Deckers Brands reported income slid 10.6 percent as a lower gross margins and higher costs offset a slight gain in sales.

Second Quarter Fiscal 2016 Financial Review

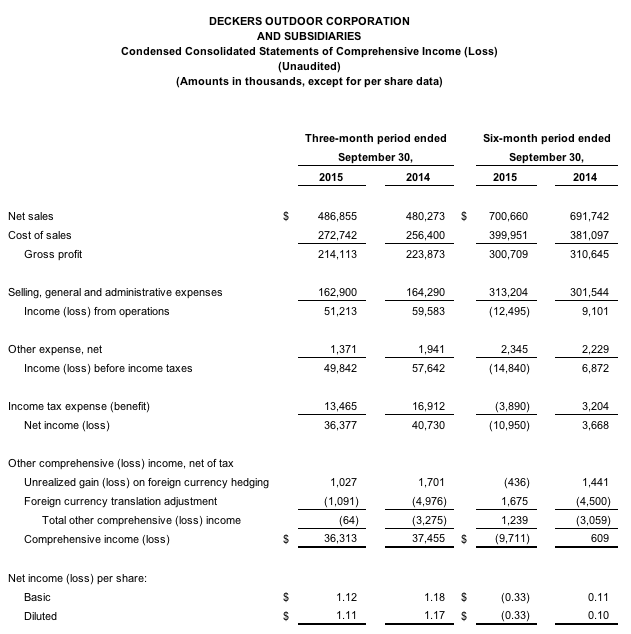

- Net sales increased 5.4 percent to $506.2 million on a constant currency basis compared to $480.3 million for the same period last year. On a reported basis, net sales increased 1.4 percent to a record $486.9 million.

- Gross margin was 44.0 percent compared to 46.6 percent for the same period last year.

- SG&A expense as a percentage of sales was 33.5 percent compared to 34.2 percent for the same period last year.

- Diluted earnings per share was $1.11 compared to $1.17 for the same period last year. On a constant currency basis, diluted earnings per share increased 21.4 percent to $1.42.

When it reported first-quarter results in late June, the company said it expected to report second-quarter earnings per share on a constant-currency basis of $1.41, and earnings of approximately $1.05 on a reported basis. Sales were expected o rise 5.0 percent on a currency-neutral basis and up approximately 1.0 percent on a reported basis.

“We delivered record second quarter revenue and continue to track towards achieving our financial objectives for the fiscal year,” commented Angel Martinez, chief executive officer and chair of the board of directors. “I'm very pleased with our current performance which wouldn't have been possible without the strategic investments we've made in key areas of the business over the past several years. From Omni-Channel capabilities and product innovation to marketing and people, we are in the process of transforming the company into a consumer centric, global brand operator positioned to deliver sustainable top-line growth and operating margin expansion. Even during this investment phase, we have continued to demonstrate our commitment to returning value to shareholders by repurchasing more than $417 million of our common stock since 2011. The entire organization is energized as we begin what we believe will be an exciting new chapter in Deckers ongoing evolution.”

Brand Summary

- Ugg brand net sales for the second quarter increased 0.9 percent to $421.1 million compared to $417.1 million for the same period last year. On a constant currency basis, sales increased approximately 5.3 percent. The increase in sales was primarily driven by an increase in domestic wholesale sales, partially offset by a decrease in global Direct-to-Consumer sales primarily driven by a decrease in tourist traffic in the U.S. as a result of the strengthening dollar.

- Teva brand net sales for the second quarter decreased 13.6 percent to $17.9 million compared to $20.7 million for the same period last year. On a constant currency basis, sales decreased approximately 11.8 percent. The decrease in sales was driven by a decrease in global wholesale and distributor sales.

- Sanuk brand net sales for the second quarter decreased 9.0 percent to $17.3 million compared to $19.0 million for the same period last year. The decrease in sales was driven by a decrease in global wholesale sales, partially offset by an increase in global Direct-to-Consumer sales.

- Combined net sales of the company's other brands increased 30.5 percent to $30.6 million compared to $23.5 million for the same period last year. The increase was primarily attributable to a $6.9 million increase in sales for the HOKA ONE ONE® brand compared to the same period last year.

Channel Summary (included in the brand sales numbers above)

- Wholesale and distributor sales for the second quarter increased 1.2 percent to $400.3 million compared to $395.5 million for the same period last year. On a constant currency basis, sales increased approximately 4.9 percent. The increase in sales was driven by an increase in domestic wholesale sales, partially offset by a decrease in international wholesale and distributor sales.

