Acushnet Holdings Corp., parent company to the Titleist, FootJoy and Kjus golf brands, reported consolidated net sales for the first quarter of 2024 increased 3.1 percent, or 4.0 percent on a constant-currency (CC) basis, to $707.6 million, a solid increase driven by higher sales volumes in Titleist golf clubs and Titleist golf balls, partially offset by lower sales volume in FootJoy golf wear. A decline in product sales volume, not allocated to one of the company’s four reportable segments, also contributed to the change in net sales.

“I am pleased to report on Acushnet’s solid first quarter, which benefited from the continued strength of Titleist golf balls and golf clubs and terrific execution by our global operations teams in launching a comprehensive lineup of new products across our Titleist, FootJoy and Kjus brands,” said David Maher, president and CEO, Acushnet Holdings.”

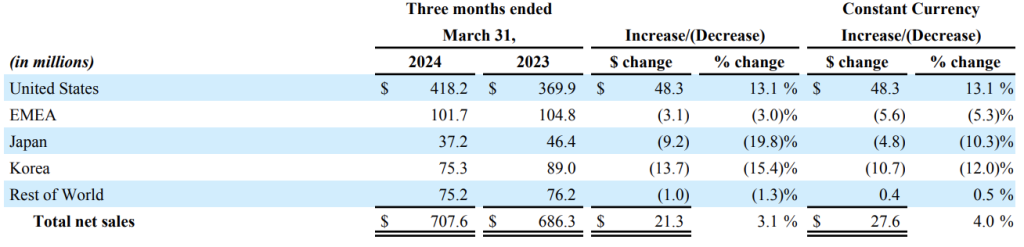

United States

The U.S. market set the pace for the quarter with a 13 percent increase in sales year-over-year to $418.2 million, driven by a 20.6 percent increase in Titleist golf clubs, a 15.5 percent increase in Titleist golf balls and 13.9 percent growth in Titleist golf gear. The increase in Titleist golf clubs was driven by higher sales volumes of the newly introduced SM10 wedges. The increase in Titleist golf balls was driven primarily by higher sales volumes of Pro V1 and Pro V1x, Velocity and the latest generation AVX, Tour Soft, and TruFeel models launched in the first quarter of 2024. The increase in Titleist golf gear sales was due to higher sales volume in golf bags and travel product categories.

International

Net sales in regions outside the U.S. decreased 8.5 percent (-6.5 percent CC). The decrease in net sales was primarily from lower sales in Korea, EMEA and Japan.

In Korea, the decrease was primarily due to lower net sales of products not allocated to one of the company’s four reportable segments and lower net sales in FootJoy golf wear, mainly apparel, Titleist golf gear, and Titleist golf clubs.

In the EMEA, the decrease was primarily due to lower net sales in FootJoy golf wear, mainly footwear, and Titleist golf gear, partially offset by an increase in Titleist golf clubs.

In Japan, net sales decreased primarily due to lower net sales in FootJoy golf wear and lower net sales of products not allocated to one of our four reportable segments, partially offset by higher net sales in Titleist golf clubs.

Maher said the golf industry is structurally healthy, and participation continues to be resilient despite poor weather, which affected some regions during the early part of the year.

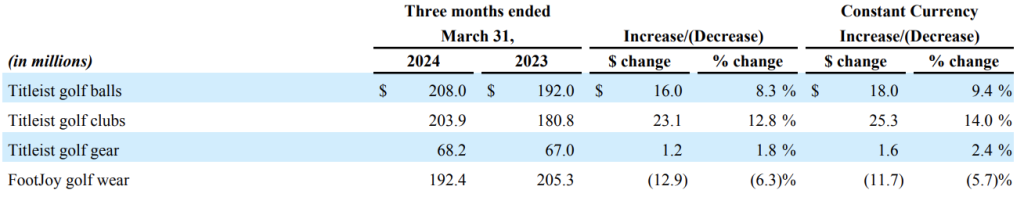

Segment Highlights

- Titleist golf balls saw an 8.3 percent (+9.4 percent CC) increase in net sales in the first quarter, primarily driven by higher sales volumes of Pro V1 and Pro V1x, Velocity and the latest generation AVX, Tour Soft, and TruFeel models launched in the first quarter of 2024.

- Titleist golf clubs posted a 12.8 percent (+14.0 percent CC) increase in net sales in Q1, said to be mainly due to higher sales volumes of new SM10 wedges launched in the first quarter of 2024 and T-Series irons launched in the third quarter of 2023. The increase was partially offset by lower sales volumes of drivers, hybrids and fairways, which were all in their second model year.

- Titleist golf gear had a 1.8 percent (+2.4 percent CC) increase in net sales in the quarter, reportedly driven by higher net sales in travel gear, golf glove and golf bag product categories.

- FootJoy golf wear net sales decreased 6.3 percent (-5.7 percent CC) in Q1, primarily due to lower sales volumes across all product categories, partially offset by higher average selling prices in apparel.

Net Income and Adjusted EBITDA

Net income attributable to Acushnet Holdings Corp. decreased 5.9 percent year-over-year to $87.8 million, primarily from an increase in net interest expense and income tax expense.

Adjusted EBITDA was $153.7 million for the quarter, up 4.7 percent year-over-year. Adjusted EBITDA margin was 21.7 percent of net sales for the first quarter, compared to 21.4 percent for the prior-year Q1 period.

Cash Dividend and Share Repurchase

Acushnet’s Board of Directors declared a quarterly cash dividend of $0.215 per share of common stock, payable on June 21, 2024 to shareholders of record on June 7, 2024. The number of shares outstanding as of May 1, 2024 was 63,069,560.

During the quarter, the company repurchased 547,233 shares of its common stock on the open market at an average price of $64.51 for an aggregate of $35.3 million. On March 14, 2024, the company entered into a new agreement with Magnus Holdings Co., Ltd., a wholly-owned subsidiary of Fila Holdings Corp., to purchase from Magnus an equal amount of its common stock as it purchases on the open market over the period from April 1, 2024 through June 28, 2024, up to an aggregate of $37.5 million, at the same weighted average per share price.

2024 Outlook

The company reaffirmed its full-year 2024 outlook and expects full-year consolidated net sales to be approximately $2,450 million to $2,500 million and Adjusted EBITDA to be approximately $385 million to $405 million. Consolidated net sales are expected to increase 3.2 percent to 5.3 percent on a constant-currency basis.

Image courtesy Titleist