its “best shelf space gains in company history.” The company expects to reflect the complete effect of shelf space gains in scanner data beginning in July 2024.

Growth Drivers

- Club channel sales in the quarter ended March 31, 2024, increased 36 percent to $63.0 million compared to $46.5 million in the prior-year period.

- Celsius sales on Amazon increased 30 percent in the quarter ended March 31, 2024, compared to the prior-year period, to approximately $28 million, and Celsius remained the No.1 energy drink brand by dollar share.

- Case volume in the food service channel increased 186 percent year-over-year and grew 113 percent quarter-over-quarter. Approximately 12 percent of Celsius’ total sales to PepsiCo in the first quarter of 2024 was to the food service channel.

Innovation and Marketing

- Sales of Celsius Essentials reached 54.5 percent ACV and 4.1 average items sold per store. The company sold the product in over 95,000 stores in the first quarter of 2024

- Celsius introduced new 12-ounce flavors in the first quarter, including Celsius Blue Razz Lemonade, Raspberry Peach, Astro Vibe, Galaxy Vibe, and new variety packs.

- Celsius On The Go powders reached the No.1 position in the energy powder category in the first quarter of 2024 and ncreased category share by 1.7 points since January 2024 to 24 percent.

International Expansion

Sales in Canada began in the first quarter of 2024, and the company reported exceeding pre-launch expectations. Celsius’ share in the energy category in MULOC in Canada was 5.5 percent as of February 29, 2024, according to Canadian NiQ data.

In the first quarter, Celsius announced plans to expand its sales and distribution into Australia, France, Ireland, New Zealand, and the UK in 2024. Sales in the UK and Ireland began in April through the fitness channel and in select gyms. Sales in Australia, France and New Zealand are expected to begin in Q4 2024 and broaden its reach through 2025.

Image courtesy Celsius