- Direct-to-Consumer sales for the second quarter increased 2.1 percent to $86.6 million compared to $84.8 million for the same period last year. On a constant currency basis, sales increased 7.5 percent. This increase was primarily driven by Direct-to-Consumer growth in the Hoka, Sanuk, and Teva brands. Direct-to-Consumer comparable sales were down 5.2 percent over the same period last year, primarily driven by a decrease in tourist traffic in the U.S. as a result of the strengthening dollar.

Geographic Summary (included in the brand and channel sales numbers above)

- Domestic sales for the second quarter increased 4.3 percent to $301.6 million compared to $289.1 million for the same period last year.

- International sales for the second quarter decreased 3.1 percent to $185.3 million compared to $191.2 million for the same period last year. On a constant currency basis, sales increased 7.1 percent to $204.6 million.

Gross Margins

Gross margin was 44.0 percent in the second quarter compared to 46.6 percent for the same period last year. The decline in gross margin was primarily driven by an approximately 210 basis point impact from foreign exchange headwinds caused by the strengthening of the U.S. Dollar versus the British Pound, Euro and Yen compared to the same period last year.

Stock Repurchase Program

During the second quarter of fiscal 2016, the company repurchased approximately 354,000 shares of its common stock at an average purchase price of $67.18, for a total of $23.8 million. As of September 30, 2015, the company had $102.9 million in authorized repurchase funds remaining under its $200.0 million stock repurchase program announced in January 2015.

Balance Sheet

At September 30, 2015, cash and cash equivalents were $99.8 million compared to $114.7 million at September 30, 2014. The company had $316.8 million in outstanding borrowings at September 30, 2015 compared to $154.6 million at September 30, 2014. The change in cash and cash equivalents and outstanding borrowings are primarily attributable to cash used for share repurchases and for purchases of inventory.

Inventories at September 30, 2015 increased 23.5 percent to $595.0 million compared to $481.7 million at September 30, 2014. By brand, at September 30, 2015, UGG inventory increased 24.4 percent to $534.5 million, Teva inventory increased 39.6 percent to $19.6 million, Sanuk inventory increased 10.3 percent to $19.1 million, and the other brands' inventory increased 4.9 percent to $21.8 million.

Full Fiscal 2016 Outlook for the Twelve Month Period Ending March 31, 2016

- The company expects fiscal 2016 constant currency revenues to be approximately $2.01 billion, reflecting a 10.5 percent increase over the twelve month period ended March 31, 2015. On a reported basis, revenues are expected to be $1.96 billion, or an increase of 8.0 percent.

- Gross profit margin for fiscal 2016 is expected to be approximately 48 percent on a reported basis, down 30 basis points from fiscal 2015 as a result of expectations regarding a stronger U.S. dollar, partially offset by lower input costs and favorable changes in the company's channel mix. The foreign exchange headwind on gross margin is expected to be approximately 120 to 130 basis points.

- SG&A expense as a percentage of sales is projected to be approximately 35.5 percent on a reported basis, compared to 36.0 percent in fiscal 2015.

- The company expects fiscal 2016 diluted earnings per share to be approximately $5.73 on a constant currency basis, reflecting an increase of 23 percent over the twelve month period ended March 31, 2015. On a reported basis, earnings per share are expected to be approximately $5.18, or an increase of 11.2 percent. The increase in earnings per share from our initial outlook reflects a lower share count due to the shares repurchased in the second quarter fiscal 2016.

Third Quarter Fiscal 2016 Outlook for the Three Month Period Ending December 31, 2015

- The company expects third quarter fiscal 2016 constant currency revenues to be up approximately 11 percent over the same period last year and up approximately 9 percent on a reported basis. The company expects diluted earnings per share of approximately $5.00 on a reported basis compared to diluted earnings per share of $4.50 for the same period last year. On a constant currency basis, earnings per share are expected to be $5.23, which represents constant currency earnings per share growth of approximately 16 percent.

- The company projects third quarter fiscal 2016 gross margins to be approximately 52 percent compared to 52.9 percent for the same period last year, and SG&A as a percent of sales to be approximately 25 percent compared to 25.6 percent for the same period last year.

Fourth Quarter Fiscal 2016 Outlook for the Three Month Period Ending March 31, 2016

The company expects fourth quarter fiscal 2016 revenues to be up approximately 18 percent on a reported basis. The company expects diluted earnings per share of approximately $0.57 on a reported basis compared to diluted earnings per share of $0.04 for the same period last year.